Over the past several weeks, I’ve written about two of the fastest-growing startup ecosystems: Pakistan and Africa. In this post, I cover the equally exciting and rapidly maturing MENA (Middle East and North Africa) market.

As you’ll see in my list below, MENA has had many interesting startup developments as it strives to transition from a fossil fuel-funded region to one that exports technology and also provides home-grown tech solutions to its people.

In this region especially, it’s been interesting to see how entrepreneurs mix successful startup ideas from other parts of the world with the unique religious and cultural values of the region.

Let’s dive in!

Other Startups to Watch:

- Top 10 Pakistani Startups to Watch

- Top 10 African Startups to Watch

- Top 10 Latin American Startups to Watch

- Top 10 European Startups to Watch

- Top 10 Indian Startups to Watch

- Top 10 Chinese Startups to Watch

- Top 10 Israeli Startups to Watch

Want to be the first to know when my posts go live?

Follow me on Medium and subscribe to my newsletter: Modern Product Manager Newsletter

Interested in Investing in Startups Like These?

Check out the Mitchell Ventures syndicate on AngelList here: https://angel.co/mitchell-ventures/syndicate

The Middle East’s Startup Environment

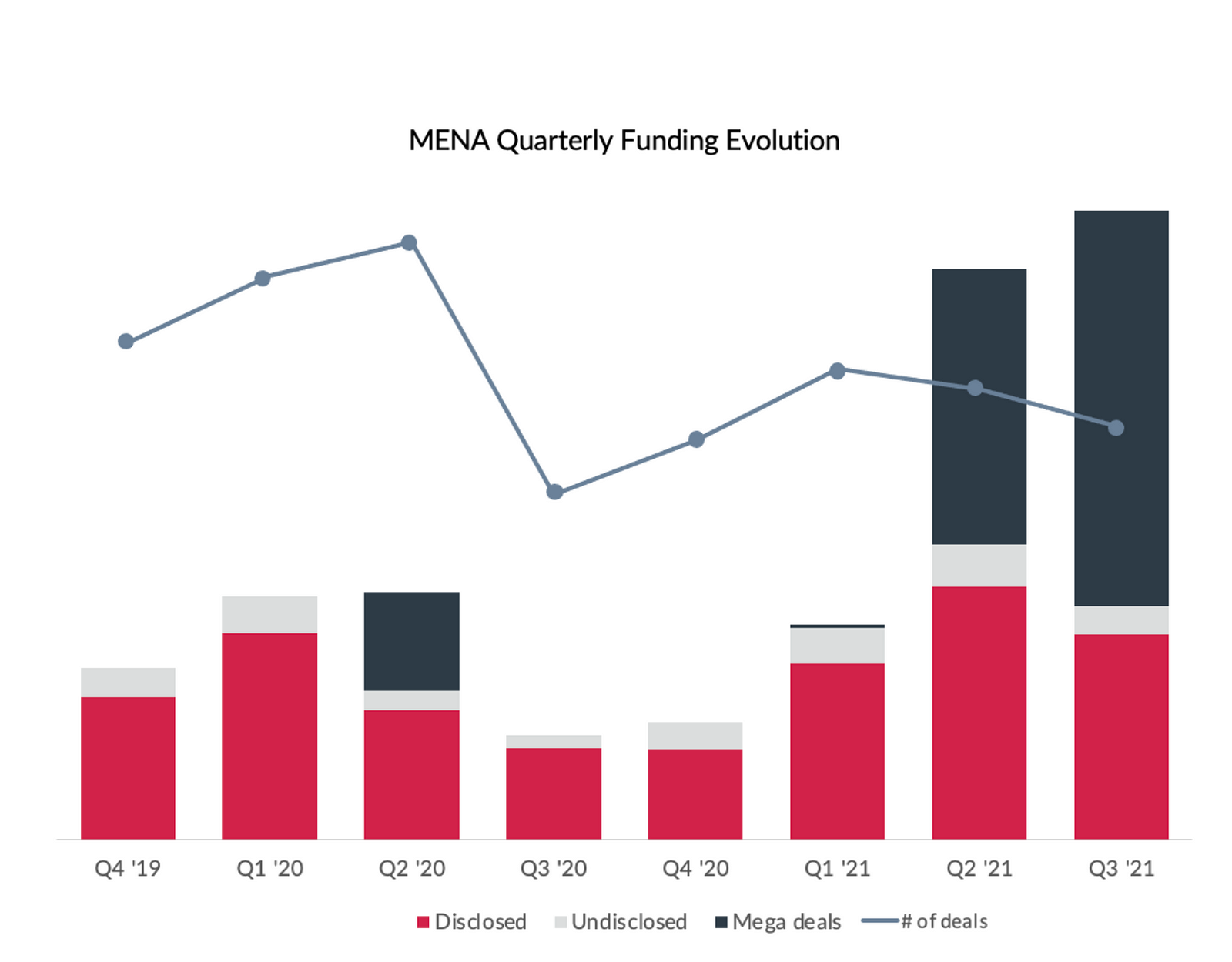

Q1 of 2021 began for MENA startups much like Q1 of 2020 with a similar amount of funding raised. In Q2, however, things started to take off dramatically and this rapid growth persisted into Q3.

According to Forbes Middle East calculations, 170 companies announced funding rounds during the first half of 2021, with 120 companies disclosing more than $910MM in financing and debt raised.

This was a record amount of funding in the first half of 2021, notably led by Saudi FinTech Tamara, which raised $116MM through two funding rounds.

