As we near the end of 2021, it’s absolutely incredible to me how quickly some startup ecosystems have grown over the past 3 years.

And, even more incredible to me is how much they’ve grown in spite of (or in some cases, because of) the pandemic.

Africa is certainly no exception.

This is my 3rd edition of the Top 10 African Startups to Watch and 2021 was the year the region truly caught ? ? ? for both startups and VCs.

It’s about time.

Other Startups to Watch:

- Top 10 Pakistani Startups to Watch

- Top 10 Middle East Startups to Watch

- Top 10 Latin American Startups to Watch

- Top 10 European Startups to Watch

- Top 10 Indian Startups to Watch

- Top 10 Chinese Startups to Watch

- Top 10 Israeli Startups to Watch

Want to be the first to know when my posts go live?

Follow me on Medium and subscribe to my newsletter: Modern Product Manager Newsletter

Africa’s Startup Environment

As I mentioned earlier, 2021 was an incredible year for African startups. The continent has already surpassed $3B in startup funding and may, just may, break $4B by the end of the year.

In the 3rd quarter of 2021, African FinTech firms ALONE raised $906m, according to Digest Africa. The FinTech sector represented more than 60% of all venture money that flowed into Africa during the quarter, and more than all other sectors combined in the first half of 2021 (!)

For context, the total funding for African FinTechs in 2018 was $385MM.

Another sign of the progress made by startups on the continent is the number of unicorns or companies worth more than $1B.

3 years ago, there was 1 (yes, 1) privately owned African startup worth over $1B, Jumia (Nigerian eCommerce).

Today, there are at least 7 African unicorns (!), including 5 FinTech companies: Chipper, Flutterwave, OPay, and Wave, and Fawry.

And it’s not just the funding, it’s the sources of funding that have improved as well. Larger multinational companies and leading VCs are demonstrating their commitment to the region by establishing dedicated Africa-focused funds:

- March 2021: YCombinator’s W21 cohort included 10 African startups

- March 2021: Tiger Global led a $170MM funding round in Nigeria’s Flutterwave, helping that company reach unicorn status

- August 2021: Nigeria-based mobile money service OPay reached a $2B valuation after a HUGE $400MM funding round led by Japan’s SoftBank and Sequoia Capital

- September 2021: YCombinator’s S21 cohort included 15 African startups

- October 2021: Google announced a $50MM fund to support African startups

- October 2021: Tiger Global invested $15MM in Nigeria’s Mono, and $3MM in Zambia’s Union54.

- November 2021: Chipper raises $150MM from Crypto platform FTX at a $2B valuation

So why did things accelerate so much in 2021?

- Maturing tech talent

Many African tech founders are now on their 2nd or 3rd startups and have learned a lot along the way.

“Investors know they’re dealing with people with a proven track record who’ve learned along the way,” said Aubrey Hruby, who advises Fortune 500 firms and other major companies on investments in the continent.

2. The market opportunity is massive and growing

40% of sub-saharan Africans are under the age of 15 and smartphone penetration is below 50% but rising sharply.

Despite all of these positive trends, there are still areas of improvement needed in the African tech ecosystem.

