There were certainly a lot of ups and downs in 2020 to stay the least. A LOT of things changed around the world.

Many businesses failed, but some startups thrived.

I’m excited to write about many of the incredibly impressive startups in the Middle East and North Africa that you need to watch in 2021. These startups not only survived the pandemic but thrived in it, managing to grow incredibly quickly by meeting and exceeding customer needs.

Other Startups to Watch in 2021:

- Top 10 Latin American Startups to Watch in 2021

- Top 10 European Startups to Watch in 2021

- Top 10 African Startups to Watch in 2021

- Top 10 Indian Startups to Watch in 2021

- Top 10 Chinese Startups to Watch in 2021

- Top 10 Israeli Startups to Watch in 2021

Want to be the first to know when my posts go live?

Follow me on Medium and subscribe to my newsletter: http://bit.ly/modern-product-manager-newsletter

The Middle East’s Startup Environment

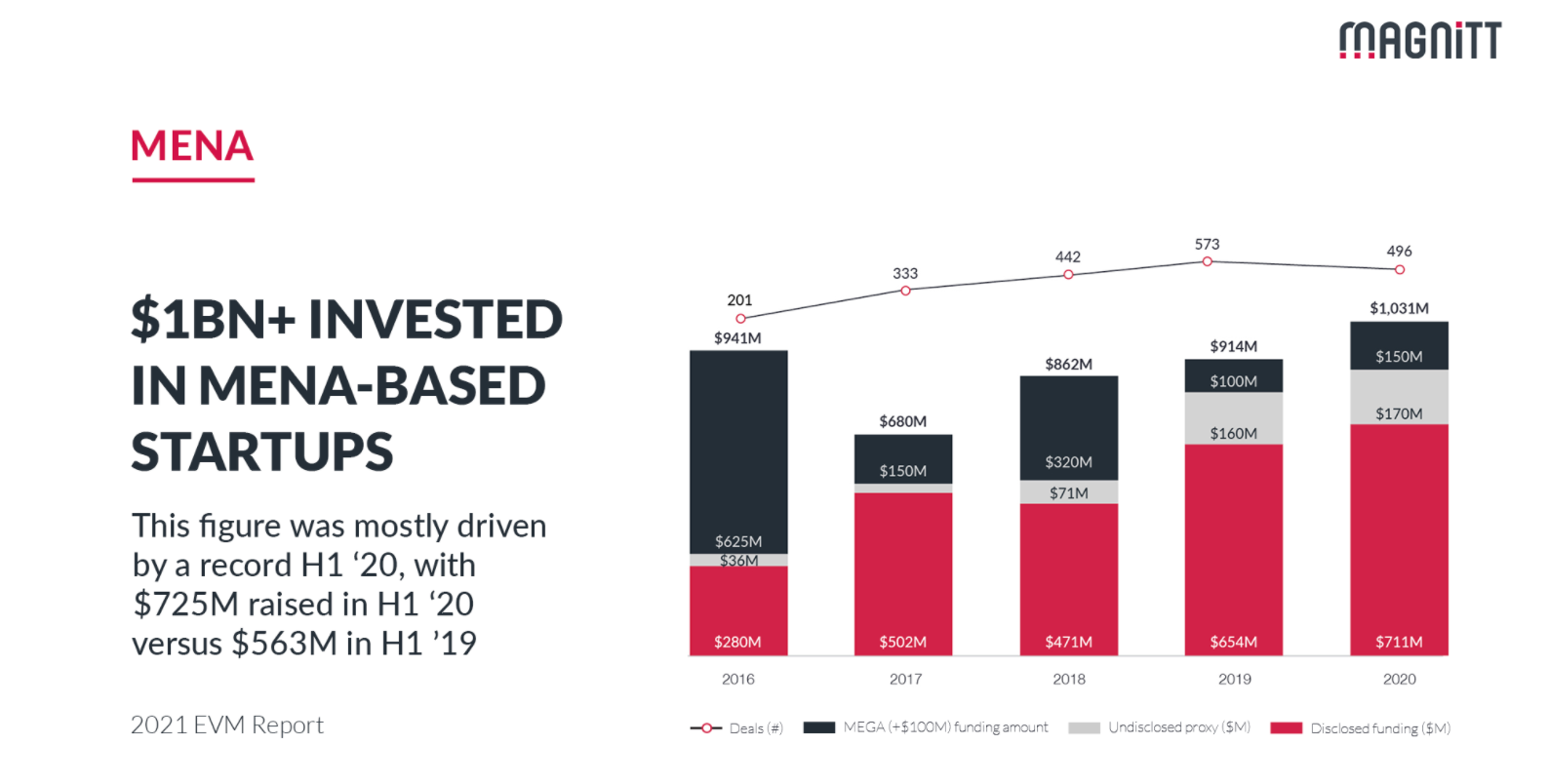

In 2020, a record $1B was invested in MENA-based startups, driven by a massive funding blitz in the 1st half of the year ($725MM).

