As I’m writing this, it’s almost the end of 2020. There were certainly a lot of ups and downs this year to stay the least. A LOT of things changed around the world.

Many businesses failed, but some startups thrived.

I’m excited to write about many of the incredibly impressive startups in Europe that you need to watch in 2021. These startups not only survived the pandemic but thrived in it, managing to grow incredibly quickly by exceeding customer needs.

Other Startups to Watch in 2021:

- Top 10 Chinese Startups to Watch in 2021 (Coming Soon!)

- Top 10 Indian Startups to Watch in 2021 (Coming Soon!)

- Top 10 Israeli Startups to Watch in 2021 (Coming Soon!)

- Top 10 Middle East Startups to Watch in 2021 (Coming Soon!)

- Top 10 Latin American Startups to Watch in 2021 (Coming Soon!)

- Top 10 African Startups to Watch in 2021

Want to be the first to know when these posts go live?

Follow me on Medium and subscribe to my newsletter: http://bit.ly/modern-product-manager-newsletter

Europe’s Startup Environment

The first few months of Covid-19 hit the European startup market hard. With countries like Italy among the worst hit in the early days of the pandemic, startups throughout Europe were definitely rattled too.

By June 2020, almost half (49%) of European startups had to turn to banks for government-backed loans in recent months, while 43% froze hiring (LocalGlobe and Dealroom).

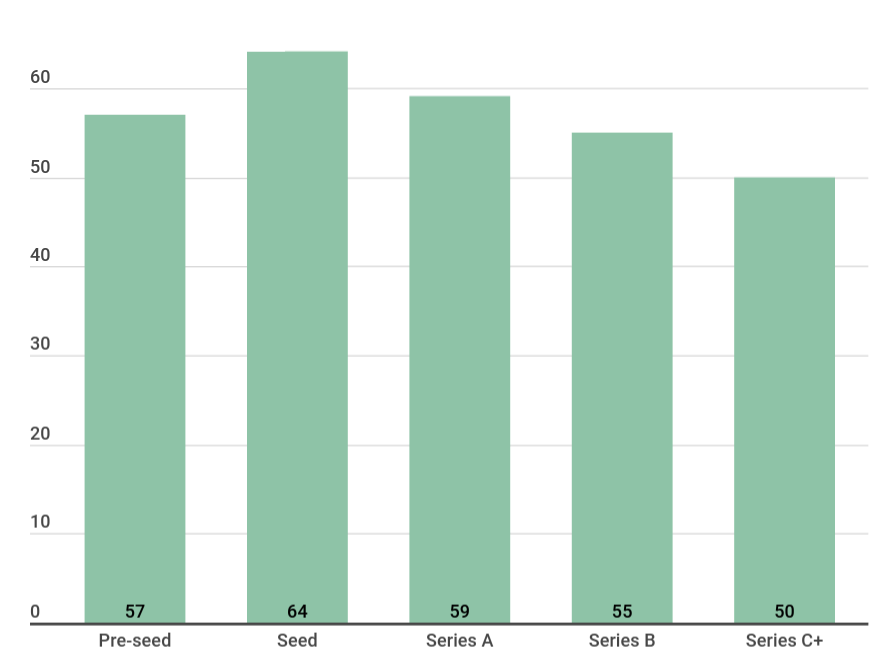

Seed stage companies were most likely to apply for this government aid, but loans were common across all stages of startups:

Additionally in June 2020, the future looked pretty bleak: 40% of European companies expected to see revenues down at least 25% in 2020, compared to previous targets.

Later-stage tech companies were more likely to have seen their revenues drop by June 2020, with 60% of Series C+ companies seeing revenues fall by at least 10% in March/April, along with 51% of Series B companies and 52% of Series A.

Overall, 35% of companies surveyed saw their revenues decline by over 25% during the first two months of the pandemic.

Fundraising was also impacted massively: More than 40% of startups planning to raise money imminently from investors delayed those plans.

However, it wasn’t all doom and gloom for European startups in 2020. As we saw in my post on the Top 10 African Startups to Watch in 2021, even within turbulent times like these, there are winners and there is growth.

First, on the positive side, 2/3rds of startups surveyed in Europe had over 1 year of runway (cash in the bank to fund operations).

In Europe, some of the winners have (unsurprisingly) been HealthTech startups. These startups already had the benefit of strong public health systems throughout the continent. For example, London-based Benevolent AI, uses artificial intelligence to identify promising new drug targets and has already identified some potential treatments for Covid-19 which are now being investigated further.

