As I’m writing this, it’s almost the end of 2020. There were certainly a lot of ups and downs this year to stay the least. A LOT of things changed around the world.

Many businesses failed, but some startups thrived.

I’m excited to write about many of the incredibly impressive startups in Africa that you need to watch in 2021. These startups not only survived the pandemic but thrived in it, managing to grow incredibly quickly by meeting and exceeding customer needs.

Other Startups to Watch in 2021:

- Top 10 Chinese Startups to Watch in 2021 (Coming Soon!)

- Top 10 Indian Startups to Watch in 2021 (Coming Soon!)

- Top 10 Israeli Startups to Watch in 2021 (Coming Soon!)

- Top 10 Middle East Startups to Watch in 2021 (Coming Soon!)

- Top 10 Latin American Startups to Watch in 2021 (Coming Soon!)

- Top 10 European Startups to Watch in 2021 (Coming Soon!)

Want to be the first to know when these posts go live?

Follow me on Medium and subscribe to my newsletter!

Africa’s Startup Environment

African tech startups had a… 2020.

In short, like many other areas in the world, 2020 has been a complete roller coaster for Africa. Once high flying startups have seen COVID force them to rethink their business models, while others have seen exponential growth that they never could have imagined.

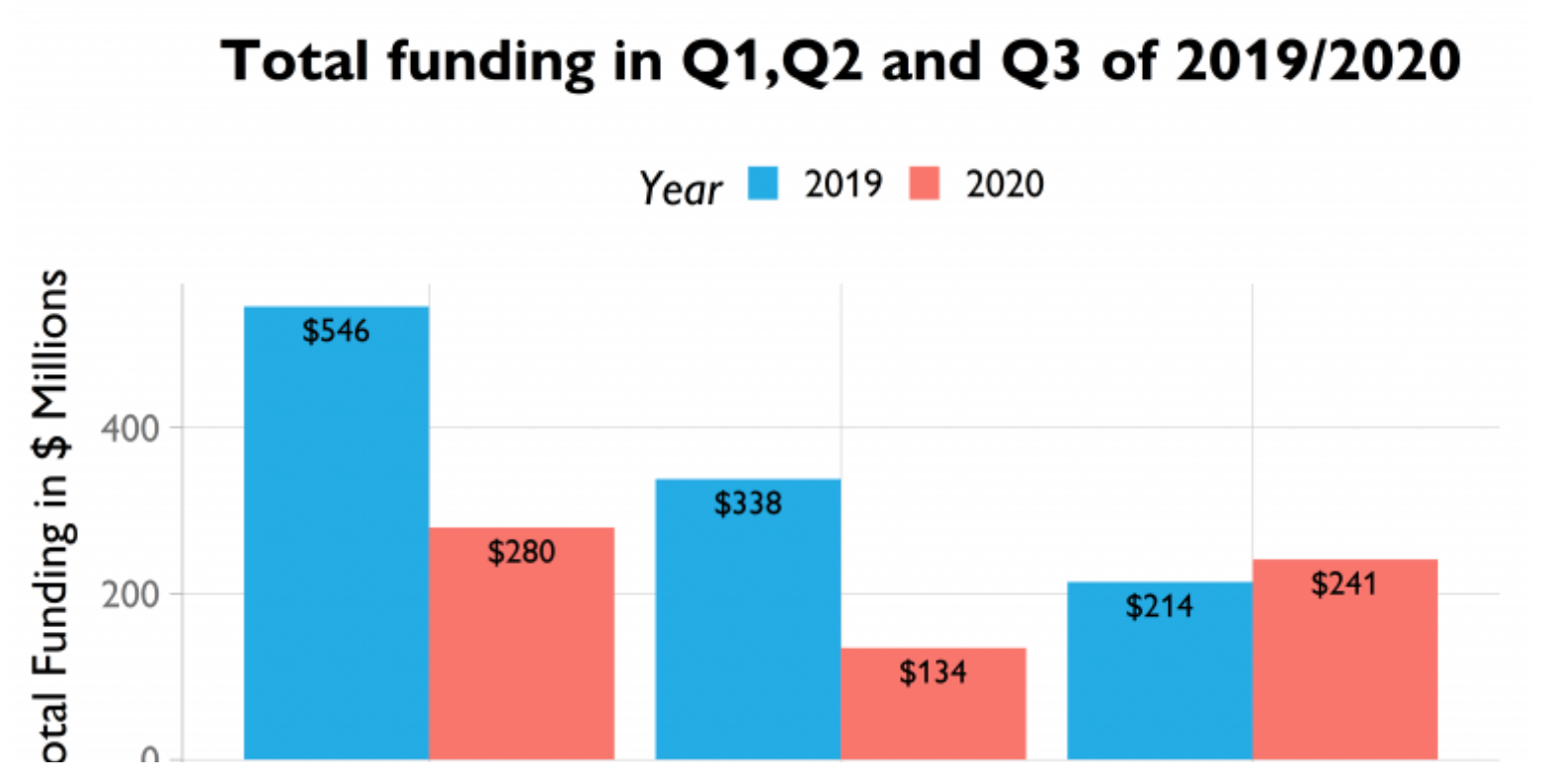

In the beginning of 2020, funding fell dramatically, with a drop of $116MM (24%) in H1 2020 YoY. 149 rounds of funding raised $371MM, compared to $486MM across 193 deals of H1 2019.

Right before the pandemic broke, however, there was 226% more funding raised in February 2020 ($125MM) than February 2019 ($38MM). The largest round in this pre-pandemic month was raised by Jumo, who closed a $55MM round on 2/26/20 (woah!).

Another trend of the first half of 2020 was the rise of YCombinator as an investor in African startups: The accelerator invested in $1.8MM in 12 Africa-based startups, making it the top investor (by count of investments) in H1 2020.

So funding fell big-time in H1 2020, what has happened since then?

In Q3 2020, funding increased dramatically, with startups raising $241M across 104 rounds representing an 80% increase in funding amount compared to Q2 and marked a strong recovery from the worst of the COVID crisis.

However, a large majority of this Q3 funding (67%) was raised in September with $160M raised across 59 rounds. Only 22% of this month’s total was disclosed venture capital, skewed by a massive $90M debt round from Greenlight Planet (Solar) and a $35M undisclosed round from Lumos Global.

So are things back to “normal” or not?

Another huge positive sign for “yes, we’re returning to normal” and the growth of the African startup scene was the October 2020 acquisition of Paystack by Stripe for $200MM.

Paystack was working on building the “Stripe of Africa” and this acquisition both speaks to the opportunity Stripe sees in the region and is a strong signal to the rest of the investing and tech world that Africa is a place to watch!

