As I’m writing this, it’s almost the end of 2020. There were certainly a lot of ups and downs this year to stay the least. A LOT of things changed around the world.

Many businesses failed, but some startups thrived.

I’m excited to write about many of the incredibly impressive startups in Latin America that you need to watch in 2021. These startups not only survived the pandemic but thrived in it, managing to grow incredibly quickly by meeting and exceeding customer needs.

Other Startups to Watch in 2021:

- Top 10 European Startups to Watch in 2021

- Top 10 African Startups to Watch in 2021

- Top 10 Chinese Startups to Watch in 2021 (Coming Soon!)

- Top 10 Indian Startups to Watch in 2021 (Coming Soon!)

- Top 10 Israeli Startups to Watch in 2021 (Coming Soon!)

- Top 10 Middle East Startups to Watch in 2021 (Coming Soon!)

Want to be the first to know when these posts go live?

Follow me on Medium and subscribe to my newsletter: Modern Product Manager Newsletter

Latin America’s Startup Environment

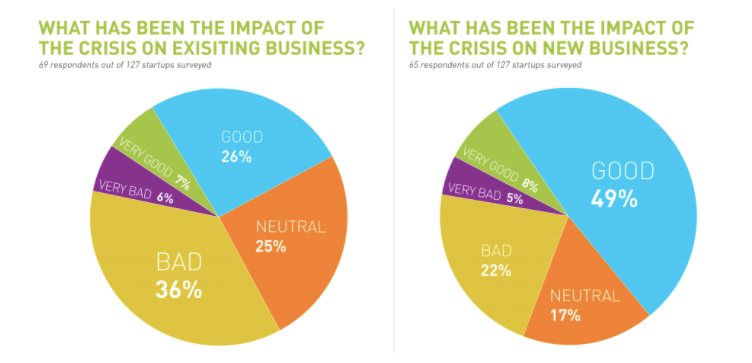

Similar to every other region around the world, Latin America was impacted heavily by the Coronavirus pandemic. By Summer 2020, data was starting to emerge from surveys of LatAm startups:

- 42% reported that the impact was bad or very bad for existing business

- 25% reported a neutral impact to existing business

- 33% reported that the impact was good or very good for existing business

However, when looking at new business, the picture was a bit better:

- Only 27% reported that the impact was bad or very bad for new business

- 17% reported a neutral impact to new business

- 57% reported that the impact was good or very good for new business

In short, even by the Summer, most of the 127 startups surveyed were adapting reasonably well, pivoting to find new business opportunities, even outside of their industry.

Latin America continued to attract capital amidst the pandemic, especially in Brazil and Mexico. Lending and delivery services have done especially well in raising funding in 2020.

Total foreign direct investment to Mexico for the first half of 2020 was $17.7B, only a 0.7% decrease compared to last year. A drop of less than 1% during a global pandemic is pretty impressive.

Startup investment specifically has seen significant growth in Mexico, despite the pandemic. According to an April 2020 Transactional Track Report, Mexican VC investment increased by 132% compared to 2019.

FinTech is a particular sector that has continued to see strong growth. A report by the LATAM Fintech Hub showed that Latin American FinTechs raised $525M in equity and debt between 74 deals in 2020 H1.

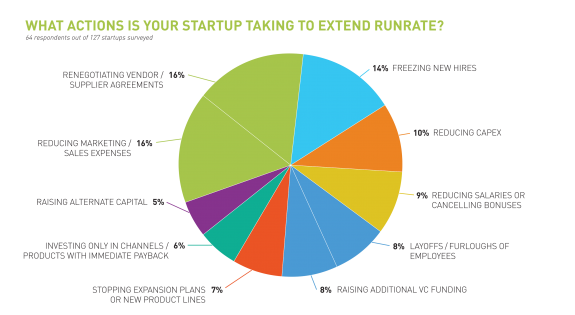

Latin American startups have also taken full advantage of many measures (as a startup should) to extend their run rate, ranging from renegotiating supplier agreements to reducing marketing expenses to freezing hiring.

Uniquely, more strongly funded Latin American startups have also found ways to give back to the communities that have done so much for them:

- Nubank launched a R$20m fund to assist customers with mental health services and credit to purchase essential goods. Nubank also launched a donation-matching portal as part of its platform where users can support ActionAid, Citizenship Action, Brazilian Red Cross, and Hospital das Clínicas in São Paulo.