Surprisingly, mega rounds ($100MM+) were not the driver of this growth, only representing $150MM of the $1B+ total in 2020.

The $150MM Series E investment in EMPG was the largest investment in the region in 2020.

Total funding was up 13% from 2019, though total deal count was down by 13% to 496 transactions.

Later stage deals ($500K-$3MM) increased by 52% in 2020, while pre-seed rounds (<$100K) decreased by 50% YoY, the driver for the decrease in total deals.

Investors didn’t pull back from investing in 2020 in the Middle East, rather, they shifted their investment into later stage deals and more proven opportunities.

In 2020, the United Arab Emirates (UAE) continued to lead the Middle East in startup and entrepreneurship maturity. The country is currently home to 33 of the region’s 50 highest funded startups. Saudi Arabia comes in 2nd with 7 startups and Egypt in 3rd with 4.

In 2020, the most active investors in the MENA region were 500 Startups with 10 investments, RAED Ventures with 8 investments, and Wamda Capital with 7 investments.

Despite the challenges of the global pandemic, 29 startups in the UAE together raised an impressive funding haul of $425 million in 2020.

Fintech, Agritech, Transport, and Delivery were especially popular startup sectors in MENA in 2020.

How Did I Choose This Top 10?

Many of the industries that excelled in the rest of the world during the Coronavirus (eCommerce, Transport, Delivery) also thrived in the MENA region in 2020.

However in 2020, we also saw an acceleration in the adoption rates for many recently launched fintech startups. The pandemic made their services essential as brick-and-mortar options for banking, bookkeeping, lending and more simply weren’t available.

This year’s list of the Top 10 Middle East Startups to watch includes both startups in industries that entered hyperdrive in 2020 and also those that are primed to accelerate as we recover back to a new “normal.”

Let’s jump in!

The Top 10 Middle East Startups to Watch

- Nana: Instacart for Saudi Arabia

Nana is quite simply Instacart for Saudi Arabia.

For context, Instacart increased order volume by 500% (!) during the COVID-19 lockdown and more than doubled their valuation to near $20B (!)

Nana was founded in 2016 and has raised $29 million from investors. The startup currently serves 14 cities across the Saudi Arabian kingdom, partnering with local supermarket chains including Carrefour, Panda, Spar, Farm Superstores, and Manuel.

Nana is a no brainer to keep an eye on in 2021. They had an amazing 2020 and 2021 will be all about building on their momentum.

Offices In: Riyadh, Saudi Arabia

Total Funding: $29MM

2. Tajir: b2b Inventory for Pakistan Stores

Retail in Pakistan is incredibly fragmented and very informal. Stores waste hours buying from dozens of wholesales and salesman. And delivery is incredibly unreliable: stores often receive orders late, if at all.

All of this inefficiency means lost sales.

Enter Tajir, an Android app where Pakistani shopkeepers can purchase inventory with transparent prices, next day delivery, and robust order tracking.

Pakistan is at a technological inflection point as more and more individuals in the highly populous country get access to Android smartphones for the first time ever.

Tajir is poised to benefit tremendously from that paradigm shift and to help solve a massive problem in the country.

Offices In: Lahore, Pakistan

Total Funding: $2MM

3. NymCard: Card Issuing and Payment Processing Platform

Over the past 5 years, Fintech has exploded across the Middle East.

NymCard was founded in 2018 to provide a modern cloud-based card issuing and processing platform for all of these emerging fintech startups and modernizing MENA banks.

Additionally, NymCard has inked partnerships with Visa and Mastercard. As banks modernize in the Middle East and new Fintech startups continue to emerge, NymCard is in a strong position to serve their card issuing and payment processing needs.

Offices In: Abu Dhabi, UAE; Beirut, Lebanon

Total Funding: $14MM

4. CreditBook: Digital Ledger for Pakistani Businesses

Small business owners and shopkeepers around the world have been neglected by technology for too long.