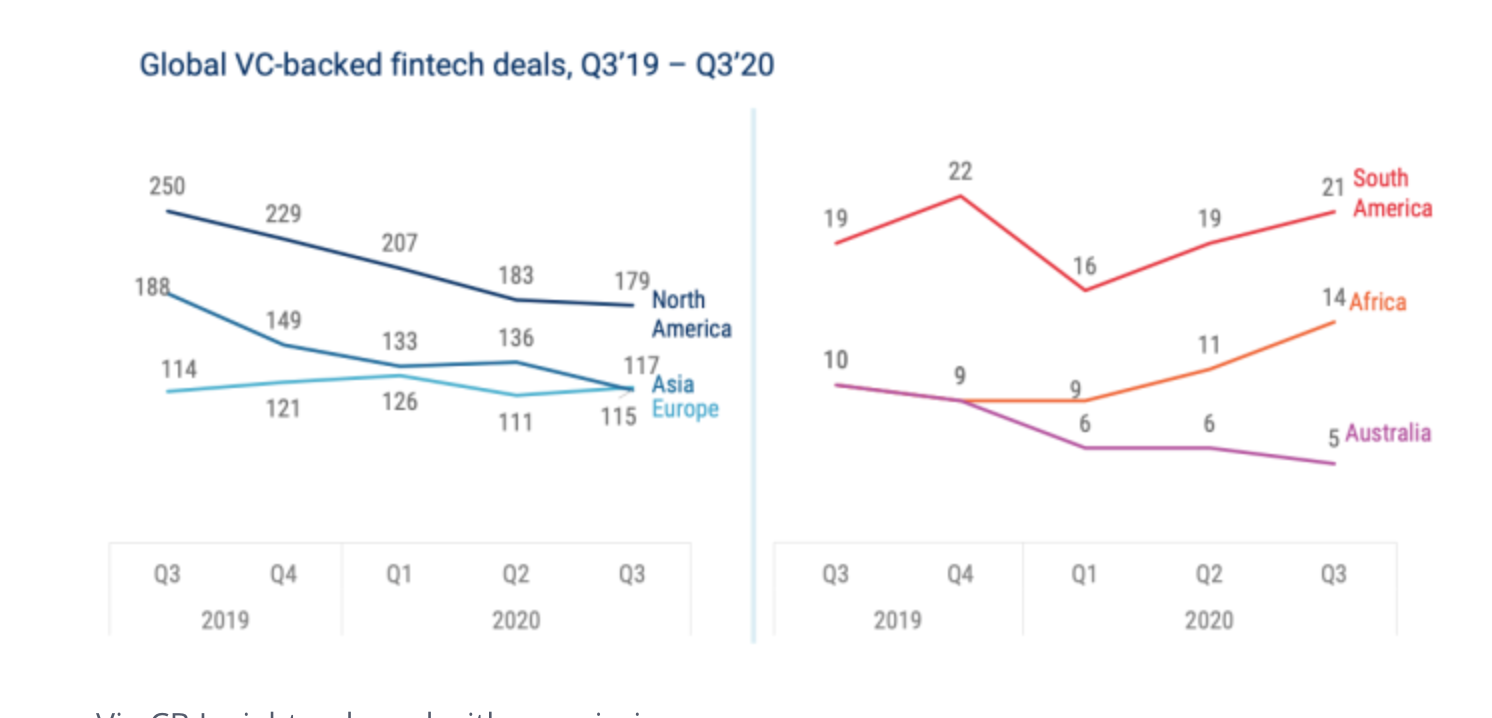

FinTech has been one of the fastest growing startup industries in Africa, with 14 investments in Q3 2020 and 11 in Q2 2020.

Keep an eye on this sector into 2021, I expect more rapid growth!

Sources: The Guardian, Techpoint.africa, Quartz, Digest Africa, Digest Africa #2

How Did I Choose This Top 10?

For this year’s list, I’ve selected African startups that have a massive opportunity to own an entire industry across a significant portion of the African continent and the 1.35+ billion people who live there.

This year, I’ve also repeated a few predictions from prior years. These are startups you still need to keep an eye on as they have the potential to become household names, not only in Africa, but across the world!

The Top 10 African Startups to Watch

- Chipper: Venmo + More for Africa (Formerly Chipper Cash)