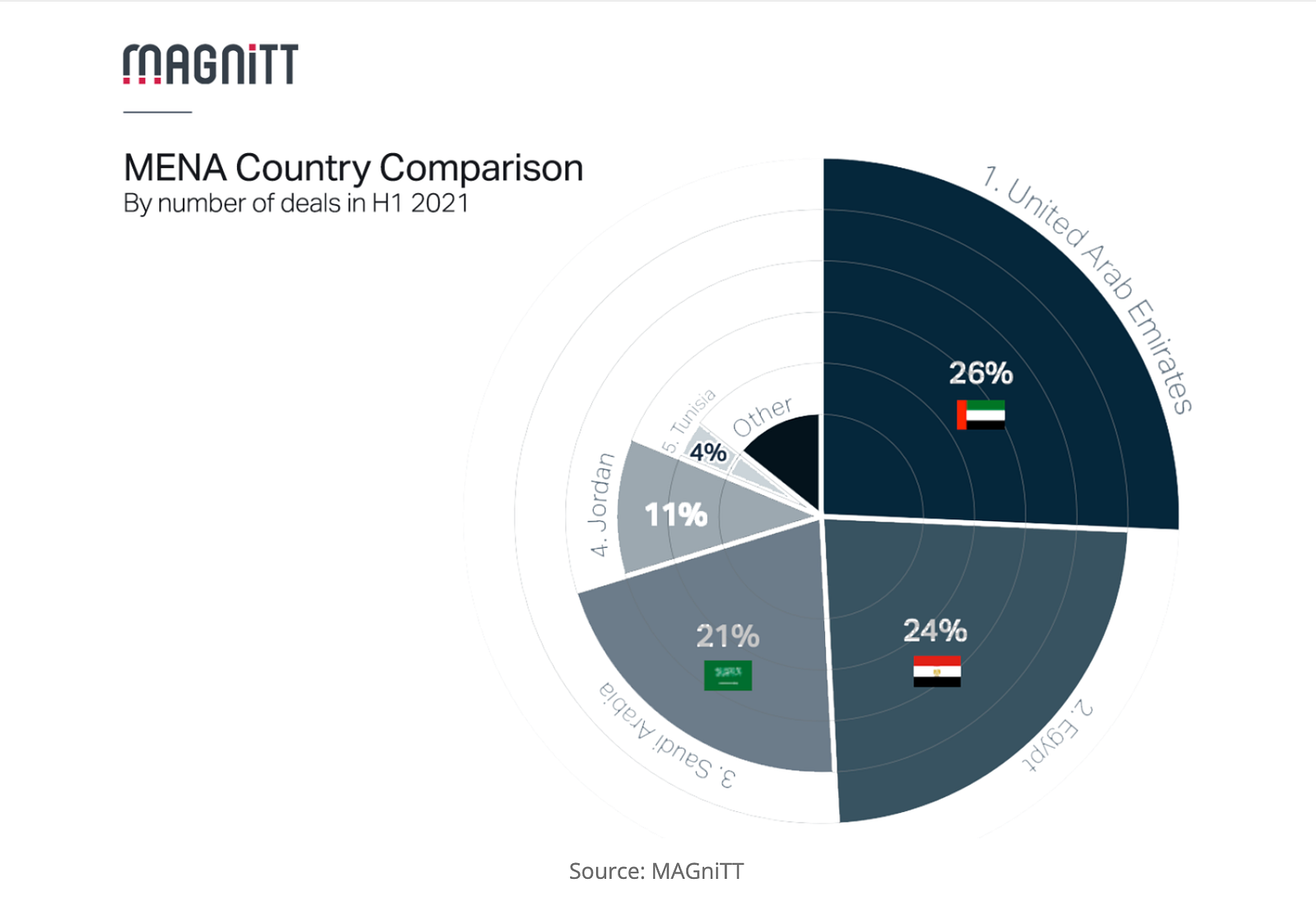

The growth was led by FinTech, e-Commerce, and food and beverage technology, with Emirati companies receiving the largest share of financing with more than $420MM, followed by Saudi Arabia and Egypt with about $245MM and $110MM, respectively.

FinTech startups in the MENA region claimed a large share of $ in these funding rounds. 1 in every 4 deals in the MENA region went to FinTech startups in 2021, as did 29% of total funds raised.

Softbank also made its first investment in the region in 2021. The Vision Fund 2 backed Dubai-based cloud kitchen startup Kitopi in a monster $415MM Series C round in July 2021. It is one of the largest venture-backed firm funding rounds in MENA history.