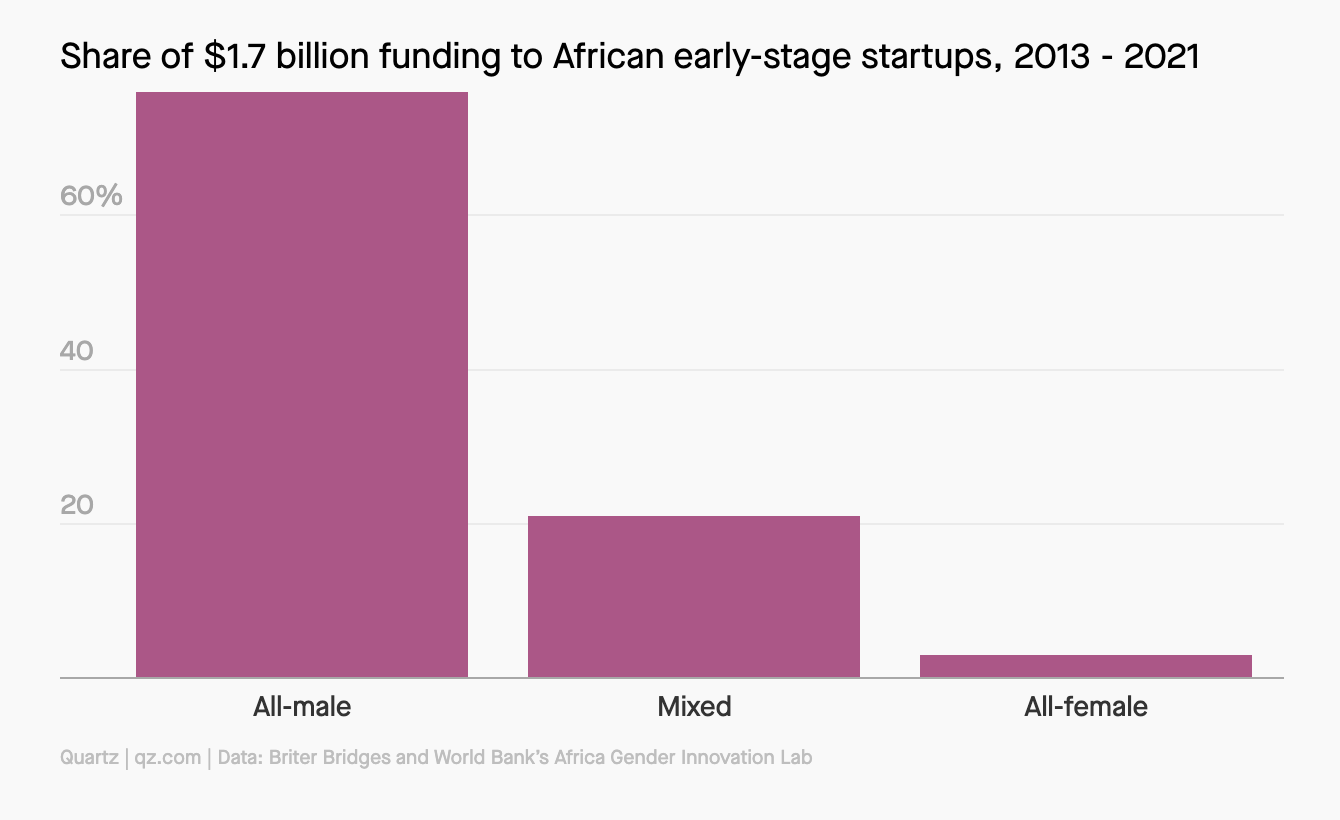

A recent analysis of African startups revealed that 75% of the 1,112 companies analyzed had all-male teams, 9% all-female teams, and 14% had a mix of male and female founders.

Just 3% of the $1.7B raised by these companies went to all-female founding teams, with 76% channeled to all-male teams.

This 3% of funding going to female founding teams is especially concerning in a continent where women make up 58% of the self-employed population.

Another challenge in the African startup ecosystem is that a large amount of the funding goes to foreign founders.

For example, in 2019, only 1 local Kenyan founder received more than $1MM in funding, whereas 11 foreign founders operating in the country achieved this milestone.

Like any startup ecosystem, African has these and other challenges to work through in the coming years. But the future is bright for the continent and the world is truly starting to notice!

