It’s Demo Day (again)!

But first, here are my past YC posts if you want to check how my older picks have done. If you want to skip to the bottom, you can also see my own evaluation of my past picks for W20, S19, W19, S18, W18, and S17.

YC’s Summer 2020 class was ENORMOUS (again)!

198 startups, representing 26 different countries, “pitched” virtually on 8/24 and 8/25/20. Notably, this was the first fully remote YC batch, and likely not the last, thanks to the COVID-19 pandemic.

Quick Diversity Stats on S20:

- Female founders: 16% of the companies have a female founder, 9% of the founders are women

- Black founders: 6% of the companies have a Black founder; 4% of the founders are Black

- Latinx founders: 10% of the companies have a Latinx founder; 10% of the founders are Latinx

Top YC S20 Categories:

- B2B Software and Services — 48%

- Healthcare — 16% (Not a big surprise to see such a spike here!)

- Consumer — 13%

- Financial Technology and Services — 11%

- Education — 4%

- Industrials — 4%

- Real Estate and Construction — 3%

- Government — 1% (surprised this is so low, think we need some help here YC)

This was definitely a non-traditional demo day and a non-traditional startup batch to say the least, but let’s get to it, I’m excited to share my favorites!

The Top 10 Companies I’d Invest In

- Dapi —Plaid for Emerging Markets

TechCrunch Description: Dapi is a fintech API play that is aimed at facilitating payments between consumer bank accounts and companies. That Dapi has managed to make its service work in seven countries with deep bank support is impressive.

And Dapi has found demand for its service, with $400k in ARR and growth of more than 50% per month as of its presentation. Of course, that growth rate will sharply decline in time, but everyone knows that fintech APIs can have big exits. Expect to hear more from Dapi.

Why I Would Invest: Dapi is quite simply: Plaid for Emerging Markets. In case you missed it, Plaid was purchased by Visa for a cool $5.3B earlier this year.

Dapi wants to make it easier for Fintech companies and startups in regions like the Middle East to manage authentication, payments, financial data exchanges, and more.

This is a big market opportunity in need of the same “financial plumbing” that Plaid helped to provide in the United States.

2. Verifiable — API To Automate Healthcare Licenses (“Checkr for Healthcare”)

TechCrunch Description: With healthcare increasingly moving online, it’s more important than ever to keep things up to date and verified. Verifiable is building an API to automate license verification for healthcare providers, integrating with state and federal sources. After launching this month, the company says it’s projecting an ARR of $210k.

Why I Did Invest: Licensing verification is an incredibly messy and time-consuming process, even for the country’s biggest hospital systems.

Verifiable provides a simple API for healthcare providers to use to verify doctor, nurse, PA, and other healthcare professional credentials.

I believe Verifiable has as large of an opportunity to improve licensing verification as Checkr had for background checks in 2014.

P.S. Checkr was valued at $2.2B in late 2019.