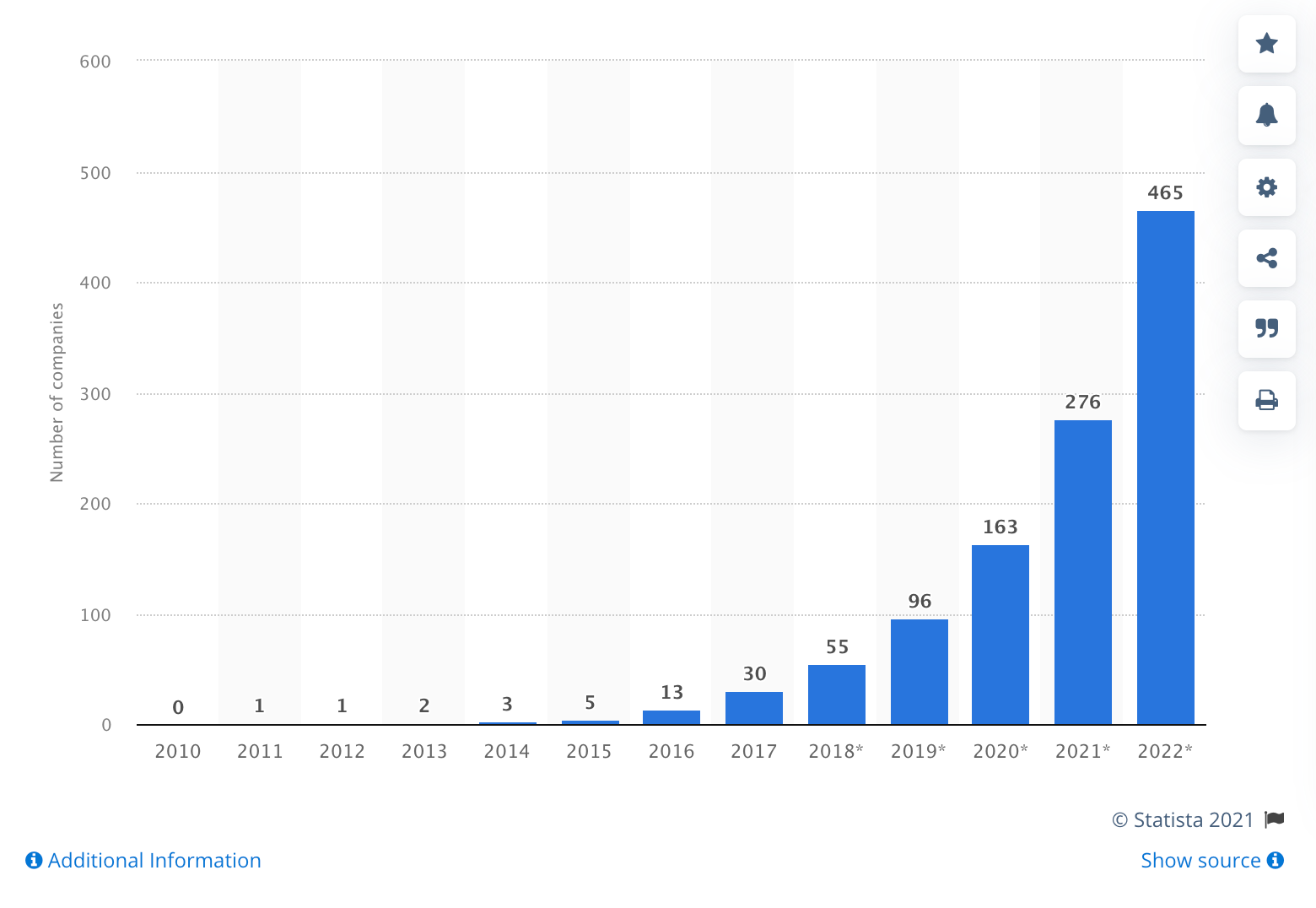

FinTech is expected to continue to dominate in the future of the region. The number of FinTech companies in MENA is expected to increase to 465 by 2022. In 2017, there were just 30 FinTech companies in the region (!)

“The UAE is the leader in FinTech innovation, comprising some 25% of the FinTechs in the region,” says Vijay Tirathrai, managing director, Techstars Hub 71.

In 2017, there were 30 FinTechs that raised nearly $80MM. By 2022, estimates predict over 500 FinTech companies in the Middle East will raise over $2B in venture capital funding.

Another opportune area for startups in the region is remittances, with Gulf nations like UAE home to a 90% expatriate population and others, like Egypt, boasting a large diaspora population that continues to support friends and family back home.

According to Techstars Hub 71′ Vijay Tirathrai, “roughly 85% of FinTech firms in the MENA region operate in the payments, transfers and remittances sector.”

However, in MENA, there is a limited FinTech infrastructure and STEM talent pool, which Pax Credit’s Balagoni cites as a major challenge for early-stage startups in the region. “Having said that, we have seen significant progress in the past year or so,” he adds.

In addition to improving FinTech infrastructure and education, MENA countries need to continue to invest in bringing their populations online.

In Egypt, internet penetration in the country reached 57% of the population during the peak of the pandemic in 2020, which is a substantial increase from 2015’s rate of 37%, but still leaves a large amount of room for growth.

MENA had a record-breaking 2021, but it still remains a region in transition. It’s been exciting to see that transition accelerate this past year and I hope to see it accelerate even more in 2022, powered by many of the startups I’ve highlighted in my top 10 list below.

Sources: Gulf Business, Northstar Dubai, Statista, ZDNet, Pioneer, Fintech News, MAGniTT, Datatechvibe