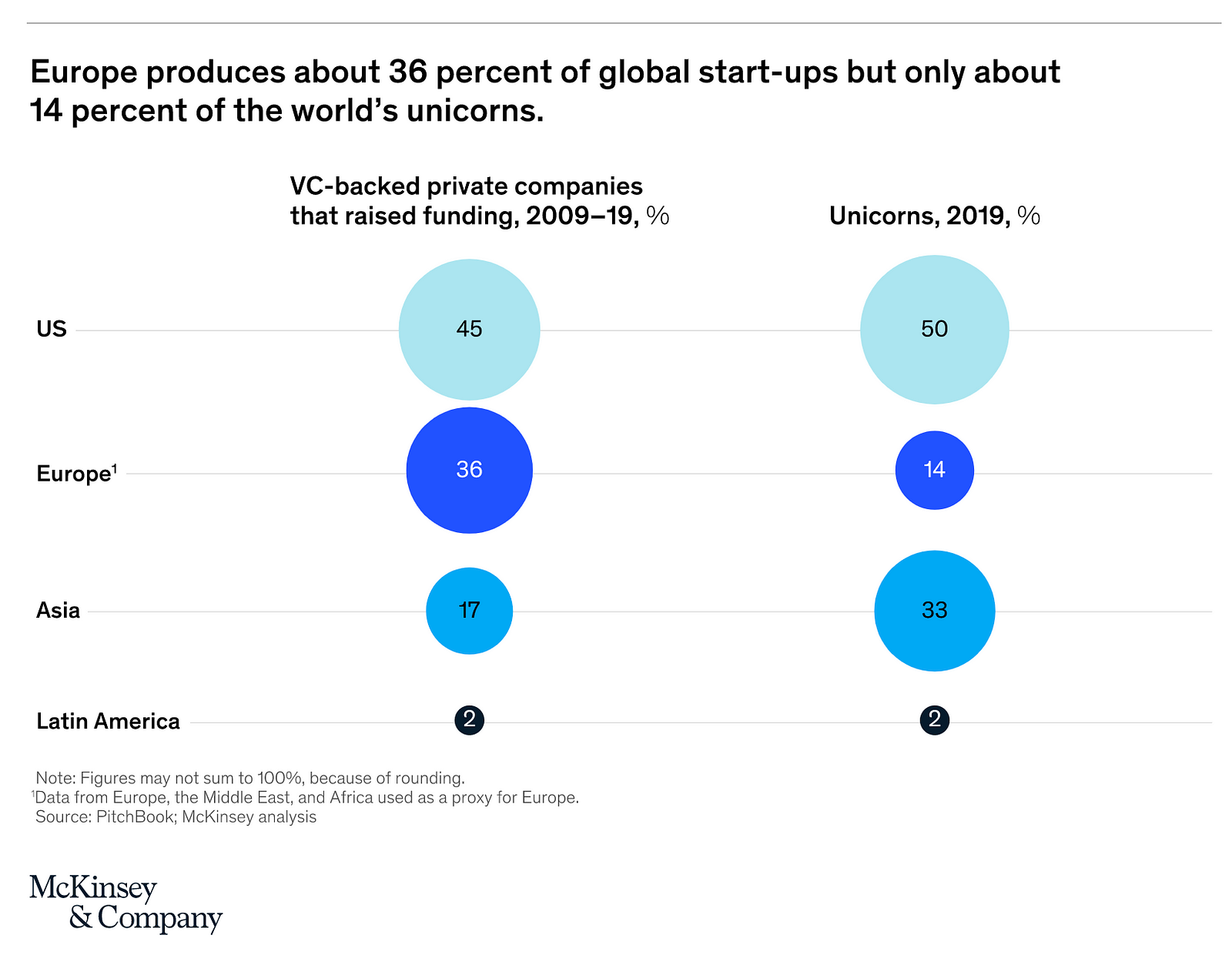

Separate from Covid-19, the European startup environment still suffers from several challenges. First, despite the region producing over 1/3 of global startups, it produces less than 1/6 of the world’s unicorns.

European startups are 30% less likely to progress from seed to a successful outcome (securing Series C funding or beyond, going public, or being sold), compared to startups that raised seed funding during that same time in the United States.

Key Characteristics Holding European Startups Back

- Domestic value pool is fragmented: At the most basic level, the fact that Europe is not a single market has large effects on what startups must focus on in their early years. Should they focus on just 1 country? Or should they focus on features that can have pan-European appeal and invest in localization/translation/etc.?