- Ayenda Hotels, a Colombian low-cost hotel chain, supported Airbnb’s Frontline Stays program in Colombia to provide free and subsidized homes for healthcare professionals and frontline responders

- Ualá, an Argentine personal financial management mobile app, donated ~$600k to the Argentine Red Cross to purchase critical medical supplies. Ualá also enabled its users to donate to the Red Cross directly through the app, and postponed installments for loans for 30 days.

- Zinobe, a Colombian fintech focused on credit origination, was approved for a $30m credit facility by Monachil Capital Partners specifically for loans destined to Colombian citizens impacted by the social isolation measures.

Sources: LatamList, Startup Directory, Statista, LAVCA

How Did I Choose This Top 10?

2020 was an incredibly unique year for startups around the world. The disruption caused by the pandemic led to some startups thriving by design, some failing by design, and others having to fight to completely redefine their business.

For this list of startups to watch in 2021, I’ve focused on the companies that built strong momentum during the pandemic, either through being in the right place at the right time and pressing their bets or pivoting into that “right place.” As you’ll see, many of these startups are operating in the FinTech industry where the pandemic has offered incredible opportunities.

Many of these companies had strong 2020’s, but I’m confident 2021 will be the year that many of them reach hockey stick growth and become the leaders of the “new normal.”

The Top 10 Latin American Startups to Watch

- Addi: Credit for Online Purchases

Addi is simplifying buying with credit in Colombia and Brazil. With just your ID and your WhatsApp, Addi can extend credit instantly with a rapidly growing roster of top retailers.

The company was founded in 2018 and has raised several rounds of funding, most recently a $15MM Series B mid-pandemic (May 2020).

Addi is somewhat similar to US-based Affirm, which filed to go public in November of 2020, likely at a high, multi-billion-dollar valuation.

Offices In: Bogota, Colombia and São Paulo, Brazil

Total Funding: $31.3MM

2. Cobli: Fleet Management and iOT

Fleet Management startup Cobli was founded in 2015 and raised a $10MM Series A in October 2019, pre-pandemic.

Cobli, like many other fleet management startups I’ve covered around the world (Trella, Liftit, Kobo360), is focused on not only managing fleets of trucks and other vehicles more efficiently, but also sharing valuable telemetric data with fleet operators. This data includes location and speed of course, but also things like g-forces, cargo temperature, and maintenance issues.

Watch out for Cobli in 2021 as they step on the gas and start scaling!

Offices In: São Paulo, Brazil

Total Funding: $17MM

3. Cora: Credit Solutions for Brazilian SMBs and Self-Employed

Cora was founded in 2019 as a tech-enabled lender to small and medium-sized businesses. Amazingly, in less than a year, the company was able to raise an uncharacteristically large $10MM seed round.

How did they pull off that kind of funding?

A one of a kind founding team. Founders Igor Senra and Leo Mendes previously founded an online payments company, MOIP, in 2005 and sold it to WireCard in 2016.

According to the founders, “[Small and Medium] businesses produce 67% of the Brazilian GDP, but are totally underserved by the traditional banks.”

I’m excited to see if Cora can build off of this early momentum with investors and prove it now with customers.

Offices In: São Paulo, Brazil

Total Funding: $10MM

4. Finanzero: Online Marketplace Simplifying Credit Applications

Somewhat similar to Addi, Finanzero is focused on making access to credit easier. But while Addi has taken the “Affirm path”, Finanzero has focused more on traditional loan products: personal loans, auto refinancing, and home refinancing.

Finanzero partners with close to 50 loan providers and allows you to Kayak-style compare the different companies and different rates in one place. The company was founded in December 2015 and most recently raised an $11MM Series B in April 2019.

Offices In: São Paulo, Brazil

Total Funding: $15.8MM

5. Habi: Simplifying Home Buying and Selling

Habi is Opendoor for Latin America. And if you don’t think this is a problem worth solving, listen to these sobering statistics:

In the Bogota, Colombia market, the average home takes 14 months to sell; that figure drops to 10 months for middle class homes.