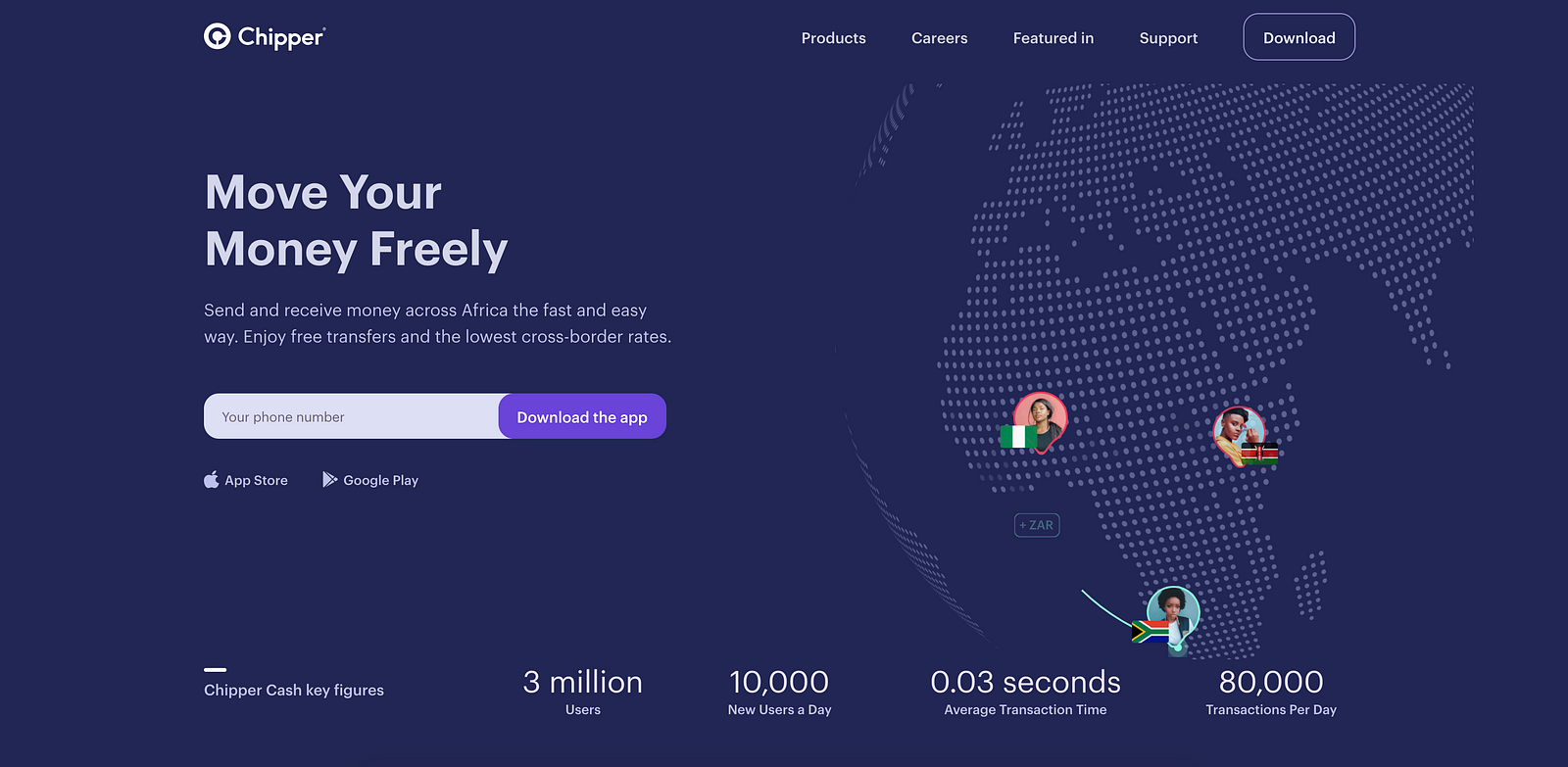

Chipper (formerly Chipper Cash) has had an amazing 2020, to say the least. Pre-COVID, the company was already on a strong growth trajectory, coming off the back of a $6MM Seed raise that closed in December 2019.

During 2020, the company raised additional funding, this time a $13.8M Series A, and they also announced they had over 1.5MM users. More recently, they’ve bumped this number up to 3MM in their advertising.

This is for a company that only went live in 2018 (!) and had only ~600k users in December 2019 (source). That is some incredible growth!

During the past 12 months, the company also expanded to new markets and is now live in Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa, and Kenya. I would expect them to continue to expand to new countries in 2021.

Chipper was a startup to watch last year and it definitely deserves to be at the top of the list this year of African startups to watch!

Offices In: San Francisco, CA; New York, NY; London, UK; Accra, Ghana; Lagos, Nigeria; Kampala Uganda; Nairobi, Kenya

Total Funding: $22MM

2. Smile Identity: Identity Verification via API

With the rise of FinTech startups like Chipper in Africa, companies like Smile Identity benefit greatly as well.

Smile Identity, as the name may indicate, is all about ID Verification and Know Your Customer (KYC) compliance as a service for FinTech, Healthcare, and other key use-cases in Africa.

The company raised a $4MM Seed round in 2019 and I wouldn’t be surprised if they raise a Series A by early 2021, given the fast-growing companies they are partnered with.

Offices In: Cape Town, South Africa; Oakland, CA