- Lower supply of late stage capital: Large funding rounds can be challenging. Historically, it has been more difficult for European companies to raise large funding rounds due to a lower supply of late-stage capital. Based on McKinsey interviews with industry insiders, this difference was partially attributed to European investors’ risk aversion.

- Cultural values are different: European startups face much greater pressure to perform, and to do so earlier, than startups in the United States, where having a failure in one’s past is typically seen as a badge of honor. Sentiment analysis of media coverage has shown that only about 17 percent of press coverage in Germany portrays entrepreneurship in a positive light, as compared with 39 percent in the United States.

- Attracting the best talent can be difficult: While Europe has a tech talent cost advantage compared to the United States, the continent’s startups often lack the tools to attract the best talent. In many European countries, unfavorable equity and stock-option rules make startups less appealing to potential employees. For example, more than 75 percent of the EU countries’ stock-option rules analyzed by the European VC firm Index Ventures lagged behind those of the United States.

- Innovation ‘superhubs’ not as densely packed with resources: “Superhubs” such as Silicon Valley and New York City, which have a high concentration of entrepreneurs, tech talent, and investors, have played a very important role in the success of the US startup ecosystem. Although London, Paris, Berlin, and Stockholm can be considered the leading hubs in Europe, they have not achieved the same concentration in terms of capital, knowledge, and talent. As a result, only about 30% of European startups have located their headquarters in a tech superhub, compared to almost 50% of startups in the US. However, Covid-19’s massive impact on remote work may make this difference less problematic and may potentially lessen the importance of superhubs.

Sources: Sifted, McKinsey, EuReporter

How Did I Choose This Top 10?

2020 was an incredibly disruptive year for European startups, who as we’ve seen earlier in this post, were already struggling with several significant headwinds compared to their counterparts in the United States.

This Top 10 list features companies not only surviving the pandemic but thriving in it. Whether they were forced to pivot their business model or not, these startups are succeeding and growing in a disruptive year to end all disruptive years.

As Covid-19 remains relevant through a large portion of 2021, these will still be startups you should watch closely.