When Habi was founded in 2019 (and still today), it was a market that lacked price transparency and where sellers used analog tactics like posting physical signage in the neighborhood in a futile attempt to attract buyers.

From these problems, founders Brynne Rojas and Sebastian Noguera started Habi, a property tech startup with a two-fold approach. The startup founders built a centralized database of residential real estate prices and trends — essentially a multiple listing service (MLS) — and then used that information to create an automated pricing algorithm to buy and sell homes quickly and efficiently. (TechCrunch).

It’s a big problem and one that others are attacking too, but Habi is off to a strong start and I’m excited to see them continue to grow in 2021!

Offices In: Bogotá and Medellín, Colombia

Total Funding: $15.5MM

6. IDWall: Identity Verification and KYC as a Service in LatAm

Another “Top Startups to Watch” list, another ID verification company, Alex? Yes, of course! Based on the performance of ID verification companies I’ve featured on past lists (Smile Identity, Intergrateme), I hope you’re buying in too.

IDWall is a 500 Startups company (2017) founded in 2016 that helps with ID document data extraction, biometric security/authentication, background checking, and more. They aim to serve all of the onboarding, know your customer (KYC), and user identification needs of the growing class of Latin America neobanks and FinTech companies.

IDWall raised a $10MM Series B in November 2019 and given the growth of their customer’s businesses, I wouldn’t be surprised if they raised a much bigger Series C in 2021.