Whereas Tajir helps small business owners in Pakistan manage their inventory, Creditbook focuses on finances, payments, and receivables for those same SMBs.

Today, most businesses in Pakistan still reconcile their finances and receivables on paper, which is prone to error, is slower, is not transparent, and makes payment collection difficult (and often very awkward!)

Creditbook (similar to Khatabook → India and Bukuwarang → Indonesia) is a replacement for all of this paperwork. The startup already has recorded millions of transactions and has hundreds of thousands of happy users.

The company is poised to benefit from the same trends as Tajir in Pakistan and has numerous expansion opportunities in 2021 as they bring more and more SMBs onto their platform.

I wouldn’t be surprised to see them add Billing, Lending/Working Capital, Inventory, and more in 2021!

Offices In: Pakistan

Total Funding: Not Disclosed

5. Tabby: Buy Now, Pay Later

In early 2021, buy-now-pay-later allstar Affirm went public and is currently trading at a market value of approximately $24B.

Tabby is a younger (founded in 2019) buy-now-pay-later startup based in Dubai. Similar to Affirm, the company partners with retailers to offer their customers, both online and in-store, the ability to defer paying for their purchases for up to 30 days or to pay in four equal monthly installments at no cost to the consumer.

The company received backing in their December 2020 Series A from major Abu Dhabi investor Mubadala Investment Company. Additionally, the company announced a partnership with Visa and joined the Saudi Arabian Central Bank’s regulatory sandbox for Fintech firms in the same year.

Tabby is in a HOT space right now and is in a great position in 2021 to benefit from the consumer demand for this service. Also, given the validation that the market provided to Affirm, Tabby is a company you need to keep an eye on!

Offices In: Dubai, UAE

Total Funding: $32MM

6. Mamo Pay: Venmo for Dubai

Mamo Pay is a recently launched (December 2020) Dubai-based peer-to-peer (P2P) payment app. In short, Venmo for Dubai.

P2P is a great wedge in markets like the Middle East for landing-and-expanding into related financial services.

I’ve written about Chipper Cash several times before (Top African Startups to Watch in 2021, Top Corona Economy Startups to Watch), they took this approach in Africa and have experienced very strong growth to date.

It’s early days for Mamo Pay, but keep an eye on them in 2021. It’s incredibly important that they get a meaningful number of users (hundreds of thousands) actively using the platform this year to provide them enough scale to add additional services.

Offices In: Dubai, UAE

Total Funding: $1.5MM

7. Load-Me: Local and Cross-Border Trucking Inventory Marketplace

Trucking has been getting disrupted in MENA by many startups over the past 5 years. Load-Me, founded in 2016, is another name to keep an eye on in the fast-growing space.

Companies like Unilever, P&G, and Kuhne+Nagel are already among their clients.

The company raised $6.3 million in 2020 to scale their technology.

