2022 is going to be a very exciting year for LATAM startups. The region has rapidly grown and matured so much over the past decade that we’re on the cusp of the “year of the IPO” for the continent.

It was a lot of fun putting together this year’s list. Like always, you may recognize a name or two, but hopefully, you’ll also learn about a few great startups that have mostly flown under the radar to date.

Let’s dive in!

Other Startups to Watch:

- Top 10 Pakistani Startups to Watch

- Top 10 African Startups to Watch

- Top 10 Middle East Startups to Watch

- Top 10 European Startups to Watch

- Top 10 Indian Startups to Watch

- Top 10 Chinese Startups to Watch

- Top 10 Israeli Startups to Watch

Want to be the first to know when my posts go live?

Follow me on Medium and subscribe to my newsletter: Modern Product Manager Newsletter

Interested in Investing in Startups Like These?

Check out the Mitchell Ventures syndicate on AngelList here

Latin America’s Startup Environment

The secret is out: LATAM has completely exploded as a startup ecosystem (in a good way!)

An incredible 2021 for LATAM startups was capped off by neobank Nubank (say that 3 times fast) going public on the NYSE at a $40B+ valuation. The region now has at least 25 unicorns, with 6 being added in the last 12 months alone. Softbank, a big player in the region, has backed at least 15 of these companies.

During the first 9 months of 2021, LATAM unicorns (including Kavak, Clip, Konfío, and Bitso) raised $14.8B, an increase of 174% from last year (CBInsights).

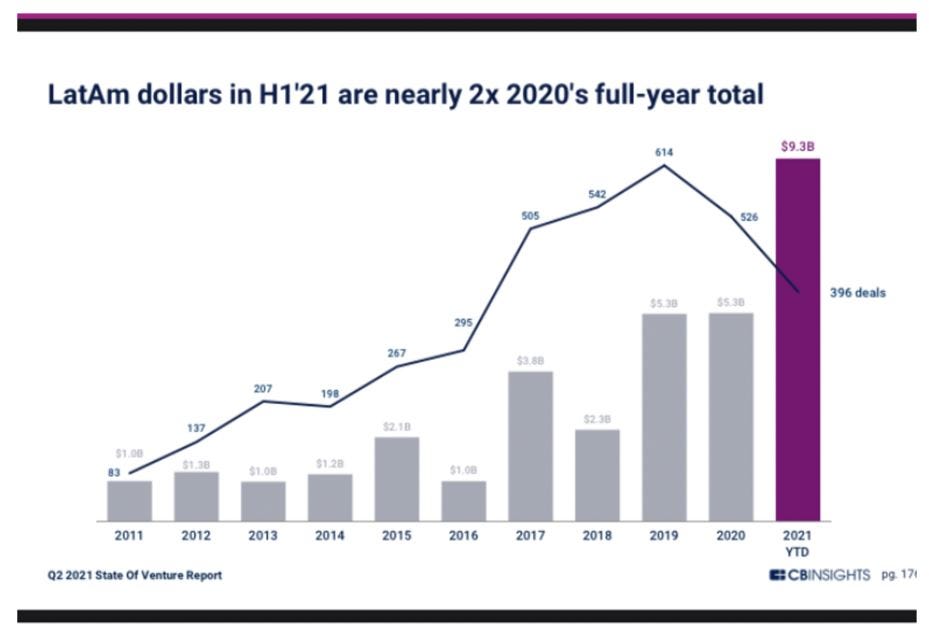

According to CB Insights’ State Of Venture Report, investment in the first 1/2 of 2021 alone for LATAM was $9.3B, an 830% increase compared to a decade ago. Funding isn’t everything, but it’s incredibly for an ecosystem that’s scaling.

Despite all of this funding, LATAM is still relatively small in the massive VC investment world. In Q2 2021, the region received only 4% of all VC investments, over 4x less than similarly populated Europe.

Harry Stebbings has a great perspective on why investing in LATAM is so powerful:

“The awesome thing about investing in LATAM: You are investing in products that make life 90% better for 99% of the population. Largely in Western markets, you are investing in products that make life 10% better for 5% of the population.”

Latin America’s startup ecosystem is a few years further down the road than another emerging ecosystem, Africa, and I hope to see that region follow the same path of incredible growth.

And things aren’t slowing down! Softbank announced in October 2021, that it will put another $3B in the area’s startups, on top of the $5B the fund has already invested in the region.