Sources: Al Jazeera, TechCrunch, Quartz, Ideas4Development, Database Africa: The Big Deal

The Top 10 African Startups to Watch

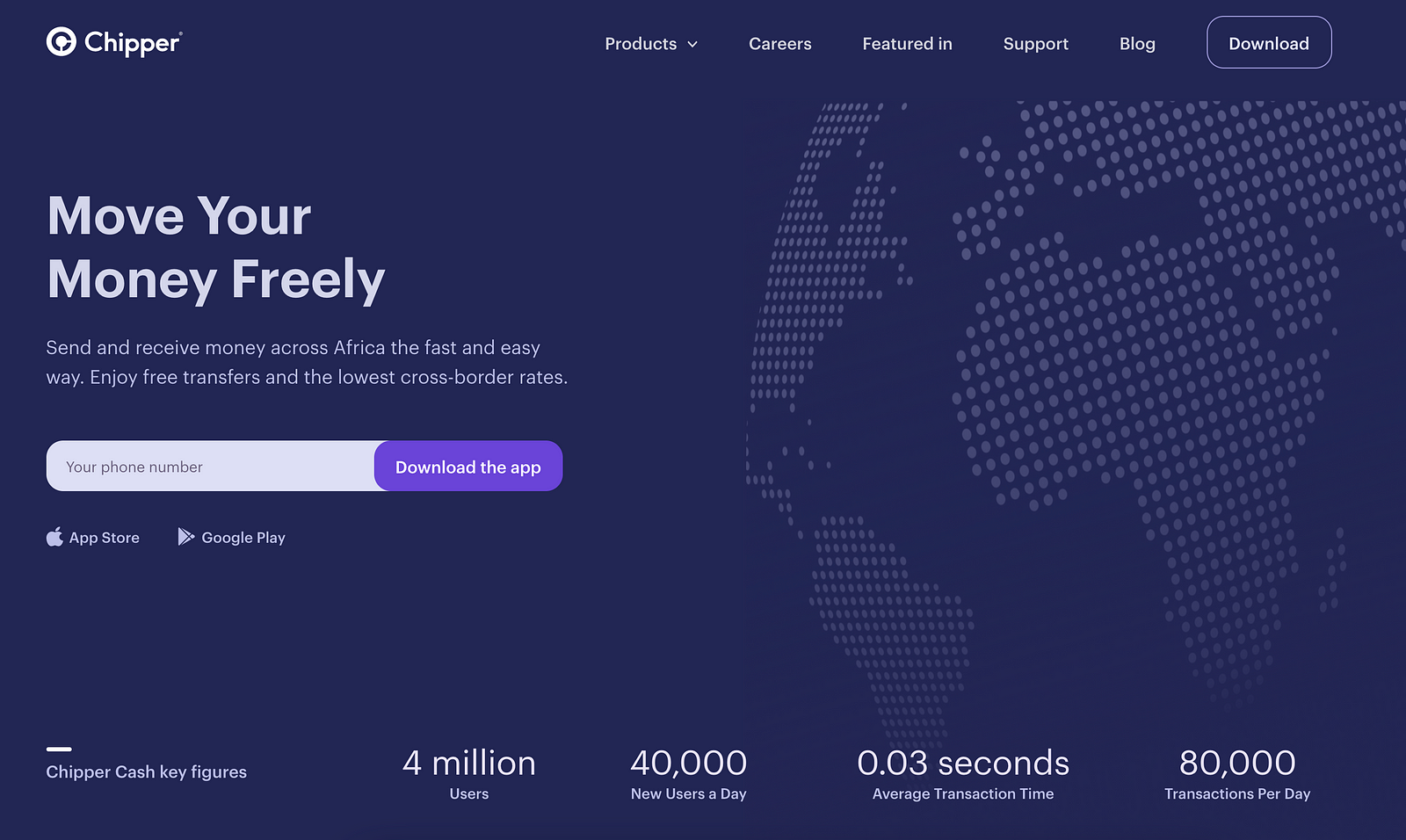

- Chipper: African FinTech Superapp (p2p + Crypto + Fractional Stocks + Payments API + More)

It’s hard to believe it’s only been 1 year and 7 months since I first wrote about Chipper (then Chipper Cash) in my Top 10 Corona-Economy Startups to Watch.

They’ve been on an absolutely incredible growth trajectory since then (and so has their valuation)!

