With the explosion of funding and the 11 public market exits for Indian startups in 2021, 2022 is poised to be one of the most exciting years to date for the ecosystem!

I’ve dug deep to pull together this year’s list. You’ll likely find a name or two you recognize, but I can guarantee you haven’t (yet) heard of a few of these startups to watch.

Now is the time to change that. Keep an eye on these companies in 2022 and beyond!

Other Startups to Watch:

- Top 10 Pakistani Startups to Watch

- Top 10 African Startups to Watch

- Top 10 Middle East Startups to Watch

- Top 10 Latin American Startups to Watch

- Top 10 European Startups to Watch

- Top 10 Chinese Startups to Watch

- Top 10 Israeli Startups to Watch

Want to be the first to know when my posts go live?

Follow me on Medium and subscribe to my newsletter: Modern Product Manager Newsletter

Interested in Investing in Startups Like These?

Check out the Mitchell Ventures syndicate on AngelList here

India’s Startup Environment

2021 was simply an incredible year for Indian startups!

The startup ecosystem bounced back in more ways than one from the Covid-induced-impact it experienced in 2020.

Here are just a couple of mind-blowing stats:

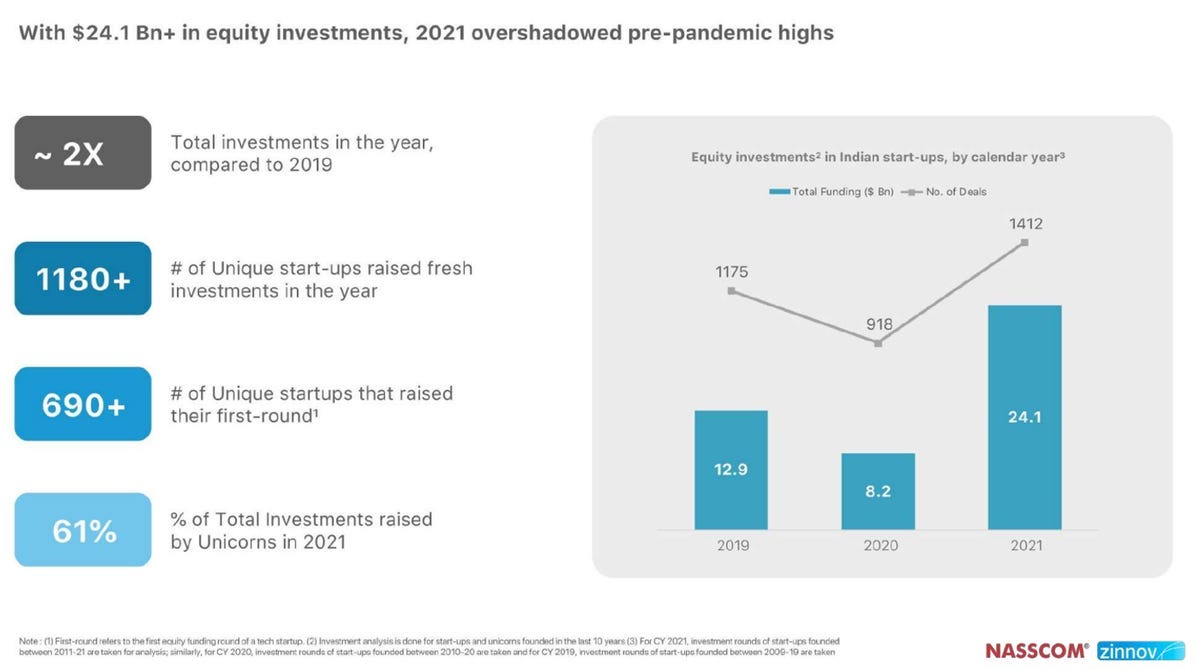

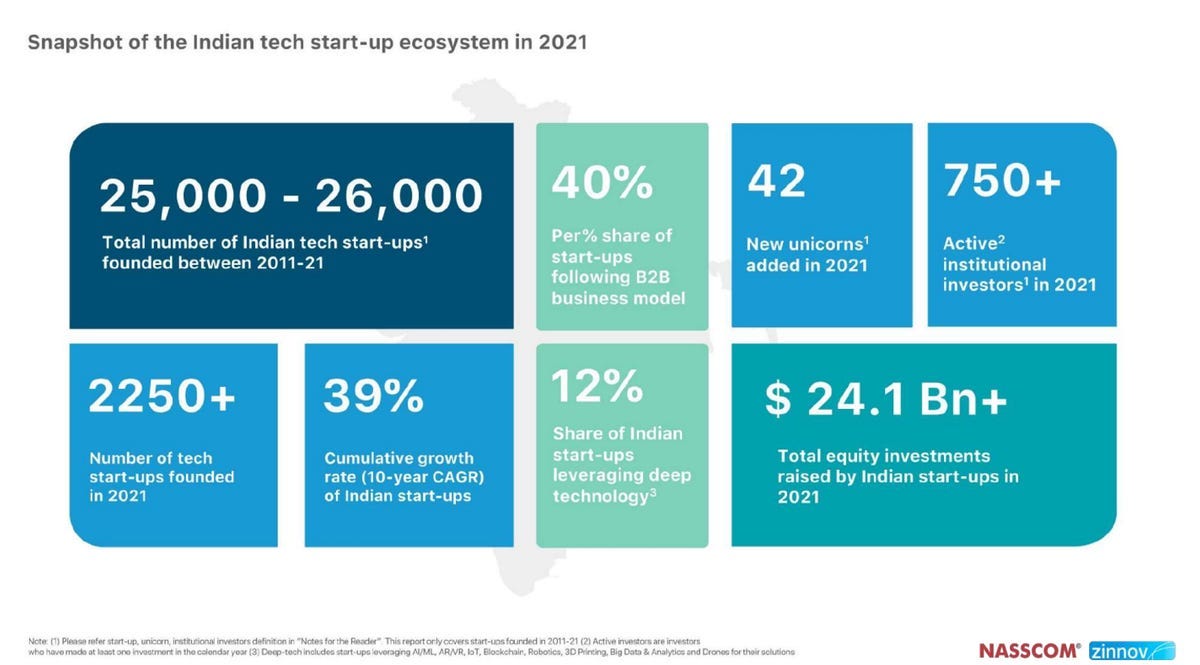

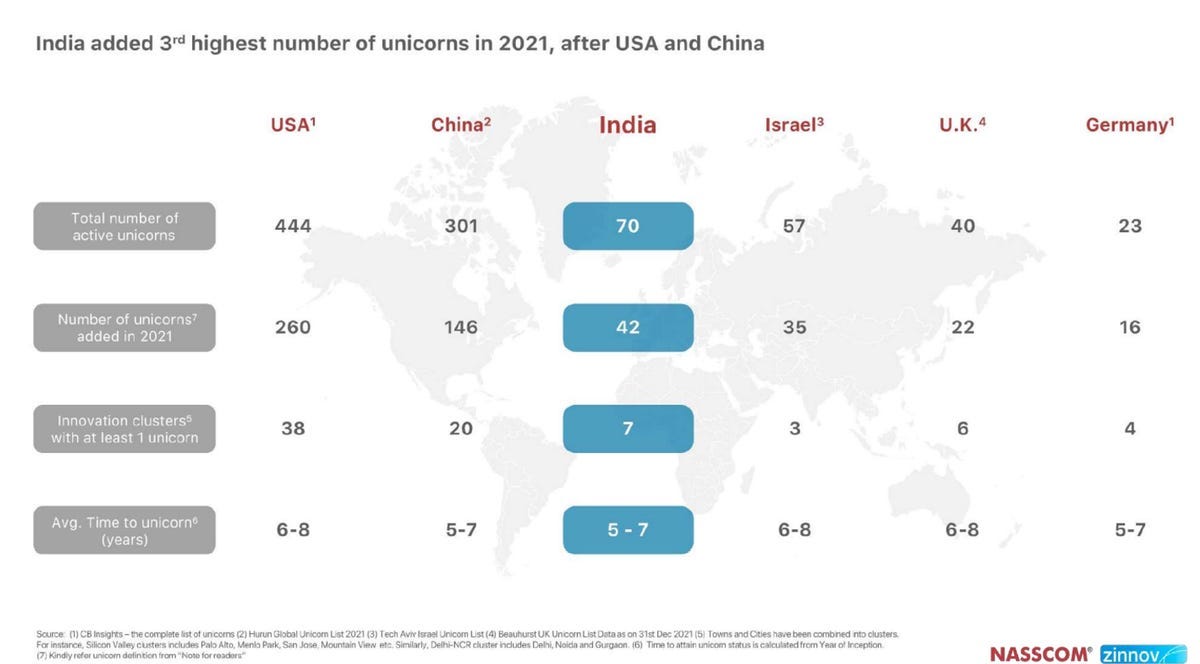

- 42 unicorns added in 2021, 3.5x from 2020

- $24.1B in funding, 3x from 2020

In addition to this funding and valuation growth, India has also seen four decacorns (valuation >$10B) so far — Flipkart, Paytm, Byju’s, and Oyo, with Paytm’s parent company One 97 Communications going public in November 2021.