Offices In: Dubai, UAE

Total Funding: $7.6MM

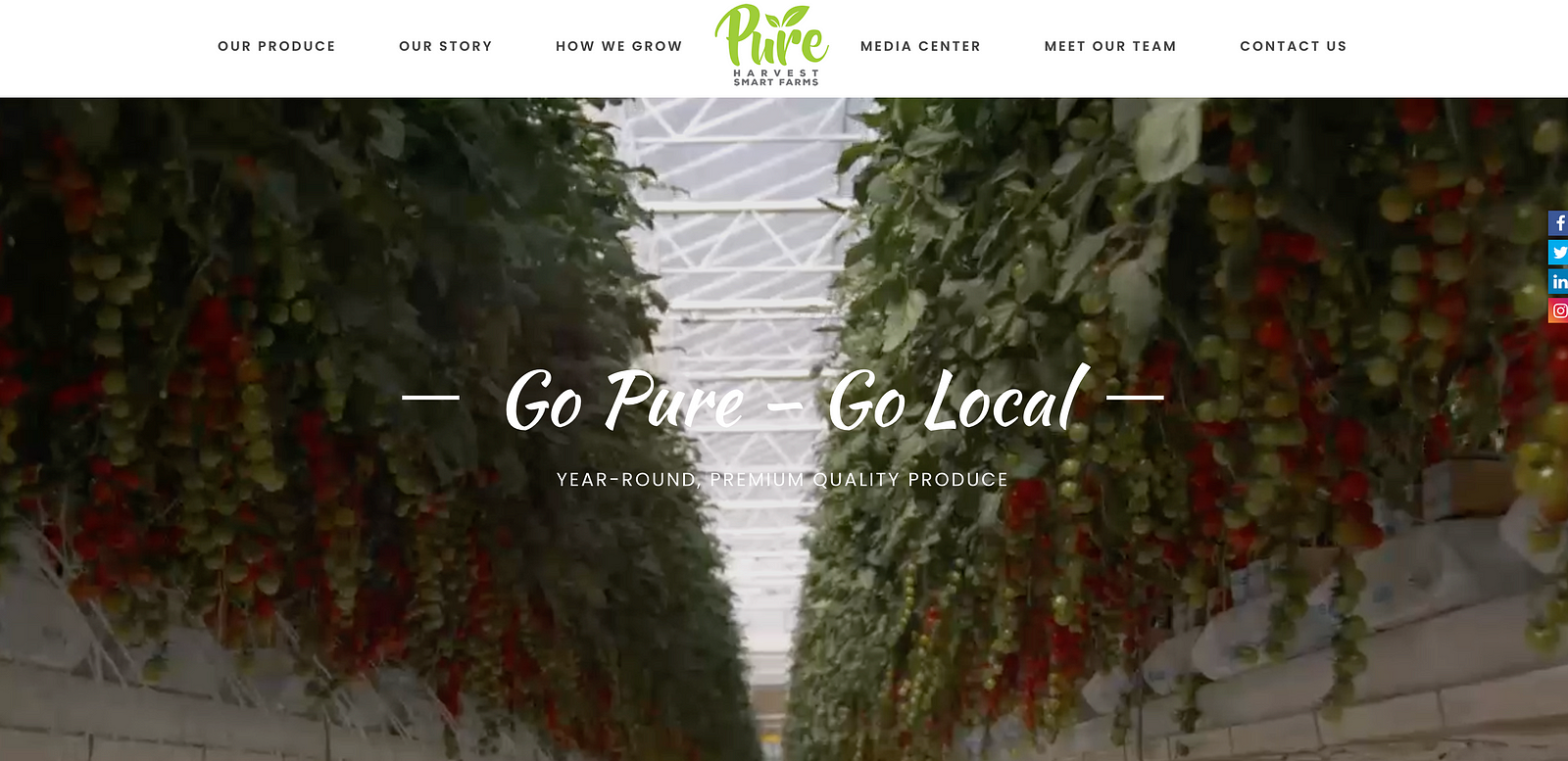

8. Pure Harvest Smart Farms: Vertical Warehouse Farming in the UAE

Vertical Farming startups are having a moment, led by high flying companies like AeroFarms ($238MM in investment) and Plenty ($541MM in investment) in the USA. The approach makes even more sense in the hot and dry environment of the Middle East, where much produce has to be imported and is very expensive.

Pure Harvest was founded in 2016 and uses controlled environment agriculture technology to produce fresh fruits and vegetables in high-tech greenhouse facilities. They currently produce over 20 varieties of tomatoes and six varieties of strawberries.

In April 2020, Pure Harvest announced a MASSIVE Series A round of $110 million led by Wafra International Investment Company. They plan to use the money to expand, both in the UAE and to Kuwait.