What began as the “Venmo of Africa” has evolved and expanded massively. Chipper today includes Crypto, Fractional Stocks, a Payments API, Chipper Checkout, a Chipper card and they are also the exclusive African payment partner for Twitter tips.

Did I mention they also recently closed a $150MM Series C extension with FTX, valuing them at more than $2B? So what’s there to watch? Haven’t they “made it”?

Believe it or not, I think Chipper is just getting started. In October of 2021, Chipper launched in the United States, unlocking a >$50B market opportunity.

Chipper has been THE African startup to watch for the past 2 years and I believe they will continue to be until they go public, which at this pace of growth, may not be very far off at all…

Offices In: San Francisco, CA; Nigeria; Kenya; Ghana; South Africa; Rwanda; United Kingdom; Uganda

Total Funding: $305MM

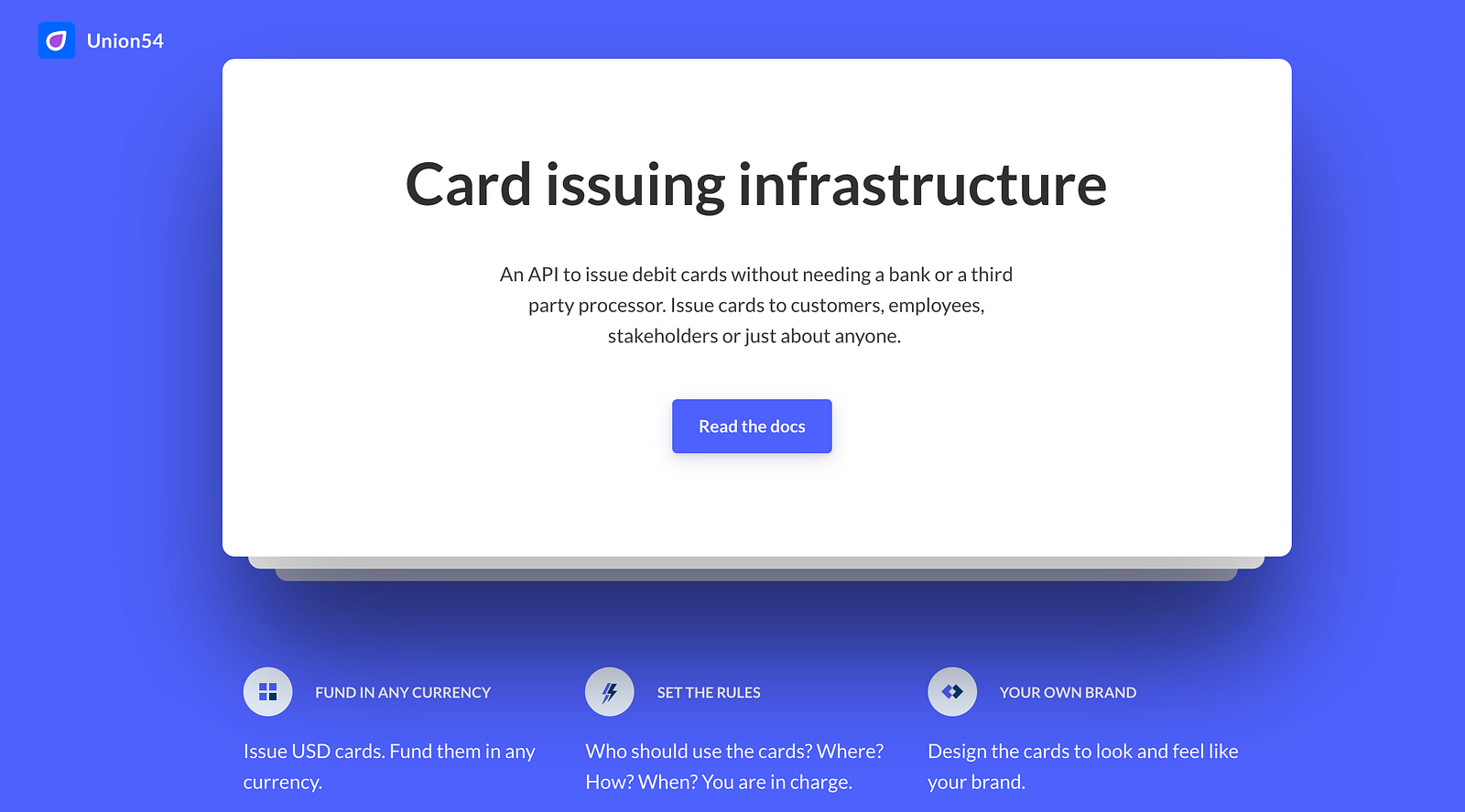

2. Union54: Card Issuing API for African FinTech

The African startup ecosystem has grown incredibly quickly over the past few years, but no sector has grown more quickly or received more funding than FinTech.

Currently, Chipper, OPay, Wave, Flutterwave, Fawry, and Interswitch are all valued at more than $1B and there has been an incredible wave of innovation and velocity in the sector.

Union54 is “selling pickaxes to gold miners” in the gold rush that is African FinTech.

Many of these FinTech startups want to offer debit cards to their customers, following the tried and true neobank playbook led by companies like Chime, Nubank, Revolut, and N26.

Union54 makes that easy, with a simple API framework that can fund the cards in any currency, configure debit card rules, and design the cards to match the company’s brand (or user-provided content).

Keep an eye on Union54. Much like SmileIdentity, this company has the potential to become part of the backbone of the fastest-growing and most valuable sector in the African startup scene.

Offices In: Lusaka, Zambia

Total Funding: $3.1MM

3. Raise: Carta for Africa

A simple way to describe Raise is “Carta for Africa,” but really, the startup is so much more.

According to the founders, “Most of the equity across Africa is still stored, tracked, and updated using paper certificates, manual processes, and fragmented government databases.”