2021 was also an important year for Indian startups like Paytm going public, with 11 getting listed publicly. These companies raised $6.2B in total capital from the public markets and now command a >$47B market capitalization.

A report by NASSCOM, conducted in coordination with research firm Zinnov, stated that the Indian start-up ecosystem saw a 2x gain in cumulative valuation from 2020 to 2021, with an estimate of ~$330 billion in total valuation (!)

Established startup cities like Delhi, Bangalore, Chennai, Pune, Hyderabad, and Mumbai account for 71% of all Indian startups. The remaining 29% are largely accounted for by developing startup cities like Jaipur, Kochi, Kolkata, and Chandigarh.

In summary, Indian startups had a great 2021 and with all of the funding and the 11 public market exits, things look promising in 2022 as well.

Let’s dig into the Top 10 Indian Startups to Watch before they become household names!

Sources: ZDNet, Economic Times, BusinessToday.In, Business-Standard, Inc42

The Top 10 Indian Startups to Watch

- Vahan: Linkedin meets WhatsApp

Vahan is the future of job searching and hiring and is embedded into the most popular and universal app in India, WhatsApp.

The company, which was only founded in 2016, has experienced strong growth and is now a major recruiter for Zomato, Uber, McDonalds, Flipkart, Dominos, Dunzo, Swiggy, and more!

The opportunity they’re attacking is massive: There are over 250MM blue-collar workers in India. Vahan has projected they are on track to be the #1 platform for hiring these workers in India by the end of 2022.

Based on that growth and this large TAM, I wouldn’t be surprised to see the company raise a sizeable Series B in 2022 (they raised their Series A in August of 2021).

Offices In: Bangalore

Total Funding: $8MM

2. Lokal: Hyperlocal News for Tier 2 and Tier 3 Cities

Much of India’s initial tech growth happened in the major cities of Mumbai, Delhi, and Bangalore. As I shared in my introduction, these startups still control the majority of Indian startup funding.

However, over the past few years, several startups have targeted the opportunity offered by so-called “Tier 2” or “Tier 3” cities (typically designated by population). These smaller cities provide both opportunities and challenges.

The opportunity is that these populations are largely unserved or underserved by technology and, collectively, they are actually quite massive in size. The challenge is that they lack much of the infrastructure provided by Tier 1 cities and that standard marketing techniques don’t work; you have to be more creative!

Lokal is one promising startup focusing on these smaller cities, bringing hyperlocal content and social media to these users.

In October 2021, the company raised a $12MM Series A led by Chinese giant Tencent and reported having more than 10MM downloads of their app. I’m excited to watch them continue to scale geographically in 2022.

Offices In: Bangalore

Total Funding: $15.2MM

3. GimBooks: Invoicing and Accounting for SMBs

Based on the success of Khatabook, which most recently raised a $100MM round of funding at a $600MM valuation in August 2021, the SMB inventory + bookkeeping space is getting hot all around the world!

Gimbooks was in the W21 cohort of YC, the same batch as Treinta, a startup with an approach that was initially quite similar to Khatabook, but focused on LATAM.

Despite the fact that both Khatabook and Gimbooks are focused on India, there is plenty of opportunity to go around. 24% of India’s GDP is still processed on paper (representing >$500B).

Gimbooks has also diversified beyond simple recordkeeping to provide more sophisticated invoicing and accounting tools, moving more towards an all-in-one business management platform (think Zoho).

This has helped the company successfully begin to monetize its millions of downloads into tens of thousands of paying customers.

To date, the company has only raised a seed round of funding, but I wouldn’t be surprised to see a Series A announcement in 2022, empowering Gimbooks to scale and develop new features faster for their SMB customer base.

Offices In: Raipur

Total Funding: Not disclosed

4. GoBillion: Social Commerce for Tier 2 and Tier 3 Cities

I wasn’t kidding, there is a big-time opportunity in Indian Tier 2 and Tier 3 cities!

GoBillion was a member of the S21 cohort of YC and has built a social eCommerce experience targeting Tier 2+ cities. They’re quite similar to Chinese giant Pinduoduo (valuation ~$40B) in this way.

In December 2021, the company raised a $2.9MM Seed round to scale their expansion and their eCommerce offerings to more categories. I’m excited to see how much growth they can deliver in this critical year.

Offices In: Delhi

Total Funding: $5.9MM

5. Odwen: Airbnb for Warehouses

Odwen is truly solving a pervasive problem in India (and to be honest, in many other countries). There are 60MM SMBs that need warehouses in India to store their products.

