As I’m writing this, it’s almost the end of 2020. There were certainly a lot of ups and downs this year to stay the least. A LOT of things changed around the world.

Many businesses failed, but some startups thrived.

I’m excited to write about many of the incredibly impressive startups in India that you need to watch in 2021. These startups not only survived the pandemic but thrived in it, managing to grow incredibly quickly by meeting and exceeding customer needs.

Other Startups to Watch in 2021:

- Top 10 Latin American Startups to Watch in 2021

- Top 10 European Startups to Watch in 2021

- Top 10 African Startups to Watch in 2021

- Top 10 Israeli Startups to Watch in 2021 (Coming Soon!)

- Top 10 Chinese Startups to Watch in 2021 (Coming Soon!)

- Top 10 Middle East Startups to Watch in 2021 (Coming Soon!)

Want to be the first to know when these posts go live?

Follow me on Medium and subscribe to my newsletter: Modern Product Manager Newsletter

India’s Startup Environment

Indian startups raised total (disclosed) funding of $8.4B between January 2020 and mid-November 2020. This is a 30% decline compared to the funding raised by Indian startups in 2019 and for reference, is almost equal to the funding amount raised way back in 2015.

For the year, Indian Startups are projected to end with ~$9.3B raised.

The number of deals declined as well, at 765 total deals for this period, below the recent low of 829 in 2017.

At the beginning of the 3rd quarter, Indian businesses and the economy began to recover from the worst of the pandemic. In September especially, there was a massive increase in funding, totaling $1.9B — up from $276 million in August.

September was buoyed by a massive $500MM investment into Byju, a rapidly scaling EdTech startup. This funding gain was also due to aggressive funding and growth in FoodTech, OTT, and online gaming sectors.

Collectively, $3.6B was invested into Indian startups during the three-month period of Q3 2020.

From January to November 2020, the top sectors in India by number of startup funding rounds were:

- FinTech and Financial Services (123)

- eCommerce/Retail (99)

- EdTech (84)

- HealthTech (80)

- Enterprise Software (42)

Together, these sectors comprised around 56% of the total deals during this period. Several sectors were strong outperformers during the pandemic and this showed in deal volume.

The fastest-growing sectors by number of funding rounds included:

- HRTech (+159%)

- CleanTech (+119%)

- RetailTech (+66%)

- Online Gaming (+59%)

- Automotive/Mobility (43%)

- Enterprise Software (+38%)

- AgriTech (+12%)

- Deep-Tech (+6%)

The State of 2020 Indian Startup Funding

Sources: TechCrunch, AngelList, Statista, YourStory, QZ, LinkedIn, TechCrunch (again)

How Did I Choose This Top 10?

In a thriving startup ecosystem like India, it’s getting more and more challenging to pick the top 10 startups to watch!

For this year’s list, I’ve selected startups in many industries including B2B Services, FinTech, EdTech, Automation/AI, HealthTech, and Logistics. I’m optimistic that these companies and these sectors will continue to outperform in 2021 and build on the lead that they created in 2020.

So let’s dive into the list!

The Top 10 Indian Startups to Watch

- Jumbotail: Online Grocery Marketplace for Businesses

In many ways, Jumbotail is similar to a startup from Pakistan that I’ve shared before (Tajir), but on a much larger scale. Jumbotail was founded in 2015 to better supply thousands of mom & pop grocery retailers (called “kirana stores”) across India.

Previously, these stores were only able to buy items from a limited catalog, delivery could take a month or more, and owners weren’t provided any other resources beyond inventory to help their business succeed or grow.

In addition to providing bountiful inventory options and fast delivery, Jumbotail also offers these neighborhood businesses credit based on the company’s unique knowledge of those businesses’ sales and inventory.

Jumbotail closed an $11MM Series B round of funding in October 2020 and I’m excited to continue to see the company scale rapidly in 2021.

Offices In: Bengaluru

Total Funding: $36.4MM

2. Loan Frame: Lending for SMEs in India

Founded in 2015, Loan Frame provides credit and finance solutions for SMEs in India. The company most recently raised $10MM in December 2019.

Primarily, Loan Frame specializes in Inventory Financing and Collateral-Free Loans. They’ve already distributed over 20k loans and SMEs can check their eligibility in under 60 seconds ? ? ?

Keep an eye on Loan Frame in 2021 as they continue to grab more market share with better technology and innovative solutions for India’s small businesses!

Offices In: New Delhi

Total Funding: $22.3MM

3. Unschool: Coding, Digital Marketing Courses, and Coaching

Unschool offers online courses in Technology, Management, and Art, taught by over 200 experts (called mentors) in those fields. It’s a marketplace model that is a little bit MasterClass, a little bit Teachable.