Total Funding: $4.1MM

3. Andela: Outsourced Development

Hopefully, Andela isn’t a foreign name to you! They burst onto the public, TechCrunch-level scene, with a $100MM raise in early 2019. So why then, are they still on my list?

Because I think there is still so much opportunity for Andela and the remote development market in Africa.

With rapidly modernizing infrastructure and rapidly upskilling talent in Nigeria, South Africa, Kenya, and more countries, the market size and TAM is HUGE here.

Offices In: New York, NY; San Francisco, CA; Austin, TX; Nairobi, Kenya; Lagos, Nigeria; Kigali, Rwanda; Kampala, Uganda

Total Funding: $181MM

4. Flutterwave: Stripe for Africa

Flutterwave is striving to become the Stripe for Africa. In October 2020, another “Stripe for Africa” called Paystack was acquired by Stripe for $200MM.

Believe it or not, this is a great sign for Flutterwave. While they are now unlikely to also get acquired by Stripe, it speaks to the opportunity outside investors/companies are beginning to see in African FinTech infrastructure.

Flutterwave most recently raised a Series B round in January 2020 of $35MM positioning the company for impressive growth through 2020 and into 2021.

Offices In: San Francisco, CA; Burundi; Central African Republic; Congo; DR Congo; Egypt; Eritrea; Guinea; Guinea Bissau

Total Funding: $64.5MM

5. Sokowatch: Inventory Management for Small Retailers

Sokowatch is the Tajir of Africa. They connect small shops to the affordable, timely inventory they need to be successful.

Since launching in 2016, Sokowatch has expanded within Kenya and into Rwanda, Tanzania, and Uganda.