And many have predicted that 2022 will be the year of the LATAM IPO:

“We expect that 2022 will be the biggest IPO year in Latin America’s history. Now is the time for us to double down on our commitment to the region”

Marcelo Claure — Executive VP & COO of SoftBank Group Corp

These IPOs are exciting because they not only deliver liquidity to founding teams who can back the next generation of entrepreneurs, but they also will help the LATAM public markets catch up to the USA.

For example, Tech companies account for less than 10% of Brazil’s Bovespa index, while they make up almost a 1/3 of the S&P 500 index in the United States.

I’m excited to see the LATAM startup ecosystem continue to mature in 2022 and now is the time to jump into my list of the 10 startups to watch this year!

Sources: LABS, Forbes, TechCrunch, Bret Waters, TecReview, LeadersLeague, RefreshMiami, PracticeEcommerce, IDG Connect, Bloomberg

The Top 10 Latin American Startups to Watch

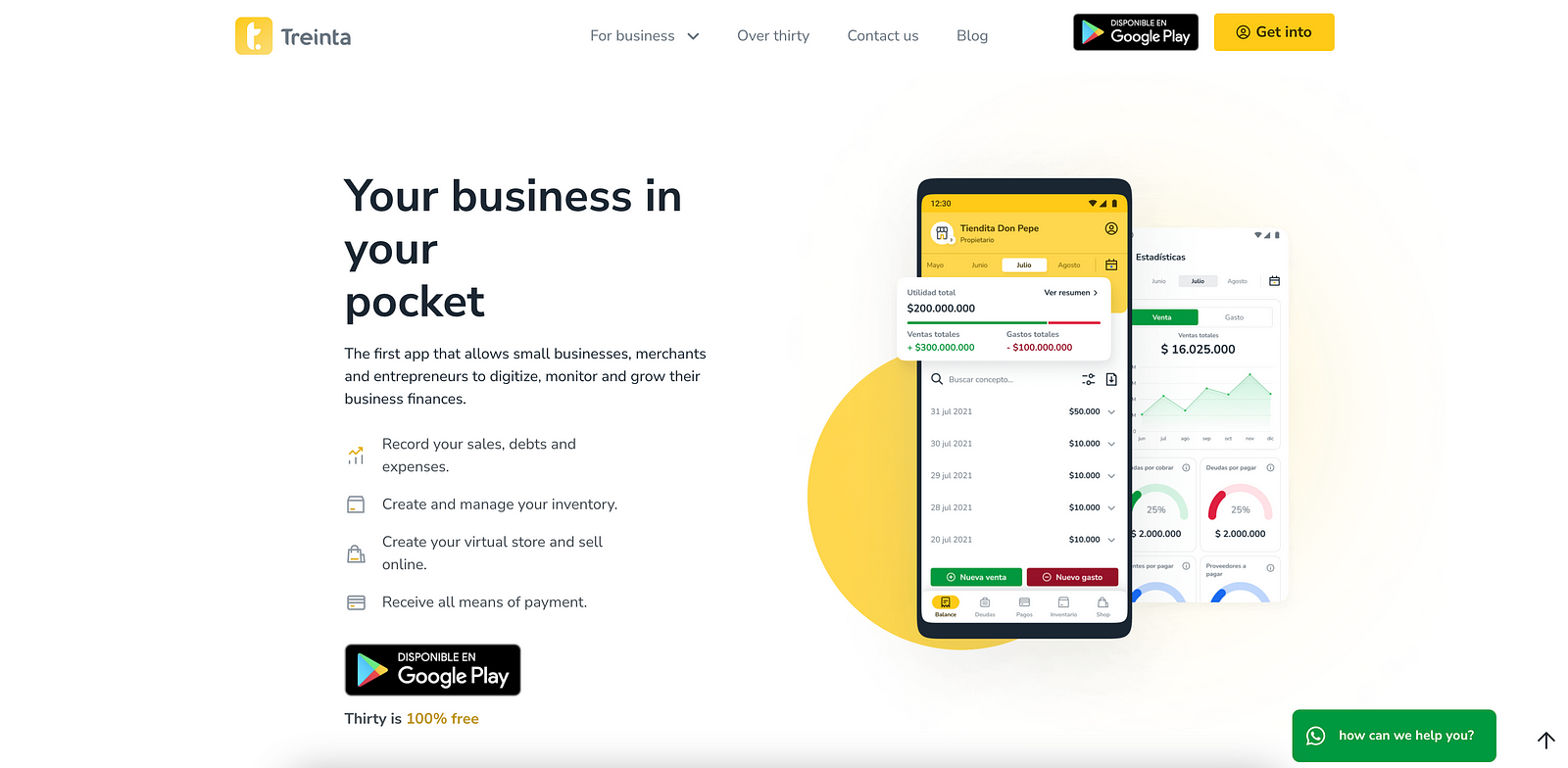

- Treinta: Khatabook for LATAM

Khatabook has been an incredibly successful “digital ledger” app for Indian small businesses, raising over $180MM since its founding in 2018.