In addition to solving the problem of modernizing cap table creation and updates, Raise is striving to solve the problem of liquidity for African startup employees and founders.

Currently, it can take several months or years to buy or sell equity, and, according to Raise, over $1 trillion of stock in Africa is “illiquid, paper-based and priced in inflationary currencies.”

That certainly seems like a valuable problem worth solving. But how does Raise compete with Carta? Market expertise.

As I’ve seen with many other African startups, building strong relationships with local governments and regulators is critical to success in the region. In taking an Africa-first approach, Raise is able to focus intently on several African countries and the unique challenges posed by the region and solve those better and faster than a global Carta can.

This may also make Raise a great acquisition candidate for Carta in the near future…

Offices In: Remote

Total Funding: Not disclosed

4. Payhippo: Lending for African SMEs

Payhippo provides loans to small businesses in Africa in under 3 hours. Their first market in Africa is Nigeria. There are 40MM SMEs in that country alone.

In November 2021, Payhippo raised $3MM in a seed round. What’s notable about this raise is that it included participation by several key founders in the region including Ham Serunjogi and Maijid Moujaled, co-founders of Chipper and Olugbenga Agboola of Flutterwave.

SMEs are a large part of Nigeria’s economy, accounting for 96% of businesses and 84% of employment in the country. However, a lack of access to credit continues to limit their growth and contribution to the country’s GDP.

Payhippo is poised to change that and I strongly believe they are a startup to watch in 2022.

Offices In: Lagos, Nigeria

Total Funding: $4MM

5. 54gene: Genetics Testing, Research, and Analysis for Underrepresented Communities

Similar to Chipper, I’ve written several times about 54gene in my profiles of Top African Startups to Watch. I continue to be impressed by how the company has executed and grown, even with the challenges of a global pandemic.

Less than 3% of genetic material used in global pharmaceutical research is from Africa. This is despite Africa representing 16% of the global population.

Since raising its Series A round in April of 2020, 54gene launched its own genetics sequencing and microarray lab in Lagos in partnership with U.S.-based biotech company Illumina.

