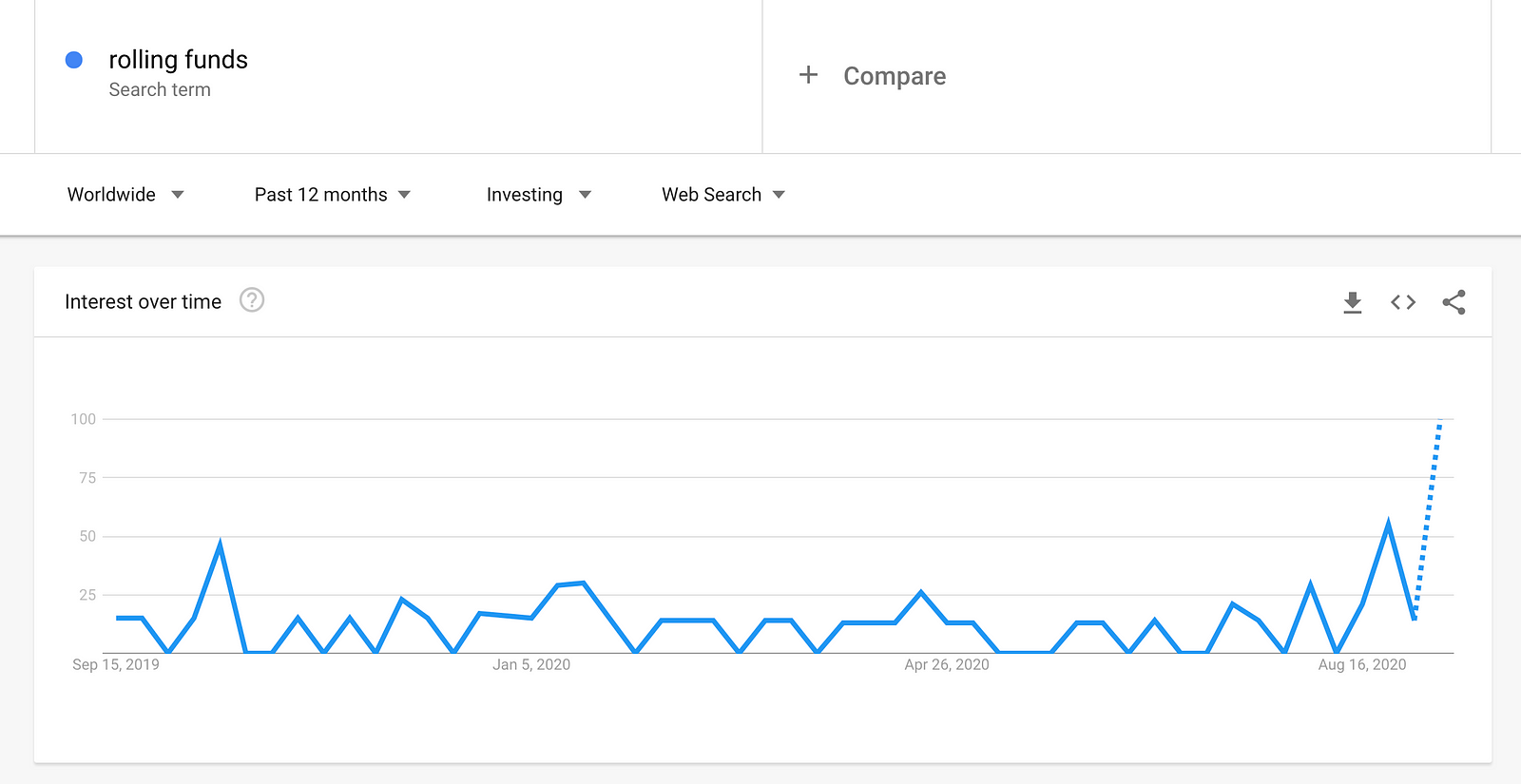

People Are Searching for “Rolling Funds” at a Rapidly Increasing Rate

Twitter is BLOWING UP About Rolling Funds ???

So…

Let’s start our own rolling fund!

Let’s invest our life savings in a rolling fund!

Let’s change the world!

Hold On! What are Rolling Funds Anyway?

A “Rolling Fund” is a new type of investment vehicle that allows its managers to invest at their discretion in opportunities on behalf of investors (often referred to as “limited partners”).

Investors typically contribute to the fund on a quarterly subscription basis.

Rolling Funds are publicly marketable and remain continuously open to new investors. (Hence the term, “rolling.”) → Source

AngelList’s introduction of a Rolling Funds product in February 2020 brought this concept to the Venture Investing mainstream.