The company delivered on common needs for small business owners: tracking purchases, offering credit, and managing payments in a simple digital ledger. Since Khatabook’s founding, numerous similar startups have emerged around the world including Creditbook in Pakistan/MENA, Kippa in Africa, BukuWarung in Southeast Asia, and now Treinta in LATAM.

Treinta has grown incredibly quickly over the past 12 months, both in terms of MAUs and in team members (they scaled from 15 → 100 people in 2021).

Its been exciting to see the new services they’ve added for their business owners in 2021 including Treinta SHOP (eCommerce stores), Treinta Payments, and Treinta Dataphone (physical payment processing). I expect big things for Treinta in 2022!

Offices In: Bogotá, Colombia

Total Funding: $14.8MM

2. FastFarma: Capsule for Ecuador and Mexico

When a new model for an existing business comes along that causes you to say: “Why weren’t things always this way?” you know they’ve done something special.

For anyone in the USA who has ever used Capsule, you likely have had this feeling. When you’re feeling sick, the last place you want to go after the doctor’s office is to the pharmacy to fill your Rx. Instead of that poor experience, Capsule rapidly delivers your Rx directly to your door, think DoorDash for your prescription.

FastFarma is bringing that model to LATAM. The company, which was a member of YCombinator’s S21 class, launched in Quito, Ecuador in February 2021, Guayaquil, Ecuador in July 2021, and Mexico City in August 2021.

I specifically love how FastFarma is mixing the “dark stores” model that’s grown so rapidly over the past year with a vertical that is woefully underserved and needed in LATAM.

I would not be surprised to see FastFarma raise another round of funding in 2022 to scale to more cities more quickly.