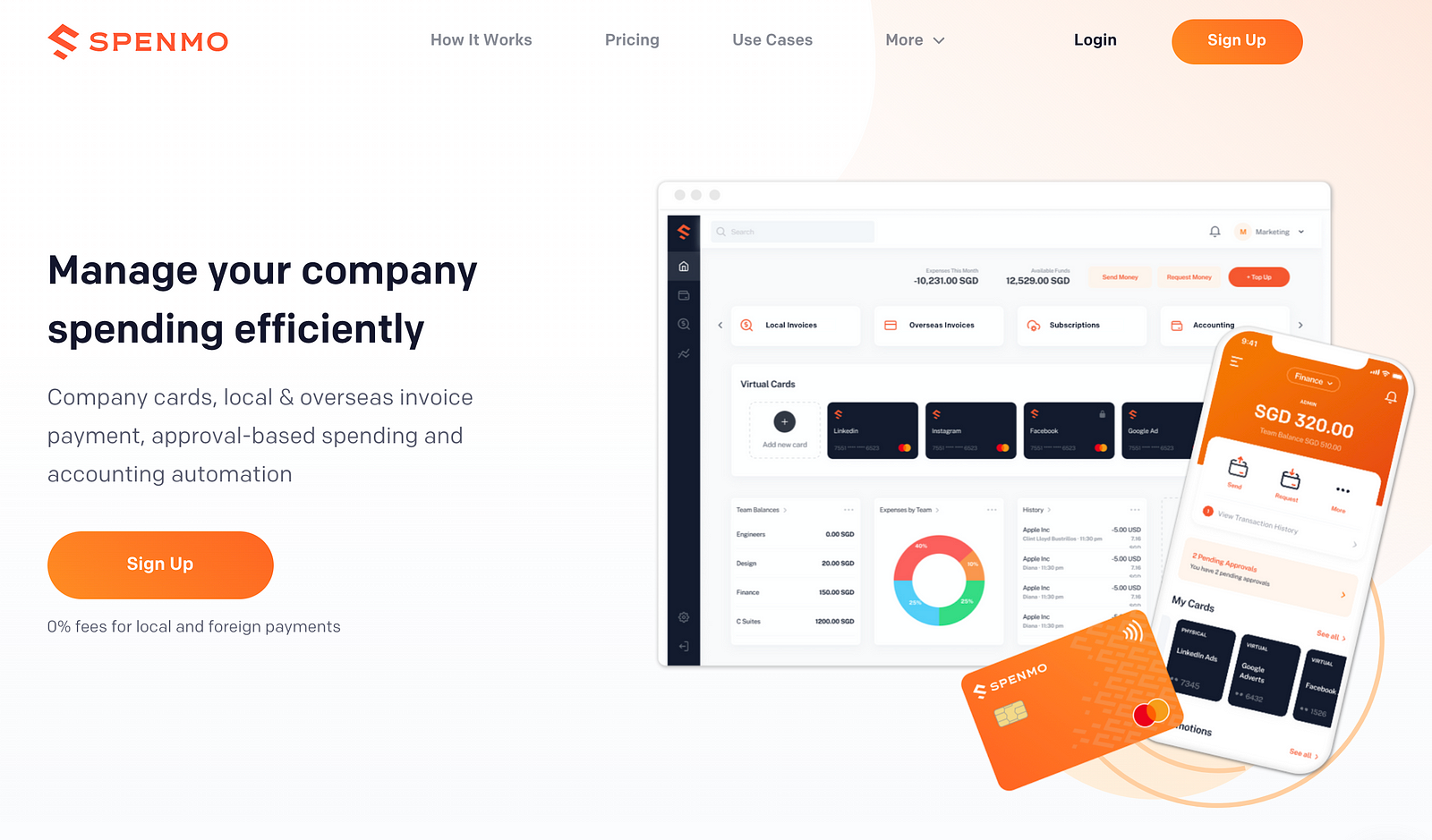

3. Spenmo— Bill.com for SE Asia

TechCrunch Description: Framing itself as Bill.com for SMBs in Southeast Asia, Spenmo helps companies manage their payments. The founding team hails from Grab, Xendit, and Uangteman. After launching 5 months ago, it has 150 companies as customers and processed $500k in transactions in July.

Why I Would Invest: There are 25–30MM SMEs/SMBs in Southeast Asia. Most are managing their finances informally — both missing opportunities to grow using credit and also taking on additional risk, leading to a higher than needed failure rate.

Spenmo steps in for these business owners, helping them manage their payments to vendors, issue company cards, and automate many of their back-office processes. If Spenmo can continue to scale rapidly, there is a major market here for them to win.