Impressively, subscribers and revenues have risen by over 10x since February!

Unschool is young (founded in 2019), but it was founded at the right time to capitalize on the massive demand for online learning accelerated by the pandemic. I wouldn’t be surprised if they raised a meaningful seed round in 2021!

Offices In: Hyderabad

Total Funding: Not disclosed

4. Yellow Messenger: Conversational Automation for WhatsApp, Google Assistant and More

Yellow Messenger offers virtual assistants, conversational automation, and conversation analysis for the world’s largest enterprises across different chat channels.

The company raised $20MM in Series B funding in April 2020 and it’s currently expanding into the US and EU and counts global names like Byju, Schlumberger, and Dominos as customers.

Yellow Messenger had a great 2020 and I expect an even better 2021 as more companies lean into automated solutions that deliver higher quality 24/7 service.

Offices In: Bengaluru

Total Funding: $24MM

5. PharmEasy: Prescriptions and OTC Delivered

A $328MM funded company on the startups to watch list? Yes!

Chances are if you don’t live in India or aren’t one of PharmEasy’s investors, you haven’t heard of the company.

PharmEasy, founded in 2015, has been on an incredible growth run that has only been accelerated even more by the pandemic. The company provides prescription and OTC medicine, diagnostic tests, and just about everything you could ever imagine seeing at your local pharmacy plus more.

PharmEasy became an essential service in 2020 and in 2021, I predict they’ll see even more impressive growth along with competitors like 1mg. In 2021, these companies will become a part of day-to-day life for more and more Indians.

Offices In: Mumbai

Total Funding: $328MM

6. Digit Insurance: Car, Bike, Commercial, and Travel Insurance for India

Digit Insurance has been on a tear almost since the day it was founded back in 2016, most recently raising an $84MM round of funding in January 2020.

The company has consistently added new forms of insurance, most recently covering Covid-19 costs through their Health and Travel insurance products. Talk about an insurance company moving quickly!

Watch for Digit Insurance continue to scale through 2021 and add even more insurance products. I wouldn’t be surprised if an IPO or a strategic acquisition by Root, Lemonade, or Hippo is on their horizon by the end of 2021.

Offices In: Bengaluru

Total Funding: $179MM

7. CRED: Get Rewarded for Paying Credit Card Bills

CRED has created something new from something boring and old (paying your bills).

Rather than simply paying your credit bills and getting nothing for it (other than perhaps preserving your credit score), CRED flips this model on its head and offer a carrot instead of a stick: Pay your credit card bills on time and earn CRED “coins” that can be redeemed for rewards or used to enter in contests.

They’re clearly onto something. They’ve already attracted 3MM+ members since their founding in 2018 and have raised $255MM in total funding, most recently raising an $80MM Series C in November 2020.

I’d love to see this rewards model expand beyond India in 2021 and unlock even more value for CRED and get many more members to sign up!