Offices In: Quito, Ecuador

Total Funding: $2.2MM

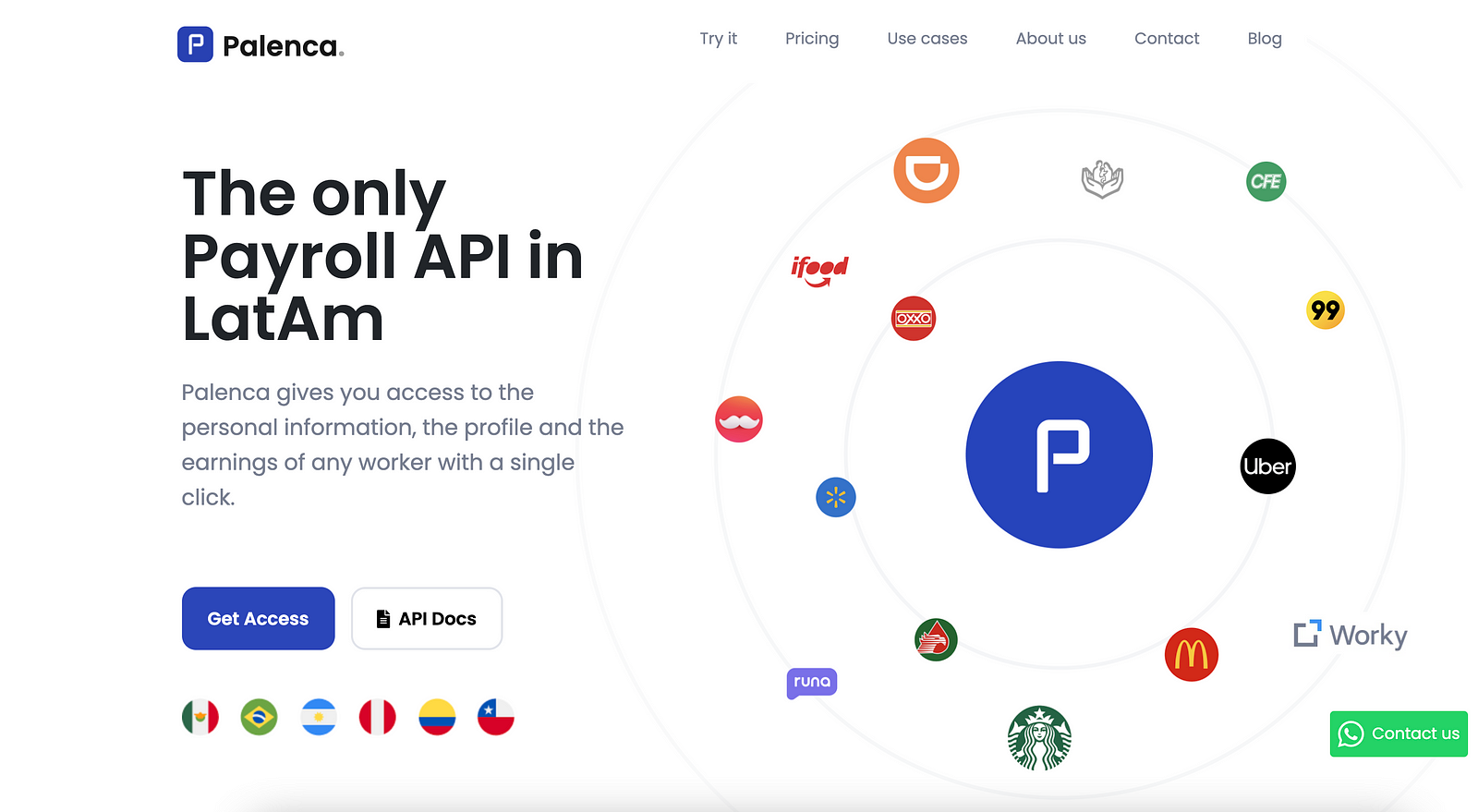

3. Palenca: Payroll and Identity APIs

Palenca has an incredibly interesting and unique business model in LATAM. With the rise of the gig economy, it’s become more difficult for businesses to verify employees’ work history and personal information.

Enter Palenca, which currently integrates with major gig economy employers like Uber, Rappi, Didi, representing more than 95% of the LATAM gig economy.

After the prospective employee authenticates with one or multiple of these employers, the new employer or service has access to their basic personal information, key performance information (i.e. driver rating, # of trips), as well as their past earnings.

By sharing this information, individuals are able to leverage their gig payroll history and performance to apply for car loans, personal loans, and other credit products or products that require a background check.

Palenca has built an incredible moat through its unique relationships with these gig economy players that would be very difficult to replicate. I’m excited to see how they leverage 2022 to unlock new use cases for this data and scale its integration with other services.

Offices In: Mexico City, Mexico

Total Funding: $125k

4. Moons: SmileDirectClub / Candid for Mexico

Moons is bringing DTC orthodontics to LATAM, beginning with Mexico. The company is working to replicate the success of companies like Candid in the USA, at a much more affordable price point.

Today, orthodontic treatment in LATAM costs ~$3,000. Moons aspires to bring that down ~85% to ~$500. This would be completely transformational for the industry and would truly democratize access.

Prior to the pandemic, Moons heavily relied on clinics. In the first few months of 2020, they completely reinvented their business model, launching impression kits and scaling their revenue beyond where they were pre-pandemic.

I’m incredibly excited to see what Moons can do in 2022 as they capitalize on the opportunity not only present in Mexico, but available in all of LATAM. I wouldn’t be surprised to see them raise a healthy Series B if they can keep up their pace!

Offices In: Mexico City, Mexico

Total Funding: $14.2MM

5. Pari: Drizly for Mexico and LATAM

US-based Drizly was already on a tear before the pandemic. Since 2020, the company grew at a breakneck pace, culminating in its $1.1B acquisition by Uber.

Pari is bringing a somewhat similar rapid alcohol delivery model to LATAM, with a few twists. Instead of relying on local liquor stores, Pari maintains dark warehouses in the cities they serve so they can deliver orders in under 30 minutes.

Pari is live in Mexico City today with near-term plans to expand to other Mexican cities and other LATAM countries. The company has scaled very quickly since its founding in January 2021 and I wouldn’t be surprised to see them raise significant scale capital before the end of the year if they can demonstrate strong demand in the cities they serve.

Hyper-fast delivery is becoming a crowded space, but similar to FastFarma, Pari’s focus on a specific segment may help them operate more efficiently and ultimately deliver a better experience than other “all-in-one” delivery apps.

Offices In: Mexico City, Mexico

Total Funding: Not Disclosed

6. Picker: Last-Mile Delivery in Ecuador

Picker offers last-mile delivery services that can be integrated into other applications. So far, the company has partnerships with McDonald’s, Subway, Dunkin Donuts, and others to help optimize hyperlocal delivery.