The Top 10 European Startups to Watch

- MediQuo: Medical Chat, Appointments, and Prescriptions

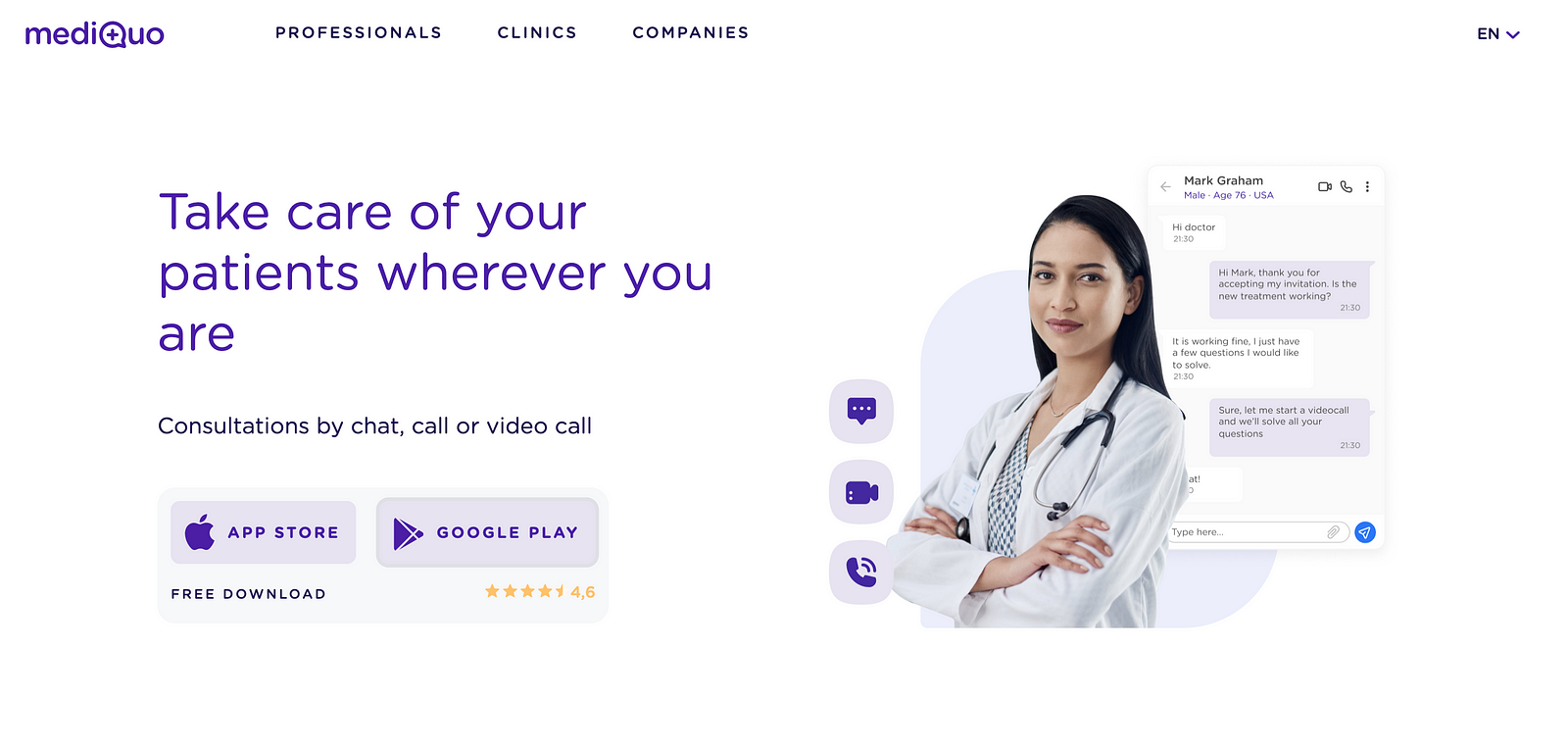

MediQuo is a Barcelona-based HealthTech startup founded in 2017 that focuses on managing medical appointments, whether remote or in person. Obviously, the former has been much more popular this year!

As of early 2020, the app has been installed by over 650,000 users managing over a million medical appointments.

Offices In: Barcelona, Spain

Total Funding: €4MM

2. G2 Esports: Top 5 Esports Club

You thought this would just be a list of HealthTech startups, right? Wrong!

Gaming has gone from rapid growth mode to hold-onto-your-seat, rockship, insane-mode growth during the pandemic. Gaming sales alone have increased nearly 40% YoY (source).

G2 Esports was founded by Carlos ‘ocelote’ Rodriguez, a former star player in League of Legends and Jens Hilgers. The club currently fields professional teams in League of Legends, Counter-Strike:Global Offensive, Hearthstone and Rocket League.

With gaming rapidly increasing and everyone having a significant increase to their time at home (and consequently their free time), G2 Esports is is positioned to grow their brand, test new ways to distribute their content, and sign new partnerships.

Offices In: Berlin, Germany

Total Funding: $27.3MM

3. Everli (Formerly SuperMercato24): Instacart for Italy

Online grocery sales grew 22% in 2019 and, propelled by high demand from Covid-19 lockdowns, look to increase about 40% this year (Coresight Research)

Of 1,152 consumers polled, 52% had bought groceries online in the past 12 months — the first time that more than half of respondents had done so and representing more than double the number of shoppers from two years ago.

Everli is in the right place at the right time, clearly! The online grocery company was founded in 2014 and started hitting it’s growth stride in 2018 with a €13MM Series B that it followed up with a €11MM round in early 2020 pre-pandemic.

With Instacart’s valuation more than doubling in 2020 (CNBC), Everli is in a great position to not only own Italy’s grocery delivery market, but also to expand rapidly into the rest of Europe.

Offices In: Milan, Italy

Total Funding: €28.4MM

4. Payflow: Instant Access to Earned Salary

Payflow is one of the youngest startups on this list, having been founded in January 2020. The company closed its first funding round of €1.6MM in the midst of the Covid-19 crisis, with investment from Rocket Internet.

Payflow allows employees to instantly collect their earned salary through a mobile app, offering an additional benefit to employees who are paid hourly. Access to liquidity like this results in lower employee turnover, higher productivity, and higher satisfaction with compensation overall.

Despite it’s young age, Payflow is positioned well to succeed in a post-Covid world and they are a startup to watch!

Offices In: Barcelona, Spain

Total Funding: €1.6MM

5. Yubo: Fostering Long-Distance Friendships for Gen Z

France-based Yubo has had a killer 2020! The social media app is focused on building long-distance friendships between young people aged 13–25 through live video streaming and instant messaging (among other features).

Yubo was founded in October 2015, but has really begun to scale in the last 12 months. Pre-pandemic, the company raised a $12.3M Series B (December 2019) and then followed that up with a whopping $47.5MM Series C in November 2020.

Keep an eye on Yubo in 2021. While the pandemic certainly gave them a once-in-a-lifetime engagement and user boost, their unique focus on long-distance friendships may help them elevate outside of the social media app fray.