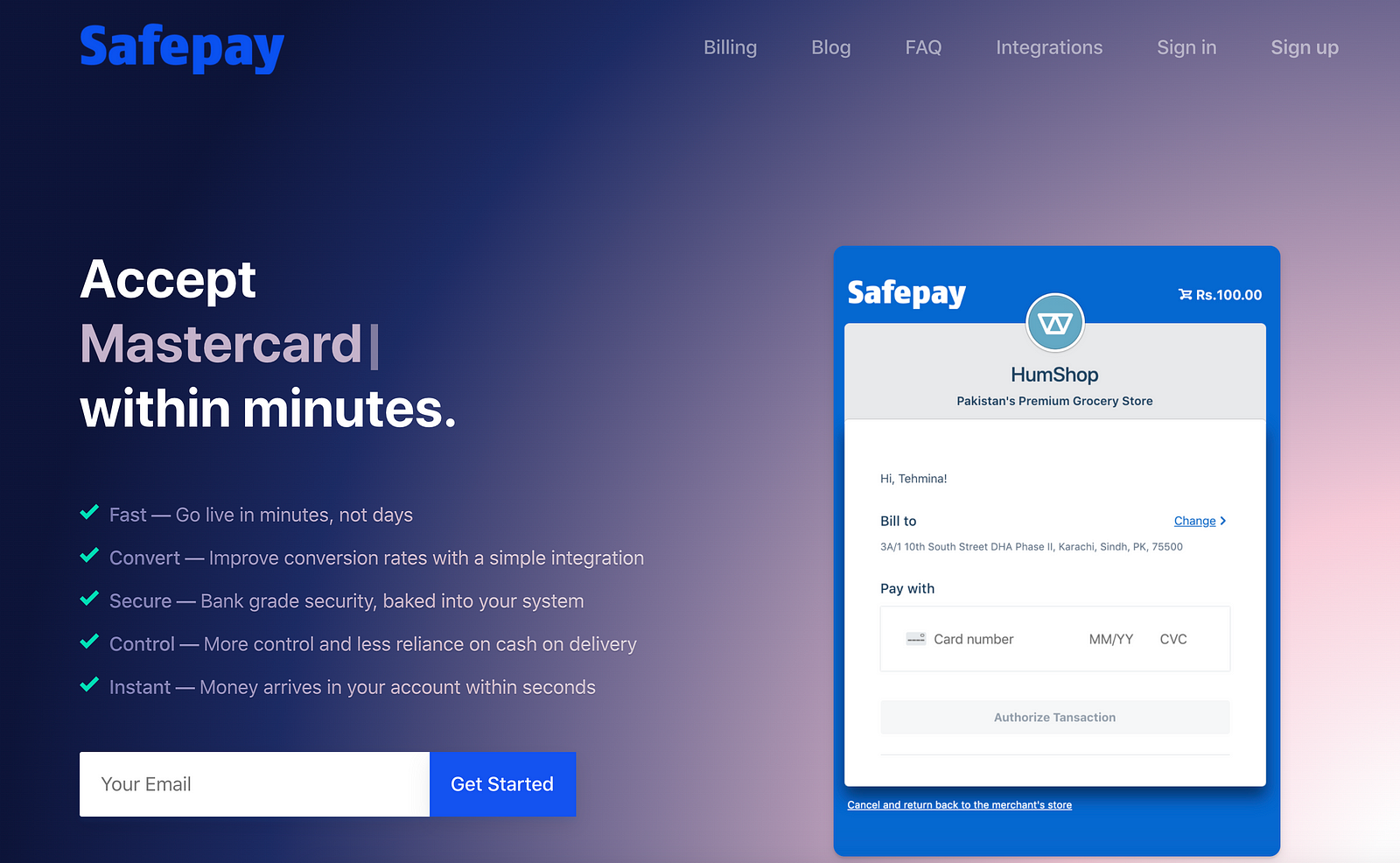

4. Safepay — Stripe for Pakistan

TechCrunch Description: Safepay wants to build a Stripe for Pakistan, crafting a digital payments API in the country where the founders say there are no other major players in this space.

Why I Would Invest: Earlier this year, I wrote about Pakistan as one of the next major startup economies to watch and about another startup there called Tajir. Pakistan has a rapidly modernizing economy and is the 6th most populous country in the world (!)

For that macro reason and because of the big problem that Safepay is attacking, I’m a major fan. I won’t dance around it, the look and feel of Safepay is a Stripe clone, but that’s ok. Why fix what isn’t broken?