Offices In: Abu Dhabi, UAE

Total Funding: $110MM

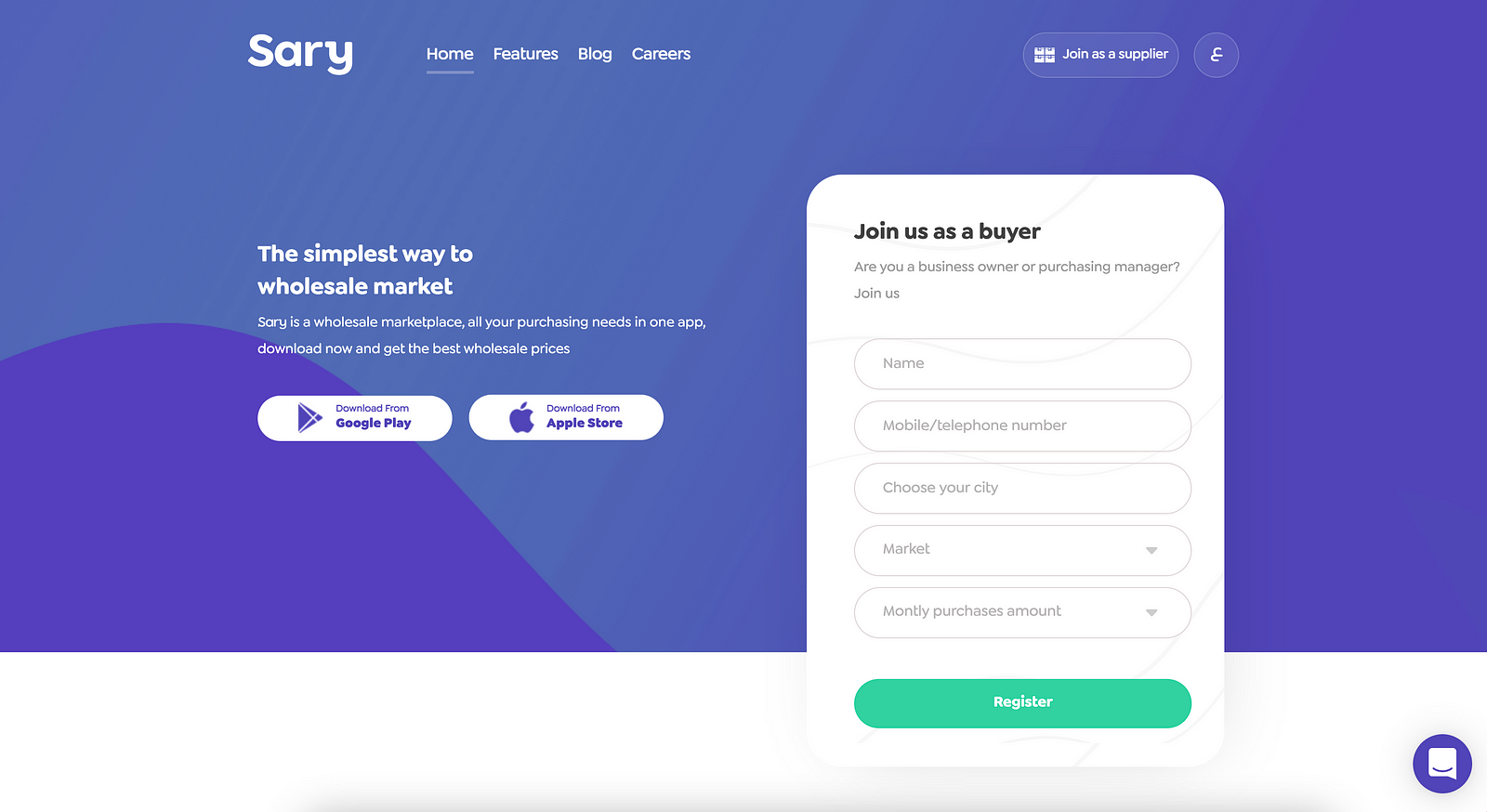

9. Sary: b2b Marketplace for Inventory

Sary offers a somewhat similar service as Tajir, but in Saudi Arabia. The company connects small businesses such as mini-supermarkets, restaurants, cafes, and hotels, with inventory suppliers.

Sary was founded in 2018, but has now entered rapid scaling mode, raising $6.6 million in 2020 alone to expand their footprint in Saudi.

Offices In: Dammam, Saudi Arabia

Total Funding: $7MM

10. Noon Academy: Social Learning Platform for the Middle East

Noon Academy is quite simply one of the fastest growing learning platforms in the Middle East, with over 9 million registered students, most of whom joined in 2020.

Students can join study groups with their friends and be taught by the best teachers across Saudi Arabia. Teachers can build a fan base of students, choose their own hours, and earn extra income.

Noon has the potential to become the VIP Kid or GoGoKid for Saudi Arabia. Those companies scaled incredibly quickly in China and continued to outperform in the pandemic.

Offices In: Riyadh, Saudi Arabia

Total Funding: $21.6MM

Honorable Mentions

Quiqup: Supply Chain Management + Same Day Delivery for Retail/Restaurants

Offices In: UAE

Total Funding: $47.5MM

JustClean: Laundry Service App

Offices In: Kuwait

Total Funding: $20MM

Telr: Payment Gateway

Offices In: UAE

Total Funding: $11.8MM

Toters: On Demand Delivery in Lebanon and Iraq

Offices In: Lebanon

Total Funding: $8.4MM

What Middle East and North Africa Startups Did I Miss?

I’m sure I missed quite a few prolific, fast-growing Middle Eastern startups. Let me know which ones on Twitter at @amitch5903!

0 Comments