In February 2020, the company raised a $15MM Series A round, striving to broader its service offerings to include credit services and analytics for Africa’s smallest businesses.

The company is clearly getting some impressive traction and I’m excited to watch what they do in 2021!

Offices In: Nairobi, Kenya

Total Funding: $18.6MM

6. Swipe Technologies: Credit Cards for African SMBs

Swipe is taking the Brex model to Africa. The company was a member of the YC W20 class.

With Swipe, small businesses can get access to credit, better control their spending, and manage payroll. The company is yet to raise a post-YC round, but I wouldn’t be surprised if they close one in the next few months off of all of the FinTech momentum happening in the region these days!

Offices In: Lagos, Nigeria; Ghana

Total Funding: $150k (YC)

7. 54gene: Unlocking the Power of the African Genome

With companies like Ancestry.com and 23andMe finding major consumer success in the past 5 years, the human genome and genetic conditions are being understood faster and better than ever before.

However, a massive population has been left out of this research.

Nearly 90% of the genetic material used in pharmaceutical research is Caucasian. Only 2% is African.

54gene was founded in 2019 to attack the significant gap in the global genomics market. As a result of this massive gap, pharmaceutical research and development is lacking the diverse data that may hold the key to medical discoveries and new healthcare solutions.

The company raised a $15MM Series A in April 2020 to further expand their biobank capacity and hire across the organization.

With a greater focus on Healthcare and genetics in the Corona-Economy, 54gene is poised to accelerate its growth even more.

Offices In: Lagos, Nigeria; Washington, D.C.

Total Funding: $19.5MM

8. mPharma: Safe and Affordable Medicine for Africa

mPharma was founded in 2013 with the mission of bringing safe and affordable medicine to the African continent. mPharma is currently operational in Kenya, Nigeria, Ghana, Zimbabwe, and Zambia.

In the past 2 years, the company really has hit its stride and the fundraising they’ve closed shows that:

- January 2019: Raised $12MM Series B

- January 2020: Raised $13MM Series C

- May 2020: Raised an additional $17MM

In addition to this impressive funding haul, mPharma is expanding its distribution channels to create a robust drug supply chain that, to this point, has never existed in many of countries they serve. Since 2013, the company has helped over 400,000 patients gain access to high-quality medicines.

The future is bright for mPharma, and Africa’s HealthTech startups, keep an eye on them in 2021!

Offices In: Accra, Ghana

Total Funding: $55.5MM

9. Helium Health: Electronic Health Records and More for Africa

Staying in the HealthTech sector, Helium Health is another African startup you need to watch in 2021.

The company provides Electronic Medical Records (EMR), practice administration, billing, and more tools for hospitals and private practices across Africa.

Currently, Helium Health is trusted by more than 300 providers, 5,000 health professionals, who manage over 165,000 patients monthly.

Helium Health recently raised a $10MM Series A round to help expand geographically. In addition to growing its current customer base in Nigeria, Ghana, and Liberia, the company will use the funding to support expansion into new markets in North Africa, East Africa, and West Africa this year.

Offices In: Lagos, Nigeria

Total Funding: $10.2MM

10. Sendy: b2b Package Delivery

Sendy offers on-demand package delivery platform between businesses in Africa. As of early 2020, the company had over 30,000 business customers, including household names like Unilever, Toyota, DHL, Safaricom, and General Electric.

Sendy raised a $20MM Series B in January 2020 and has used that money to begin their expansion into West Africa.

According to the company’s founder/CEO Meshack Alloys, “Using Sendy’s technology, businesses have been able to lower the cost of logistics by up to 40% and dramatically shortened the time it takes to deliver products to their customers.”

With the fragmented state of delivery in Africa and the rapid growth of eCommerce in the region and around the world, Sendy is well positioned to have a great 2021.

My prediction? A Series C round in the next 12 months.

Offices In: Naiorbi, Kenya

Total Funding: $27.5MM

Honorable Mentions

Carry1st: Mobile Game Company for African Smartphone Owners

Offices In: Cape Town, South Africa

Total Funding: $4MM

WhereIsMyTransport: Mobility Data for Low and Middle Income Cities

Offices In: Cape Town, South Africa

Total Funding: $13.3MM

Skynamo: Field Sales Management Software

Offices In: South Africa

Total Funding: $30MM

Apollo Agriculture: ML for Micro Farmers

Offices In: Nairobi, Kenya

Total Funding: $7.6MM

What African Startups Did I Miss?

I’m sure I missed quite a few prolific, fast-growing African startups. Let me know which ones on Twitter at @amitch5903!

0 Comments