The company closed a $25MM Series B round in September 2021. Aided by the increase in HealthTech investments post-COVID, 54gene is definitely a startup you should be watching in Africa and one that can truly change the world and the health of Africa’s population.

Offices In: Lagos, Nigeria; Washington, DC; Kano, Nigeria; Dar el Salam, Egypt; Boston, MA

Total Funding: $44.7MM

6. Vendease: Food Supplies for African Restaurants and Hotels

Vendease is a marketplace that enables restaurants and hotels in Africa to order directly from farms and food manufacturers.

While they are starting with procurement, Vendease also collects a significant amount of data that could be monetized going forward through business financing and embedded banking services.

The company is already trusted by thousands of businesses and closed a $3.2MM Seed round in October 2021.

Offices In: Lagos, Nigeria

Total Funding: $3.3MM

7. Mono: Plaid for Africa

As I mentioned earlier, FinTech in Africa has grown incredibly quickly. With all of this growth of different banks, trading apps, crypto apps, and super apps, there needs to be an identification/data-sharing layer that connects all of these services securely together.

Enter Mono, which can be best summarized as “Plaid for Africa.” If you aren’t familiar with Plaid, chances are you’ve probably already used it many times to authenticate secure data exchange between your financial applications.

Mono raised a $15MM Series A in October 2021, led by Tiger Global. This money will help them expand their footprint beyond Nigeria and Ghana to Kenya, Egypt, and South Africa according to their founders.