The Top 10 Middle East Startups to Watch

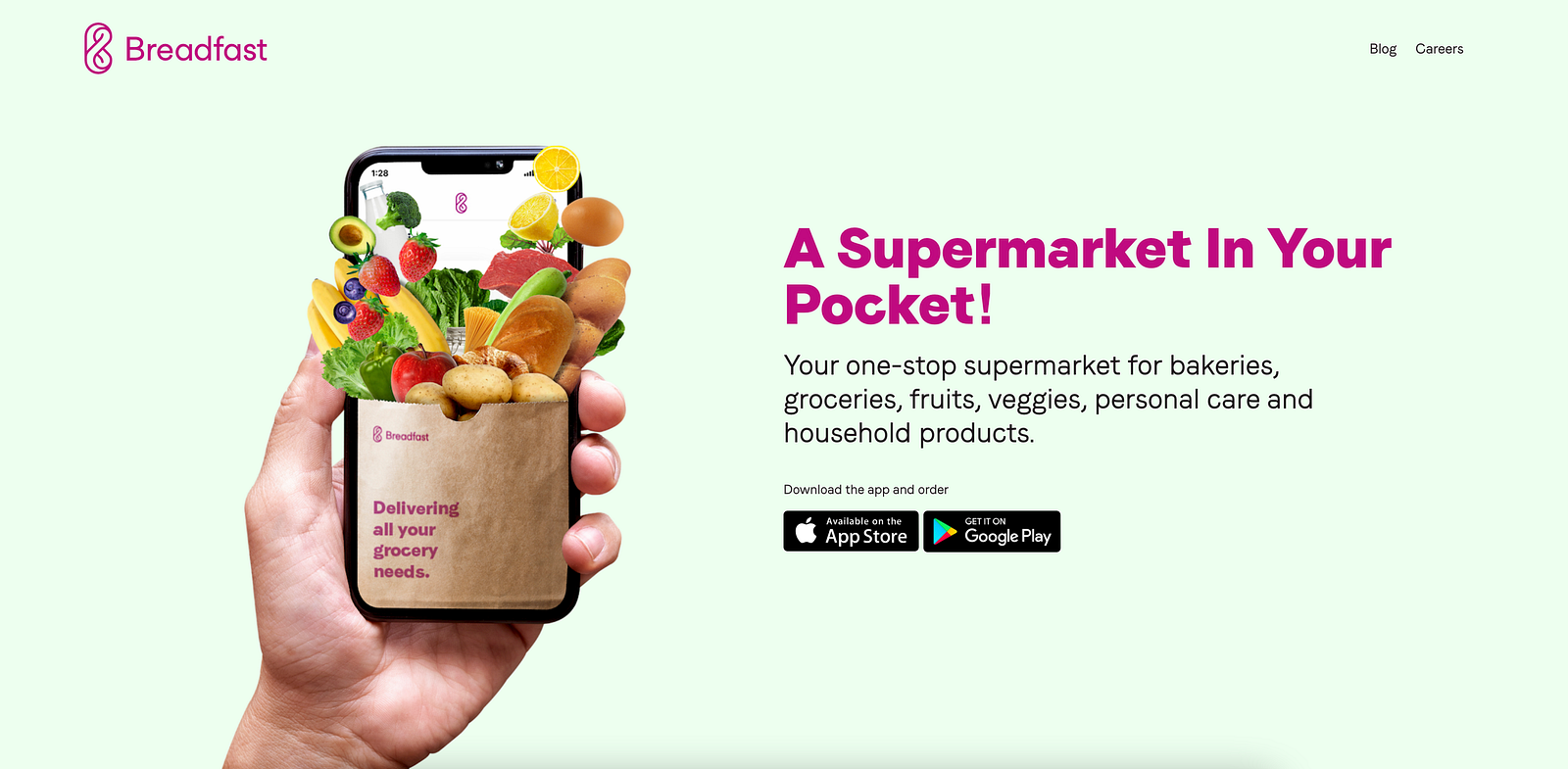

- Breadfast: GoPuff + Instacart for MENA

Breadfast began, like their name sounds, by delivering just one thing (bread!) and doing it very very well. At their founding in 2017, they focused on that universal household staple, baking their own bread and delivering it to customers across Cairo, starting at 5am every morning.

Over the past 4 years, the company has scaled dramatically, adding thousands of items while still preserving their scrappy nature, knowledge of raw material sources, and building an incredibly strong supply chain. The company has delivered millions of orders since its founding and has both incredibly positive reviews (4.9/5 rating) and very strong MoM retention.

It’s no surprise then that Breadfast was able to raise a $26MM Series A in November of 2021. The company was already delivering fast (<60 minutes), but has recently expanded to offer ultra-fast delivery (<20 minutes) to go head-to-head with upstart competitors like Rabbit.

Keep an eye on Breadfast in 2022: they have the position, the customer trust, and the know-how to continue to scale fast and sustainably across MENA.