Offices In: São Paulo, Brazil

Total Funding: $23.8MM

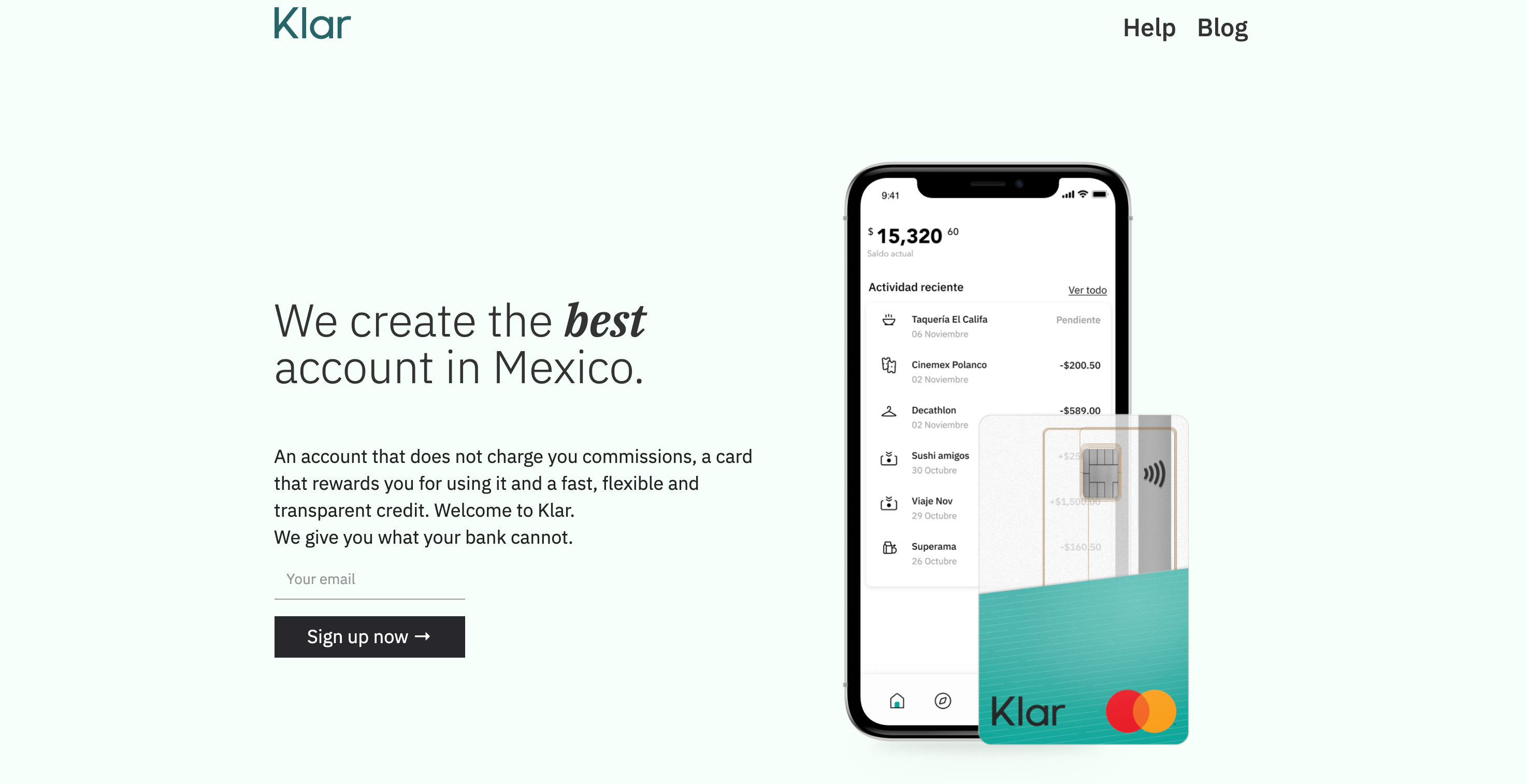

7. Klar: Mexican Fintech Focused on Personal Finance and Lending

Founded in 2019, Klar is a relatively new-to-the-scene challenger bank in Mexico. Despite its young age, the company has raised $72.5MM (although $50MM of that is debt financing), most recently raising a Series A of $15MM in October 2020.

Founded by Stefan Moller, a former consultant at Bain & Co. who advised large banks, Klar blends Moller’s work experience in Mexico with his connections to the German banking world and the tech team at Berlin-based n26 to create a challenger bank offering deposit and credit services for Mexican customers. (TechCrunch)

Klar’s opportunity is HUGE in Mexico, where only 10% of adults have a credit card today. I’m excited to see them continue to modernize the state of the financial sector in Mexico and beyond in 2021!

Offices In: Mexico City, Mexico

Total Funding: $72.5MM

8. Minu: Access Your Earned Wages Before Payroll

Minu offers employers a (free) service that allows their employees to access their earned wages before payroll. On the employee’s side, they pay a fixed fee for early withdrawals of their salary, which are deposited in the same account that their paycheck is.

The company, founded in 2019, is similar to US-based Dave, Even, and DailyPay.

So far, the company has raised only a $6.5MM seed round of funding in September 2019, but I wouldn’t be surprised to see them raise another round in early 2021 to accelerate their growth and allow them to work with more employers.

Offices In: Mexico City, Mexico

Total Funding: $6.5MM

9. Vittude: Online Therapy in Brazil

Vittude is an on-demand platform that connects you to psychologists covering various therapeutic approaches based on your personal needs.

According to WHO, Brazil has the most anxious, the 2nd more stressed, and the 5th most depressed population of the world!

The company was founded in 2016 and most recently raised funding (R$4.5M) in November 2019. They are serving a real need and I’m excited to see many more mental health startups gaining serious traction in Latin America.

Offices In: São Paulo, Brazil

Total Funding: R$5.1M

10. VirtusPay: Installment Payments for eCommerce Purchases (Affirm for Brazil)

Installment payment/on-demand credit companies are so HOT right now in LatAm. Even though Affirm has delayed their IPO until early 2021, investors still expect the company to valued in the $10B range.

VirtusPay, founded in 2017, is bringing Affirm to Brazil and going heads up against Addi there. But, to be honest, there is more than enough market opportunity for both companies in Brazil and beyond for a couple of years at least.

I’m excited to see so much FinTech innovation in Latin America lately and VirtusPay is positioned well to be a part of that growth!

Offices In: São Paulo, Brazil

Total Funding: $63k

Honorable Mentions

Ubits: Online Learning Platform

Offices In: Bogota, Colombia

Total Funding: $2.5MM

EasyLex: LegalTech

Offices In: Mexico

Total Funding: Unknown

Crack the Code: LatAmCode School

Offices In: Peru

Total Funding: Unknown

Talentu: Hire and Retain Manual Labor

Offices In: Colombia

Total Funding: Unknown

What Latin American Startups Did I Miss?

I’m sure I missed quite a few prolific, fast-growing Latin American startups. Let me know which ones on Twitter at @amitch5903!

0 Comments