But, the warehouse market is highly fragmented (90% independent owners) and inconsistent. Odwen adds a technology and trust layer to the experience, helping these SMBs find the space they need in minutes at prices 20% below market and completely online.

As of late 2021, the startup already had 500+ warehouses across 91 cities in 21 states (making them the largest integrated network in India!)

The TAM of this market is estimated at >$37B (representing 15% of the supply chain industry in India), which is incredible.

If Odwen can continue to build their network quickly, they have a huge opportunity to own this sub-industry and become the brand for SMB warehousing in India.

Offices In: Noida

Total Funding: $800k

6. Snazzy: DTC Orthodontics at an Unbeatable Price Point

DTC orthodontics has certainly had a moment in the United States, but other countries have lagged several years behind.

Despite the delay in time, these countries and startups have the opportunity to dramatically push down the prices of these services and leapfrog the v1 experience created by companies like Smile Direct Club and Candid.

Snazzy was a member of the W21 class of YC and is pursuing a similar goal as Moons in LATAM (which I’ve written about before) — lowering the price point of at-home orthodontics significantly to unlock TAM in lower-income countries.

Depending on the complexity of the case, Snazzy charges only $600 or $800 which is 75%+ lower than the comparable cost in the US.

2022 will be a pivotal year for the company to prove they can generate significant demand for their service at a reasonable cost of acquisition.

Offices In: Hyderabad

Total Funding: $2.2MM

7. PayCrunch: Microcredit for College Students

PayCrunch was founded in 2020 and provides an alternative credit scoring model, with a buy now, pay later (BNPL) option focused on college students.

More than 150MM people in India cannot access credit due to a lack of financial data or low credit scores. PayCrunch is striving to unlock part of this audience via other data signals that can help the company better understand the likelihood of the individual to pay loans back.

The company is currently very early stage with no funding yet disclosed and they are participating in the W22 batch of YC (currently ongoing).

Offices In: Bangalore

Total Funding: Not disclosed

8. smallcase: Invest in Ideas

smallcase brings simplified investing to India.

Instead of focusing on individual stocks, smallcase shares “themes” or “ideas” that first-time investors can put small amounts of money into to gain exposure to a basket of companies.

Since 2019, the company has grown its users 7x (reported to be more than 3MM) and their revenue an incredible 15x! It’s no surprise investors have noticed and continued to double down on their investments, most recently funding the company’s $40MM Series C in August 2021.

More recently, smallcase has attracted the attention of a FinTech giant in India: CRED (currently valued at $4B). The startup is rumored to be interested in investing in smallcase’s newest round.

Offices In: Bangalore

Total Funding: $62MM

9. Plum: Health Insurance for Startups

Plum is an insurtech company focused on company-sponsored health insurance. The company already serves several notable Indian (smallcase, GigIndia, Simpl) and non-Indian (Tindr, Twilio) startups.

The company is working to be a full-stack provider of simple-to-manage and use insurance services. Tiger Global led the company’s $15.6MM Series A in May 2021, providing the company with the capital to scale its product offering and sales team significantly.

Plum is targeting 10MM customers by 2025. India has a massively untapped insurance market. Digital distribution, like Plum, today accounts for just 1% of the industry (!)

If Plum can continue to deliver a great user experience (for both their corporate buyers and their employees) and rapidly release new features, they’ll continue to capture market share and be well on their way to their 10MM customer goal!

Offices In: Bangalore

Total Funding: $20.6MM

10. Stack: Automated Investments

Stack is solving the “simplify investing” problem in a different way than smallcase. They are focused on putting investing on autopilot, in a somewhat similar way as Acorns in the US.

They also have some elements of a Wealthfront/Betterment, but Stack is trying to keep investing simpler than those companies.

Stack was a member of the S21 class of YC and claims to have more than 50k users to date. They’ve focused on offering low fees, which are especially important when the average $$$ invested are much lower.

With so many Indians investing in the stock market for the first time, Stack is in the right place at the right time, but is their solution the right one?

Time will tell!

Offices In: Bangalore

Total Funding: Not disclosed.

Honorable Mentions

Shuttl: High-Quality Shared Transit

Offices In: Gurgaon

Total Funding: $122.3MM

Agnikul: Rockets for Micro and Nano Satellites

Offices In: Chennai

Total Funding: $14.5MM

CropIn: AgTech Data and Insights

Offices In: Bangalore

Total Funding: $32.6MM

What Indian Startups Did I Miss?

I’m sure I missed quite a few prolific, fast-growing Indian startups. Let me know which ones on Twitter at @amitch5903!

0 Comments