Offices In: Cairo, Egypt

Total Funding: $28MM

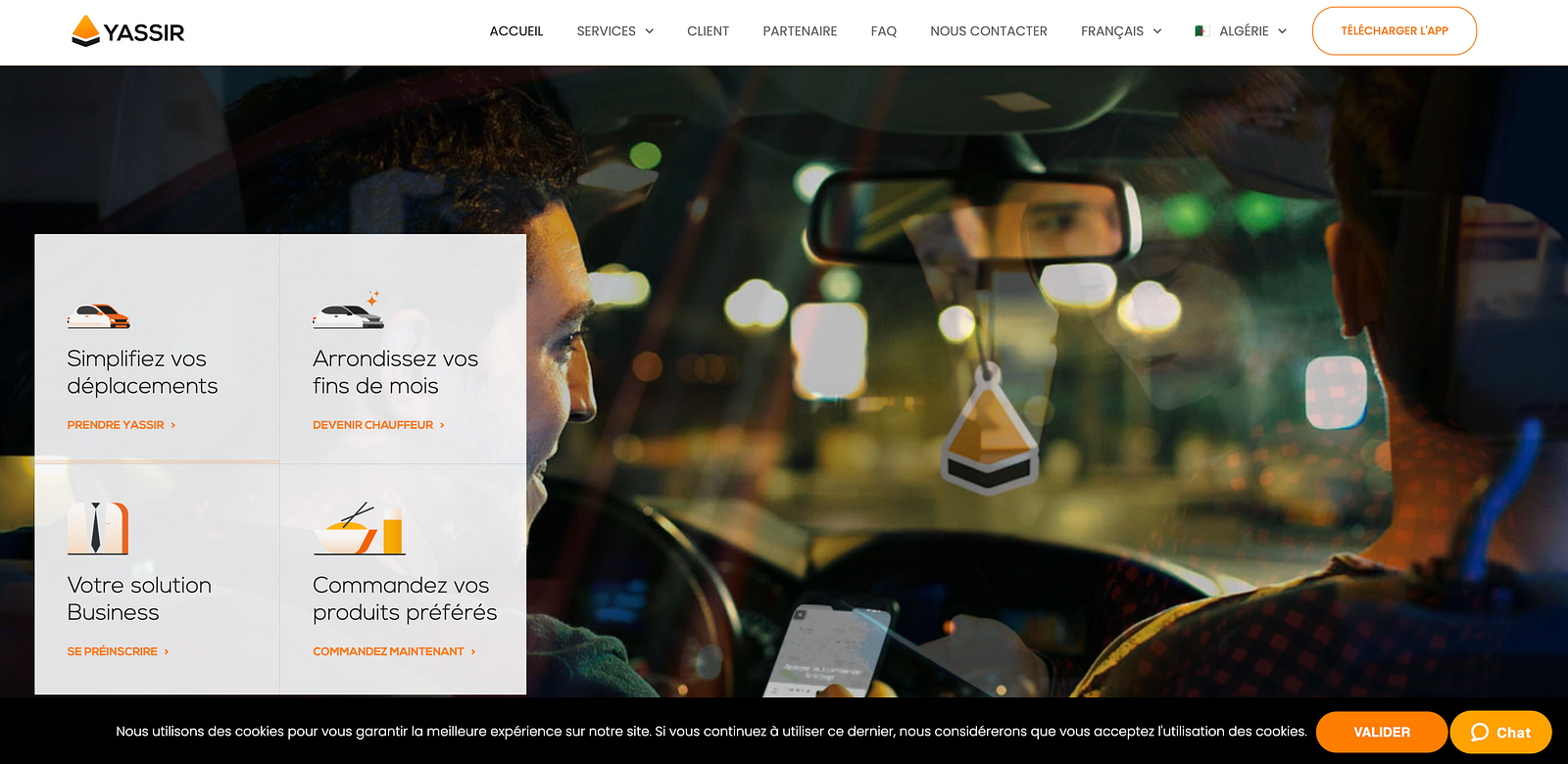

2. Yassir: MENA’s Ride-Hailing and Delivery Super App

Yassir began in 2016 as the locally founded ride-hailing alternative to Uber, Glovo, and Careem, with a presence in Algeria, Morocco, and Tunisia.

As a result of the pandemic, Yassir has evolved to position itself as the super app of the region. They’ve added last-mile delivery services, creating a multi-sided marketplace that brings drivers, couriers, merchants, suppliers and wholesalers to individual users on their platform.