Offices In: Paris, France

Total Funding: $65.7MM

6. AccuRx: Bringing Patients and Healthcare Teams Together

In the remote-first world we now live in, AccuRx has come up with a simple solution to a complicated problem. They’ve realized that making interactions between healthcare workers and their patients easier, more efficient and remote can both save time, money and lives.

The startup offers a full-stack platform for primary and secondary care providers and patients including messaging, digital documents, video consultations, surveys and more.

It almost goes without saying, but AccuRx is perfectly positioned for the world we live in. Look for them to raise a large Series B in 2021.

Offices In: London, England

Total Funding: £9.1MM

7. CoachHub: Digital Coaching and People Development

Coaching and people development had already started to transition online, but Covid-19 has pushed these activities fully digital. CoachHub provides a platform for many of Europe’s (and the world’s) largest companies to help turn “Mangers into Leaders.”

Beyond simple growth and development, these companies are now also looking for coaching on how to be effective with remote work and more. I’ve written about coaching and mentoring a lot before; I’m a big believer in its importance!

By the way, check out my profile on MentorCruise or my personal site

Coaching with Alex Mitchell: https://the-modern-product-manager.teachable.com/p/coaching-with-alex-mitchell

By the way, you aren’t just getting a corporate video that is many years old, you’re getting a real-life, actual human coach with CoachHub who provides 1:1 personalized support and tracking. Pretty cool!

Offices In: Berlin, Germany; Copenhagen, Denmark; Stockholm, Sweden; Amsterdam, Netherlands; Brussels, Belgium; Dublin, Ireland; Paris, France; London, UK; Zurich, Switzerland; Vienna, Austria

Total Funding: $20.7MM

8. IDNow: Identify Verification as a Service for Europe

If you’ve read a few of my “Top Startups to Watch” blog posts, you should know that I absolutely love ID verification as a service companies. In fact, I recently wrote about one called Smile Identity in my African Startups to Watch in 2021 post!

Why do I like these companies so much?

First, they are a critical part of all of the popular FinTech, HealthTech, and many other apps you use every day. In order for those companies to process signups and verify IDs, they need companies like IDNow.

Additionally, with more and more people moving these types of actions/behaviors online, manual, in-person ID verification is disappearing FAST. Technology is so much better designed to handle this problem!

On top of all of that, they are incredibly scalable businesses with very high margins. What’s not to like?

IDNow raised a $40MM round in late 2019, but I wouldn’t be surprised if they raised an even larger round in 2021.

Offices In: Munich, Germany

Total Funding: >$40MM

9. Eligma: Facilitators of Crypto Payments

Ok, so hang in there with me on this one! Eligma is riding the crypto wave (which has heated up quite a bit in the end of 2020) and has several key crypto POS products

- Web POS — accessible through browsers; suitable for local stores

- Integrated POS — plug-in or custom integration; suitable for local stores that use supported ERP (cashier/POS) software

- Plug-in POS — e-commerce plug-in; suitable for online stores

Eligma is also one of the companies behind an incredibly interesting project called BTC City (see it on Google Maps here), where over 450 densely located stores and 70 bars and restaurants all accept Bitcoin as a form of payment.

The jury is still out on whether Bitcoin or crypto more broadly will become a payment standard worldwide anytime soon, but Eligma is one of the companies fighting to make that happen and already has in a few key places like BTC City!

Offices In: Ljubljana, Slovenia

Total Funding: $17.4MM

10. ABTasty: A/B Testing, Personalization, and Experience Optimization Platform

Although I’m definitely not a huge fan of the name, I am a BIG fan of the growth that optimization platform ABTasty has pulled off in the last year. While the company has been around since 2014, it’s often been in a backseat position to other industry players like Optimizely (or more recently Split).

However, in 2019 and 2020, ABTasty really hit its stride, most notably raising a $40MM Series C round in June 2020. In addition to focusing on Europe, the company has focused on large multi-national brands like L’Oreal, Disney, and Klarna.

Their platform offers everything you need to maximize the value of each visitor to your site. With web traffic increasing dramatically this year, they are understandably in very high demand these days!

Offices In: Paris, France

Total Funding: $65.7MM

Honorable Mentions

Velmio: Pregnancy HealthTech With Personalized Advice

Offices In: Tallinn, Estonia

Total Funding: Unknown

Mintos: The Prosper/LendingClub of Europe

Offices In: Riga, Latvia

Total Funding: €14.2M

What European Startups Did I Miss?

I’m sure I missed quite a few prolific, fast-growing European startups. Let me know which ones on Twitter at @amitch5903!

0 Comments