(Stripe is valued at ~$35B)

But what Safepay has done differently than Stripe, of course, is focus on Pakistan. The company has begun to scale, with over 250 large Pakistani eCommerce, Marketplace, and Charities using their API and services.

I’m excited to see how they finish out 2020!

5. Bikayi — WhatsApp Shop Manager for India

TechCrunch Description: Shopify isn’t a good match for consumers in the Indian market because of consumer habits that differ from those of the US (for instance, many purchases are made through WhatsApp rather than the web.) The founders started Bikayi after seeing family businesses using pen and paper to handle incoming orders online. They charge merchants $100 per year.

Why I Did Invest: Shopify has failed to find product-market fit in India.

Business owners significantly prefer selling over WhatsApp because it meets customers where they are already. However, there is a TON of friction with selling over the chat platform.

Enter Bikayi, a WhatsApp-integrated shop platform that provides merchants everything they need to manage inventory, promotions, shipping, and more.

The company is scaling at an incredibly fast rate and from my vantage point, Bikayi has already leapfrogged Shopify, which has been live in India for 3 years and only has 18k stores on its platform to show for it.

6. Bits — Credit Score Booster via Virtual Credit Cards

TechCrunch Description: Bits helps people build their credit score by providing them with a digital credit card that they pay off every month. Sure, you could do it yourself, but why not have a service that helps you out?

In 9 months, the company has attracted 10,000 paying customers and collected $1.9M in revenue, and some customers have seen their credit scores jump by hundreds, so clearly there’s something to it. The founder hopes that this straightforward beginning will be the basis for a new, more full-service billion-dollar fintech company.

Why I Would Invest: The traction that Bits has seen in only 9 months is incredibly impressive.

If they can keep up this growth rate, Bits could follow a similar path as Credit Karma and Truebill: Keep a singular focus for the first few years and completely knock it out of the park.

Then, diversify into other related financial areas and increase average customer LTV.

7. Panadata — Checkr for Latin America

TechCrunch Description: Background checks are an ordinary part of doing business everywhere in the world, but the data is fragmented across multiple government databases and other document hoards.

Companies have emerged to sift through the mess in the U.S. and E.U., but Latin America provides a unique challenge and Panadata hopes to tackle it. Its automated check system is already in action and in use by banks, law firms… even the local governments in charge of the data it uses.

Why I Would Invest: This is the second time I’m mentioning Checkr in this post!

Panadata is taking the same approach, but for Latin America, albeit dealing with significantly more messy and incomplete data.

It’s encouraging to see that the company’s data is already quality enough to be used by banks, law firms, and governments. Time to scale!