Currently, over 3MM people and 40,000 partners now use Yassir. The company raised a $30MM Series A round in November 2021.

So far, Yassir is a shining example that local talent and local customization can be a winner in Northern Africa. I’m excited to see them continue to scale and add additional features in 2022.

Offices In: Algiers, Algeria

Total Funding: $67.6MM

3. Wahed: Ethical and Halal Financial Management (Robinhood for MENA)

I first wrote about Wahed close to 2 years ago as a Middle East Startup to Watch in 2020 and they certainly have delivered!

The Ethical and Halal investing startup has ridden several tailwinds since then, including a spike in consumer trading interest brought by the pandemic, and the desire for ethical investing by younger investors.

Wahed raised a $25MM funding round in June 2020 and I’d expect to see them raise again in 2022 as they continue to scale into new markets. The TAM is massive for Wahed and their approach is a much better fit for their target customers and the region vs. companies like Robinhood.

Offices In: New York, New York; UK; Bahrain; Malaysia

Total Funding: $40MM

4. Tabby: Buy Now, Pay Later (BNPL) for MENA

Buy Now, Pay Later continues to be on ? around the world, with a new unicorn seemingly being minted each month and legacy FinTech players scrambling to add this high demand, conversion-rate-increasing feature to their products.

Tabby is the latest on the BNPL scene, raising a monster $50MM round at a $300MM valuation in August 2021, after only being founded in 2019 (!) That seems extreme until you remember that Block (formerly Square) purchased Afterpay for $29B and Affirm is currently valued at ~$28B on the public markets.

Tabby’s biggest challenge is to stand out from the competition in MENA where are there (at least) 10 other BNPL startups. The winner in this space will be the one who can sign partnership agreements the fastest with eCommerce leaders in the region AND also develop effective risk models. Failure to do either will result in ?.

I’m excited to watch how BNPL plays out around the world. I expect a lot of consolidation and failure in 2022, but Tabby has a great chance to be a survivor if they can execute with the lead they’ve built.

Offices In: Dubai, UAE

Total Funding: $132MM

5. Ziina: P2P with Neobank Aspirations

Ziina is following a similar playbook as Venmo / Cash App / Chipper Cash, beginning with a wallet and P2P features before likely expanding to add other neobank elements.

However, the startup is a bit mysterious at the moment, having raised $8.5MM on a waitlist with the promise of a forthcoming app. Despite that, they’ve earned a spot on this list because the region truly needs this offering. Both Ziina and Telda (#10 on this year’s list) are working to deliver on that need.

Ziina attended the W21 class of YC and closed a $7.5MM round in June of 2021. The FinTech sector in MENA is growing fast at a CAGR of 30%. In the Middle East, it is estimated that over 450 FinTech companies will raise about $2B in 2022 compared to the $80MM raised in 2017 (source).

Ziina has also been in continuous contact with regulators. But they’ve had some challenges finding the right banking partners according to their founder, “You need to make a case to the banks that this is basically a mutually beneficial partnership. And the way we’ve done that is by basically highlighting different cases globally like CashApp that worked with Southern Bank,”

Being one of the first neobanks in the region is challenging, but the opportunity is worth it and I’m rooting for Ziina to pull it off!

Offices In: Dubai, UAE

Total Funding: $8.5MM

6. Abwaab: EdTech (Secondary School) for MENA

Sometimes, timing is everything. Abwaab was founded shortly before the pandemic and has scaled massively over the past 18 months. The company claims to have grown active users by 10x in the 2020/21 academic year alone, although we don’t know how low the base was in the prior year.

The startup has positioned itself as a complement to nationally provided education, offering “bite-sized” micro-lessons that match national curricula.

Their approach clearly has been successful so far, with the company raising a $5MM Seed round in March 2021 and quickly following that up with a $20MM Series A in November 2021.

The value proposition is powerful too: For $15 (the cost of 1 hour of tutoring in the countries they serve), Abwaab provides assessments for test prep, chat, and video tutoring, and these bite-sized lessons.

I’m excited to see the company continue to scale and positively impact the EdTech space in MENA.