Offices In: Lagos, Nigeria

Total Funding: $17.6MM

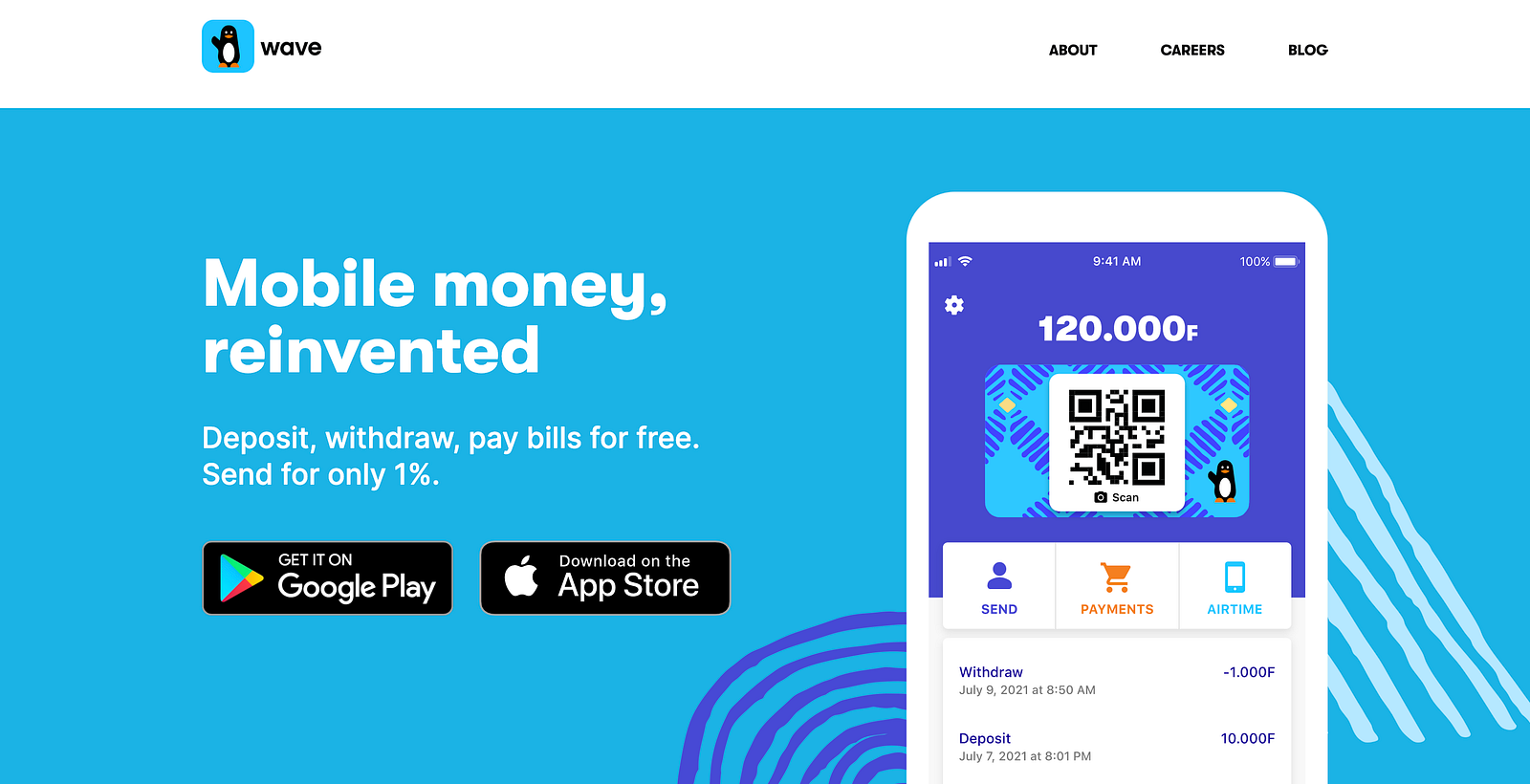

8. Wave: P2P and Remittances for Francophone Africa

Wave is somewhat similar to Chipper feature-wise (P2P, Airtime, Bill Pay), but the startup began by focusing on Francophone Africa.

Their first and biggest market is Senegal. The company launched in Cote d’Ivoire in April of 2021 and plans to expand into Uganda, Mali, and other African markets in the coming year.

The company captured major attention when it raised a $200MM Series A (!!!) led by Sequoia and Stripe in September 2021. The founders of Wave had a previous exit with similarly named SendWave, a remittance-focused startup acquired by WorldRemit for a reported $500MM.

Keep an eye out for Wave in 2022 and also keep an eye on how Chipper may expand into Wave’s territory in Francophone Africa. The African financial market is certainly big enough for two startups, but it will be interesting to see how things play out between the two.

Offices In: Dakar, Senegal

Total Funding: $200MM

9. FloatPays: Payroll and Financial Education for African Employees

In today’s hyper-competitive hiring environment, earlier paydays, instant payroll, and payday advances have become a competitive weapon in recruiting top talent.

FloatPays Earned Wage Access (EWA) provides employees instant access to a % of their earned income at any point in the pay cycle, meaning they can cover any emergencies or unexpected costs without having to borrow and pay interest or late fees.

The company participated in the S21 class of YCombinator and has focused on South Africa to date.

If FloatPays can crack product-market fit there, they have a great opportunity to expand this service to other African countries where lack of access to capital when emergencies arise is a major problem.