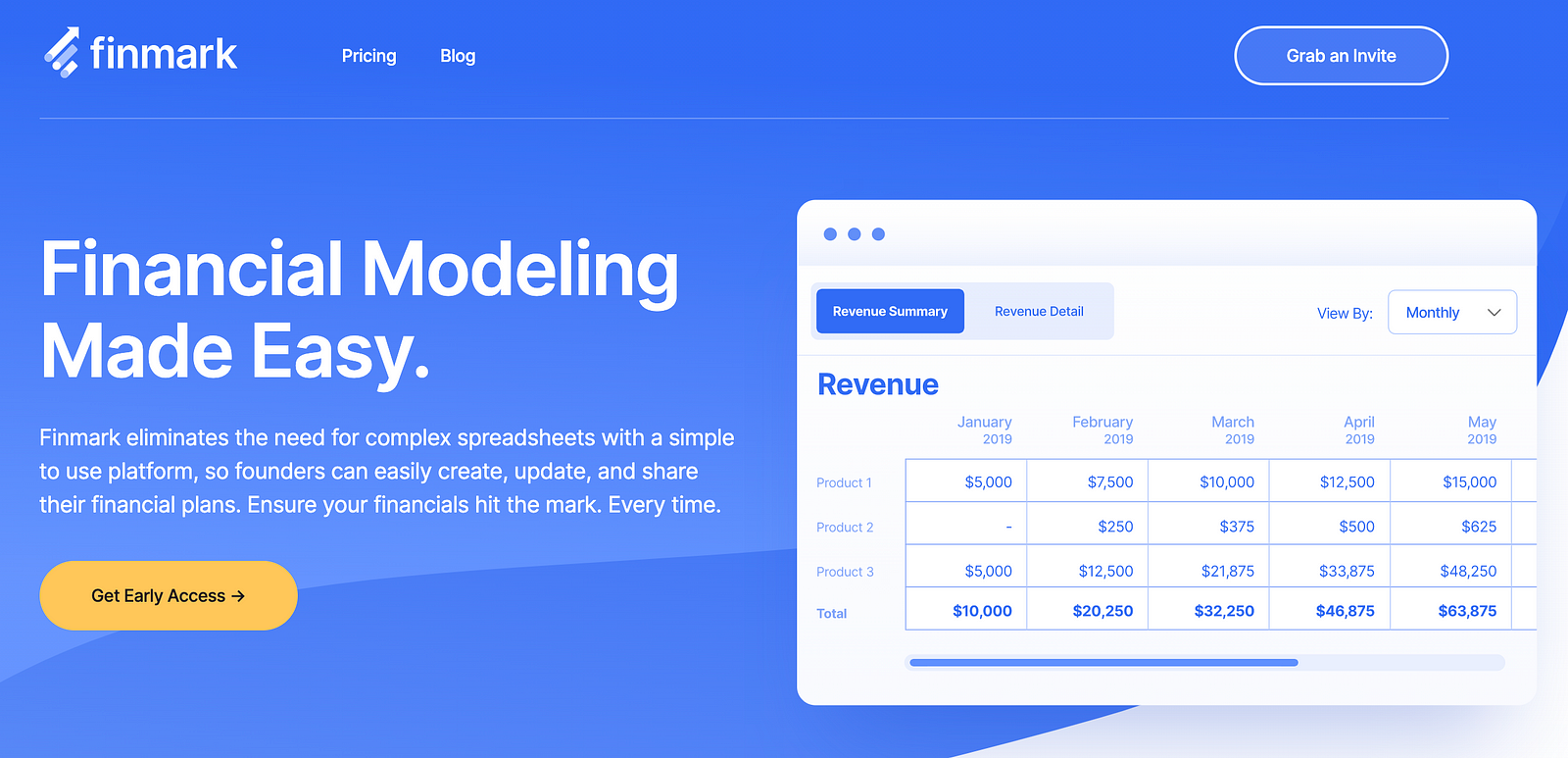

8. Finmark — Carta for Financial Modeling and Management

TechCrunch Description: Doing for financial management what Carta did for equity and fundraising, Finmark is financial planning software for startups to manage runway and cash.

Trying to manage your business off an excel sheet is painful, but for startups proper oversight this can mean the difference between thriving and dying. 300 companies have signed up for its financial management service, the company says.

Why I Would Invest: Carta has revolutionized the management of equity at startups. What was previously a black box to startup employees and a challenging distraction for founders has become significantly simpler and more manageable, thanks to Carta.

Carta was valued about a year ago at $1.7B

Finmark is attacking an equally important problem: financial management for startups. Startups are always focused on their cash (or should be), their runway, and funding needs. Finmark helps startups avoid rookie financial mistakes and eliminates the need for a financial planning excel spreadsheet.

I love SaaS businesses that kill spreadsheets.

9. Decentro — Plaid for India

TechCrunch Description: Continuing the X for India trend that is taking shape in this batch, Decentro wants to build Plaid for India. The company provides an API for banking integrations, like Plaid.

That Plaid sold for billions of dollars earlier this year is still on the mind of every sentient VC, so the comparison could prove enticing. Decentro is still small, with around $1 million in gross transaction volume (GTV), and around $7,000 in MRR. Still, with just four customers and 45 more in the pipeline, it’s on a good path.

Why I Would Invest: Dapi and Decentro are very similar, albeit in different parts of the world. While Plaid does support some European countries, the Middle East, Asia, and Africa are notably absent.