Offices In: Amman, Jordan

Total Funding: $27.5MM

7. Dapi: Plaid for MENA + Payment Infrastructure for MENA Banks

Plaid for MENA is the easiest way to describe Dapi. But the truth is, the company does a lot more than that.

In addition to providing the secure connection between more than 300 banks spanning 20 countries (!), Dapi also offers a Payment API that provides the best parts of both ACH and credit cards for businesses: No transaction fees, instant confirmations, and same day settlements.

While Dapi has raised a modest $2.2MM to date, that’s been enough to build out their initial APIs and integrations. I expect them to raise a large Series A in 2022 as they scale their integration partners and bring on a sales team to promote their Payment API.

Offices In: San Francisco, CA

Total Funding: $2.2MM

8. Rabbit: GoPuff for MENA

Another GoPuff for MENA? Yes! The fast delivery space is very very hot right now and rightly so.

But do we really need 20-minute delivery? Wasn’t 60-minute delivery good enough?

That sentiment reminds me of a famous Jeff Bezos quote:

“They want fast delivery; they want vast selection. It’s impossible to imagine a future 10 years from now where a customer comes up and says, ‘Jeff I love Amazon; I just wish the prices were a little higher,’ [or] ‘I love Amazon; I just wish you’d deliver a little more slowly.”

Faster delivery will win.

The main challenge for Rabbit is: can they scale quickly enough to capture market (and mind) share with so many other players in the market? Breadfast certainly has an infrastructure and funding lead, but so did Instacart and GoPuff still managed to scale to become a >$40B company.

As I mentioned earlier with Breadfast, I’m truly looking forward to seeing how the rapid delivery space shakes out in 2022. Will players consolidate, go out of business, or expand the pie together? And how will the economics play out longer-term?

Only time will tell, but I’ll be watching Rabbit closely.

Offices In: Cairo, Egypt

Total Funding: $11MM

9. Flextock: On-Demand Warehousing + eCommerce Logistics

While highly visible pandemic startups like Instacart, GoPuff, Talkspace, or Calm get all of the media attention, others like Flextock have been just as important behind the scenes.

Flextock, founded in early 2021 and a member of the W21 YC batch, helps consumers and businesses manage e-commerce and fulfillment operations from warehousing and logistics to delivery and cash collection.

The company currently serves only the Egyptian market and claims to have signed more than 100 merchants to its platform and onboarded thousands of SKUs.

It’s certainly the early days for Flextock, but MENA’s $25B e-commerce logistics market is a massive opportunity that larger rivals like Trella, Kobo, and SEND have only just begun to tap into.

Offices In: Cairo, Egypt

Total Funding: $3.4MM

10. Telda: MENA’s Neobank

As I mentioned with Ziina, MENA does not yet have a dominant Neobank, though many startups have emerged in recent years to tap into that massive opportunity.

Only 40% of the MENA population has access to a bank account today.

Telda was founded in April 2021 to tackle that problem. Before Telda, CEO Ahmed Sabbah was the co-founder and CTO of Egypt’s ride-hailing company Swvl and CTO Youssef Sholqamy was a former senior engineer in Uber’s infrastructure team.

Despite being so young, Telda has several key advantages.

First, it is the first company to receive a license from the Central Bank of Egypt to issue cards and onboard customers digitally.

Second, their seed funding is from Sequoia, unquestionably a top-tier VC with very deep pockets. Eight years ago, the VC led the seed investment in Latin American digital bank Nubank before it scaled massively (P.S. it’s now worth north of $25B!)

Telda is certainly well positioned, but they still have to execute. I look forward to them attacking the pervasive unbanked problem in not only Egypt but also across all of MENA.

Offices In: Cairo, Egypt

Total Funding: $5MM

Honorable Mentions

Trella: Logistics Management Platform

Offices In: Cairo, Egypt

Total Funding: $42.8MM

Capiter: Cash Flow Solutions for SMBs

Offices In: Cairo, Egypt

Total Funding: $33MM

What Middle East Startups Did I Miss?

I’m sure I missed quite a few prolific, fast-growing Middle East startups. Let me know which ones on Twitter at @amitch5903!

0 Comments