But… why didn’t this product catch ? right away?

The COVID pandemic got in the way.

The people best suited to start these funds (founder/investors) were busy trying to pivot and keep their companies alive.

What Makes Rolling Funds Different than Traditional Venture Funds?

- They continuously raise funding

Traditional funds do a “big bang” fundraise that forces them to raise an entire fund in a short period of time. This can lead to missed opportunities during this phase and also missed opportunities to raise additional capital during portfolio markups.

2. They provide investors flexibility

There are opportunities for Limited Partners (aka “investors”) to increase/decrease/stop their investment commitments on a typically quarterly basis.

3. More control over fees and fewer legal headaches

Specific to AngelList Rolling Funds: On AngelList, the Admin fee is .15% of committed capital for a 10-year term. The traditional venture fund is 1% (!).

Additionally, AngelList shoulders almost all of the legal paperwork on behalf of the fund manager making it much easier to get started.

What Makes Rolling Funds Different than AngelList Syndicates?

AngelList Syndicates invest in one company at a time.

Syndicates aggregate a group of Angels into 1 special purpose vehicle that invests in the startup.

Example: 100 Angels each write $5k checks, this becomes a $500k syndicate investment into the target company.

Syndicates lowered the bar to Angel investing and provided a greater level of access to startup deal flow.

Rolling Funds have destroyed this bar (almost) completely.

Why Are Rolling Funds Getting Popular Now?

Rolling Funds have dramatically (-90%!) lowered the cost (legal, time, fundraising, etc.) to create a venture fund and have removed many of the most stressful and challenging parts.

By removing these massive barriers, it’s now possible for founder/investors to start and run their own funds.

In the past, these founder/investors have typically only invested their own money in startups. In some rare cases, they’ve started syndicates and invested with others in individual startups.

But now, these founder/investors can raise million dollar funds on Twitter in a matter of weeks and scale their impact MASSIVELY.

Founder/investors can also more effectively monetize their incredibly unique access to other early-stage founders and their unique position to recognize great ideas that others may miss.

Founder/Investors with Rolling Funds (Partial List)

- Sahil Lavingia: CEO Gumroad

- Immad Akhund: CEO Mercury

- Jude Gomila: CEO Golden

- Jake Seid: Previously President of Auction.com/Ten.com

- Ben Tossell: CEO of MakerPad

- Shaan Puri: Previously CEO of Bebo (Acquired by Twitch)

+And many, many more!

Should You Invest in a Rolling Fund?

I couldn’t agree more Sahil Lavingia!

However, this needs a bit more explanation.

Pure “old school” angel investing (picking individual companies or syndicate investments) should only be done with money that you are completely willing to lose.

Most financial professionals would recommend a maximum of 5–10% of net worth allocated to this type of investment.

Rolling Funds, however, may be a bit different…

My Hypothesis: I believe that angel investing, specifically through rolling funds, will displace small-cap publicly traded company investing.

It used to be (see the dot-com bubble) that you could invest in a diversified group of small-cap stocks and benefit over the long term from higher risk and higher reward.

Just a few fun examples of (formerly) small-cap stocks:

- Amazon went public at a valuation of $300M

- Dell went public at a valuation of $85M

- Apple went public at a valuation of $1.8B

Today, however, as more companies delay going public as long as possible, the small-cap stage of the public markets is almost completely getting jumped over by most attractive startups.

In the most extreme example, Uber was valued at $82B (!) when it finally went public in 2019.

In this new world, investing in a Rolling Fund or a fund of startups may be a good strategy for investors who have the same hypothesis that small-cap investing ain’t what it used to be. (NOTE: This is NOT investment advice).

In much the same way as picking individual stocks has been proven inferior to holding the S&P500 for just about everyone, I strongly believe that picking individual startups for angel investing leads to dramatically inferior performance for just about everyone vs. investing in a diversified Rolling Fund of startups selected by an expert founder/investor.

So let’s get rolling!

What Questions Do You Still Have About Rolling Funds?

Let me know in the comments or on Twitter at @amitch5903!

Disclosure: This blog post is distributed for general informational and educational purposes only and is not intended to constitute legal, tax, accounting, or investment advice. The information, opinions, and views contained herein have not been tailored to the investment objectives of any one individual, are current only as of the date hereof, and may be subject to change at any time without prior notice.

All investment strategies and investments involve the risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal financial objectives, needs, and risk tolerance.

The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service.

0 Comments