Offices In: Johannesburg, South Africa

Total Funding: $125k

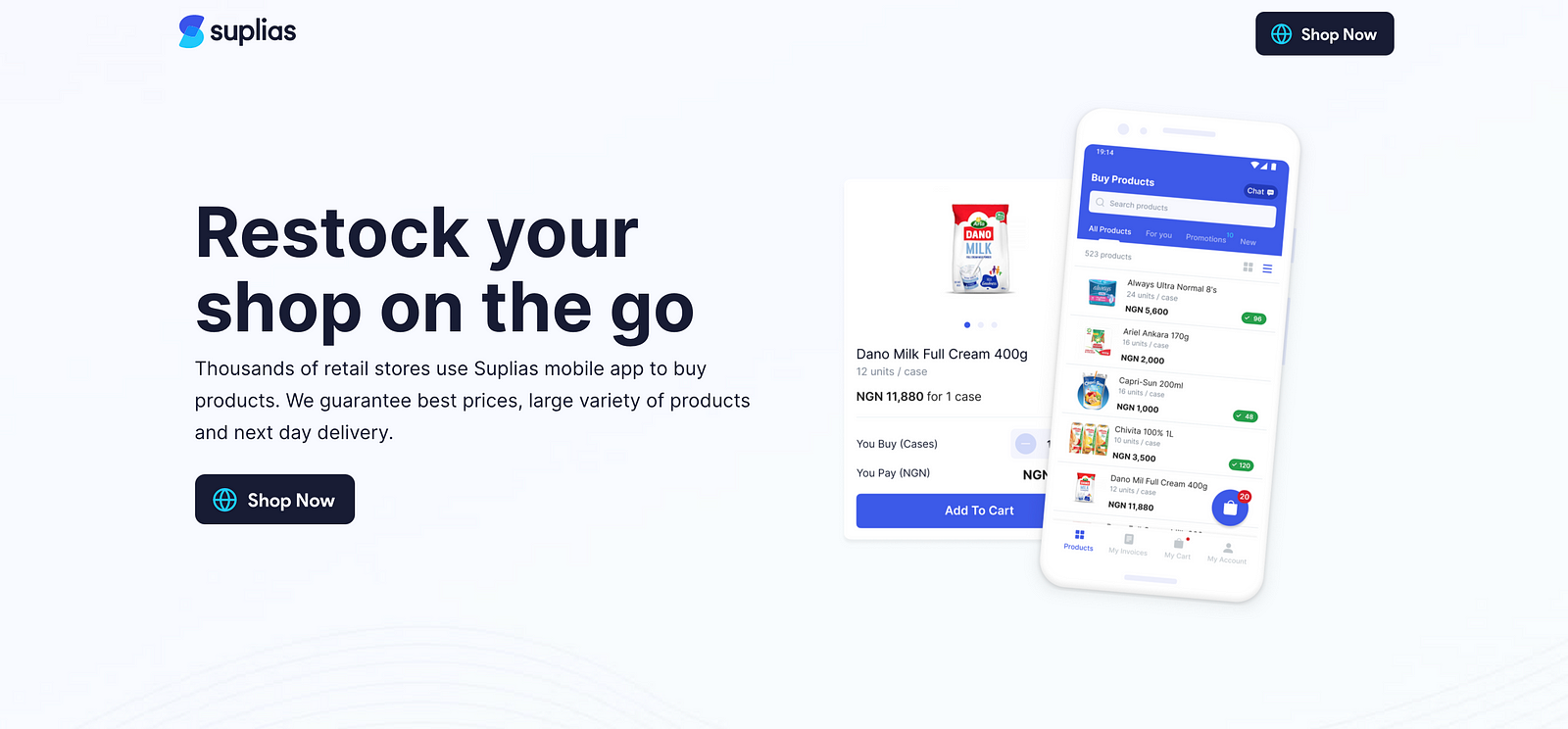

10. Suplias: Inventory for African Shops

Similar to Tajir in Pakistan, which I’ve written about in several of my “Top Startups to Watch” posts, Suplias has focused on providing quality, dependable, fast, and transparently priced inventory to African shops, beginning with Nigeria.

The founding team has a combined 25+ years of experience in supply chain and eCommerce, having worked for Procter & Gamble, PepsiCo, Gap, and Jumia, the largest eCommerce company in Africa.

The company has also been growing 40% MoM for the last 12 months as they’ve onboarded thousands of retail shops across the country. Keep an eye on Suplias as they expand to more cities in 2022 and move to offer additional services like financing and payments to shopkeepers.

Offices In: Lagos, Nigeria

Total Funding: $125k

Honorable Mentions

Twiga: b2b eCommerce for Shop Owners

Offices In: Nairobi, Kenya

Total Funding: $157MM

Klasha: Payment APIs for Africa

Offices In: San Francisco, CA

Total Funding: $2.6MM

What African Startups Did I Miss?

I’m sure I missed quite a few prolific, fast-growing African startups. Let me know which ones on Twitter at @amitch5903!

0 Comments