Offices In: Bengaluru

Total Funding: $255MM

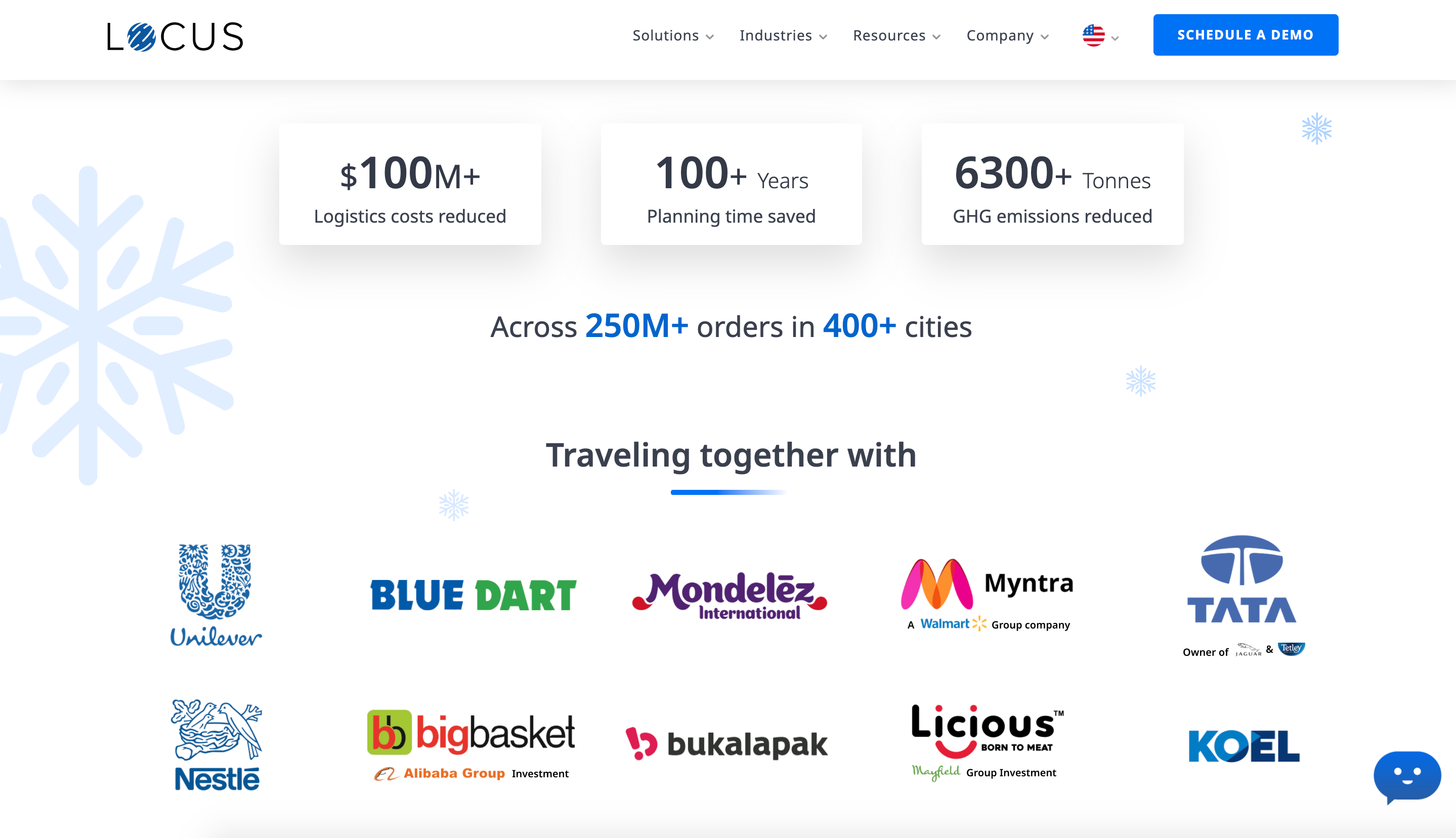

8. Locus: Intelligent Logistics for India

Logistics are even more important in India, where roads can vary highly in quality, extreme weather is frequent, and crowded cities are the norm.

Locus helps large brands like Unilever, Nestle, and BigBasket plan, track and optimize their distribution via dispatching and tracking solutions. Locus even helps these companies optimize the “mix” of delivery vehicles they have in their fleet for long, mid, and short haul transport.

Locus last raised a round of funding in May 2019 with a $22MM Series B. Given the hockey-stick growth in eCommerce in 2020 due to the pandemic, I wouldn’t be surprised to see Locus raise a very large Series C in 2021.

Offices In: Bengaluru

Total Funding: $28.8MM

9. Nanonets: Machine Learning Model Building Platform

Despite strong feature enhancements from major platform providers like AWS, it often can still be very difficult to build and deploy ML models.

Nanonets steps in to solve this problem, focusing on key use cases like Invoice, Driver’s License, Passport and ID Card OCR. The company has built ready-to-use models for many common business problems and their technology is already being used by companies like Deloitte, Tesla, and Doordash.

Offices In: Bengaluru; Mumbai; San Francisco, CA

Total Funding: $1.5MM

10. Vernacular.ai: Speech Recognition and Voice Assistant as a Service

Vernacular.ai works primarily with Banking, Food and Beverage, and Travel/Hospitality businesses to improve the experiences they offer customers via voice.

More specifically, their technology can handle complex servicing, qualification and activation needs without a human ever having to be involved. Vernacular.ai has had strong traction for their service since their founding in 2016, most recently raising a $5.1MM Series A in May 2020.

As voice and automation continue to be massively important in 2021, I expect to see Vernacular.ai scale their integrations with companies they’re already working with and sign many new customers, culminating in a much bigger Series B by the end of the year.

Offices In: Bengaluru

Total Funding: $5.1MM

Honorable Mentions

Dunzo: Hyper-local Delivery App

Offices In: Bengaluru

Total Funding: $120MM

Hippo Video: Video Engagement Platform

Offices In: Chennai

Total Funding: $6MM

BestDoc: Patient Relationship Management

Offices In: Kochi

Total Funding: $2.1MM

SquadStack: Scale Sales with ML/AI

Offices In: New Delhi

Total Funding: $7.1MM

What Indian Startups Did I Miss?

I’m sure I missed quite a few prolific, fast-growing Indian startups. Let me know which ones on Twitter at @amitch5903!

0 Comments