These companies integrate with Picker’s API and when a delivery is needed, Picker automatically connects that delivery with the best local delivery provider, whether that is Gacela, Uber, or Picker itself. Picker also provides the order tracking experience that customers desire, including SMS/Email/WhatsApp notifications.

For large food/beverage companies and smaller startups looking to deliver, Picker is a great option to keep costs lower and deliver a great delivery experience to customers. It’s no wonder the company was picked by 500 Startups for their Batch 14 in October 2021.

Picker has a unique opportunity to be the backbone for last-mile delivery in LATAM and 2022 will be a big year for them to scale their partnerships.

Offices In: Guayas, Ecuador

Total Funding: $600k

7. Hash: b2b Payment Infrastructure

Similar to Picker, albeit at a large scale, Hash operates in the background as a b2b service in LATAM. Put simply, Hash offers white-label payments software.

The company had a banner year in 2021, first raising a $15MM Series B led by fintech powerhouse QED and then raising a $40MM Series C co-led by QED Investors and Kaszek. Clearly, they are doing something right!

Hash is tapping into a rapidly growing market of non-financial institutions looking to offer banking or other financial services. The company provides everything those companies need including POS, mobile applications, payment functionality, and more.

In 2021, Hash reports that it has seen “10x growth in POS transactions, and anticipates it will top $275 million in total payment volume by year’s end.” Wow. Hash is in the right place at the right time.

Given how fast they are growing, I wouldn’t be surprised to see a Series D in 2022 and a unicorn valuation.

Offices In: Sao Paulo, Brazil

Total Funding: $58.7MM

8. Belvo: Plaid and More for LATAM

Belvo is bringing secure access to financial data to LATAM. Similar to Plaid, Belvo enables any application to access data from their end-users through a single API linked to hundreds of bank (and non-bank) sources.

As of 2021, Plaid was valued at approximately $15B.

Belvo’s differentiation is its familiarity with the LATAM market, having built partnerships with BBVA, Santander, Rappi, just to name a few. In addition to connecting personal finance data, Belvo can be used for loan applications, accounting and ERP, and new account onboarding.

Belvo raised a massive $43MM Series A in June 2021 and I’d expect to see an even bigger Series B in late 2022 as they scale up their partner network and customer use cases this year.

Offices In: Mexico City, Mexico

Total Funding: $56MM

9. Ripio: Cryptocurrency Payment Company

Ripio in many ways is similar to other larger, well-known crypto companies like Coinbase: They offer digital wallets and cryptocurrency trading.

However, they are in major growth mode. In January 2021, they bought Brazil’s 2nd biggest crypto exchange, BitcoinTrade, and have recently reported more than 2MM users across Argentina and Brazil. The company plans to enter Colombia soon and has also mentioned Spain being on its near-term roadmap.

Ripio’s biggest challenge in 2022 will be differentiating itself effectively from other, larger competitors like FTX and Binance. How can the company compete against these bigger startups? Delivering localized services is one approach and new, innovative product development is another.

Offices In: San Francisco, CA

Total Funding: $94.4MM

10. Fondeadora: Remittance and Mobile Wallet

Fondeadora is Nubank for Mexico.

They are following many of the common elements of the neobank playbook including a debit card with no fees, easy registration, and simple p2p payments.

Key backers of the startup include YCombinator, Google’s Gradient Ventures, and Sound Ventures.

Cash is still king in Mexico and Fondeadora plans to be a big part of changing that. The neobank frontier in Mexico and given Nubank’s recent IPO and valuation of $43B (as of early 2022), there is plenty of value here!

Offices In: Mexico City, Mexico

Total Funding: $32.2MM

Honorable Mentions

Mujer Financiera: Finance-related education for women

Offices In: Argentina

Total Funding: Not disclosed

Bitacora: Workplace planning

Offices In: Mexico

Total Funding: Not disclosed

Addi: Credit and banking solutions, BNPL, and more

Offices In: Bogota, Columbia

Total Funding: $376MM

Bitso: Cryptocurrency exchange platform

Offices In: Mexico City, Mexico

Total Funding: $378MM

Tiendanube: SMB tools to set up, manage, and promote online businesses

Offices In: Buenos Aires, Argentina

Total Funding: Not disclosed

Bendo: provides a platform to help users establish an online shop

Offices In: Monterrey, Mexico

Total Funding: Not disclosed

What Latin American Startups Did I Miss?

I’m sure I missed quite a few prolific, fast-growing Latin American startups. Let me know which ones on Twitter at @amitch5903!

0 Comments