Decentro wants to fill this gap in India, supporting the next generation of Fintech apps. While they are still small, the opportunity here is MASSIVE (again). Plaid for everywhere!

10. BukuWarung — Micro-accounting app for merchants in Indonesia

TechCrunch Description: A micro-accounting app for merchants in Indonesia. It enables mom and pop stores to bring payments and credit to their businesses. The service currently has 350,000 monthly active merchants.

Why I Would Invest: As I mentioned before, there are 25–30MM SMEs/SMBs in SE Asia and Indonesia has the highest concentration of these businesses in the region. BukuWarung simplifies the lives of these (mainly) sole proprietors, giving them access to simple payment and credit technology that also help them scale their businesses.

Their 5-star app has >500k downloads and they already have >350k monthly active merchants. They’ve found great PM-fit and are ready for the next leg up.

Honorable Mentions

- Cradle: Platform for B2B payments in India

- Hypotenuse: AI-generated copy for product descriptions, ads, blog posts, and more.

- GitDuck: Video chat tool built specifically for developers.

- Zuddl: Zuddl is a startup that aims to bring conferences online for big companies.

- Revel Technologies: Aiming to make a “better caffeine,” without the jitters/anxiety, called Paraxanthine.

- Farmako Healthcare: Electronic medical records for India.

- Tappity: Interactive Netflix for kids.

- Strive School: Lambda School for Europe, leveraging income-share agreements to train software engineers who don’t pay for the education until they get a job in the industry.

- Mailwarm: Prevent “legit” marketing emails from being relegated to the spam folder.

- Toolbox: An application and labor marketplace that connects general contractors on construction sites with qualified laborers.

- Conta Simples: A digital bank account for startups based in Brazil.

- Vitable Health: Basic healthcare coverage (emergency + preventative) for $50/month.

- Layer: A developer tool that creates staging environments quickly and allows developers at smaller companies to have access to a similar workflow as the major tech companies of the world.

- Thndr: Robinhood for the Middle East.

How Have My Picks from Past YC Classes Done?

W20

Too soon to report on the good, the misses, and the ?’s from the W20 YC class! Check back in a few months.

S19

The Good

- EARTH AI: Raised $3.8MM in funding, including a $2.5MM Series A in August 2019.

- Narrator: Raised $7.4MM in funding, including a $6.1MM seed round following YC.

- Tandem: Raised $7.5MM in funding, including a seed round with participation from Andreesen Horowitz.

- Apero Health: Only has raised $150k from YC (or has not disclosed). Well-positioned though in the Corona-economy!

- Well Principled: Raised $2.6MM in funding.

The Misses

- Too early to determine!

The ?’s

- Metacode: Only has raised $150k from YC (or has not disclosed)

- Localyze: Only has raised $150k from YC (or has not disclosed)

- Soteris: Only has raised $150k from YC (or has not disclosed)

- Lezzoo: Only has raised $150k from YC (or has not disclosed)

- SannTek Labs: Only has raised $150k from YC (or has not disclosed)

W19

The Good

- CareerKarma: Raised $1.5MM seed round in July 2019; 38 employees as of August 2020.

- Superb-AI: Raised $2MM seed round in February 2019; 22 employees as of August 2020.

- YourChoice: Raised $1.6MM seed round in January 2019. Pivoted to focus on COVID treatments in March 2020.

- FlowerCo: Raised $2.8MM seed round in July 2019; 38 employees as of August 2020.

- Boundary Layer Technologies: Raised $2.3MM seed round in March 2019; 6 employees as of August 2020.

- Pronto: Raised $2.2MM in total funding; 30 employees as of August 2020.

- Skill-lync: Only has raised $150k from YC, but appears active and scaling based on LinkedIn.

The Misses

- Modern Labor: Website doesn’t load and I don’t see any signs of life, calling this one dead.

The ?’s

- Cherry: Only has raised $150k from YC; only 2 employees on LinkedIn as of August 2020.

- CareerTu: Only has raised $150k from YC; 13 employees on LinkedIn as of August 2020.

S18

The Good

- Kyte: Originally a Smart SMS inbox for India — rebranded as KhataBook, raised a $25MM Series A round in September 2019 and a $121.5MM Series B in May 2020 (!!)

- OKCredit: Raised $1.7MM seed round in August 2018 and a $15.5MM Series A in June 2019. Raised $67MM Series B in 2019 (!)

- Berbix: Raised $2.5MM seed round in July 2019 and $9MM Series A in August 2020.

- Alpha Vantage: Raised $2.2MM seed round in 2018, nothing raised since

- Goodly: Raised $1.3MM seed round in March 2019, nothing raised since

- CSPA: Raised $1.5MM seed round in September 2018, nothing raised since

- Inscribe: Raised $3MM seed round in December 2018, nothing raised since

- Togg: Raised $4MM seed round in September 2018, nothing raised since

- Scanwell Health: Raised $3.5MM seed round in November 2019

The Misses

- Cambridge Glycoscience:Has not raised a seed round. 3 employees, calling this one dead

W18

The Good

- Juni Learning: Raised an additional $790k in January 2018. Raised a $10.5MM Series A in August 2020. Scaled to 417 employees as of August 2020.

- Veriff: Raised a $7.7M Series A in June 2018. Raised a $15.5MM Convertible Note in July 2020. 209 employees on LinkedIn as of August 2020.

- NexGenT: Raised $2MM in January 2018. Raised $15MM Series A in November 2018. 67 employees on LinkedIn as of August 2020.

- Sheerly Genius: Rebranded as Sheertex, raised undisclosed Series A in September 2019. 48 employees on LinkedIn as of August 2020.

- HelloVerify: No disclosed fundraising since YC, but scaled to 129 employees (LinkedIn) as of August 2020.

- Reverie Labs: Seed round raised in March 2018 (undisclosed). 14 employees on LinkedIn as of August 2020.

- OpenLand: Raised $2.3M in August 2018 and pivoted into a messaging app. 12 employees on LinkedIn as of August 2020.

The Misses

- Onederful: No fundraising since YC. 2 employees on LinkedIn as of August 2020. Calling this one dead.

The ?’s

- Memora Health: No fundraising since YC. 20 employees on LinkedIn as of August 2020.

- Lawyaw: No fundraising since YC. 12 employees on LinkedIn as of August 2020.

S17

The Good

- Standard Cognition: Raised $5MM (October 2017) from Charles River, Initialized Capital, and YC. Raised $40M Series A in November 2018. Raised $35MM Series B in July 2019. 121 employees on LinkedIn as of August 2020.

- PayFazz: 464 employees on LinkedIn as of August 2020 and closed a convertible note after YC (September 2017). Raised $21M Series A in November 2018. Raised $53MM Series B in July 2020.

- PullRequest: Raised a $2.3MM seed round from Google’s Gradient Ventures in December 2017 and then raised a $10.4M Series A in April 2018. 33 employees on LinkedIn as of August 2020.

- Dahmahkan: Raised $5MM Series A in May 2019. Raised $18MM Series B in February 2020.

- 70MillionJobs: Finalist in the Social and Culture Technologies Category at SXSW Accelerator Pitch Event. Raised $150k from Quake Capital Partners in March 2019. 15 employees on LinkedIn as of August 2020.

- Zendar: Incredibly difficult to find information on this company over the past year, but they raised a $10.5MM Series A round in March 2019. 23 employees on LinkedIn as of August 2020.

- Piggy: Pivoted into banking for couples: 23 employees on LinkedIn, but no money raised since YC.

The Misses

- Ubiq: Little to no press since YC. Last blog post on the website is 10/30/17. I’m calling this one dead.

- Net30: Similar to Ubiq, little to no press since YC. Down to 2 employees on LinkedIn. Haven’t raised money post-YC. I’m calling this one dead.

- Plasticity: Only 2 employees on LinkedIn, no money raised since YC. No press since 2017. I’m calling this one dead.

0 Comments