When I began writing my “Startups to Watch” posts several years ago, I started with China and India, uncovering many startups that have now gone on to become unicorns (and, in the near future, some likely decacorns).

As I continued my writing on startups, I expanded my view to Latin America and Africa, which today are among the fastest-growing regions for startups. Africa, especially, is having an incredible 2021, with multiple companies reaching unicorn valuations and many >$100MM rounds of funding. This is a continent that in 2015 was eclipsed in total funding by 1 round of Snapchat’s funding.

Today, I’m incredibly excited to bring you my first post on Pakistani Startups to Watch. While the country has received some notable press in the past few months, the opportunity is massive in the country and deserves more attention and, honestly, much more funding.

I sincerely hope you enjoy my profile of the Top 10 Pakistani Startups to Watch in 2022 and that you start learning more about the powerful things happening both in this country and in the startup scene.

Other Startups to Watch:

- Top 10 Middle East Startups to Watch in 2021

- Top 10 Latin American Startups to Watch in 2021

- Top 10 European Startups to Watch in 2021

- Top 10 African Startups to Watch in 2021

- Top 10 Indian Startups to Watch in 2021

- Top 10 Chinese Startups to Watch in 2021

- Top 10 Israeli Startups to Watch in 2021

Want to be the first to know when my posts go live?

Follow me on Medium and subscribe to my newsletter: Modern Product Manager Newsletter

Pakistan’s Startup Environment

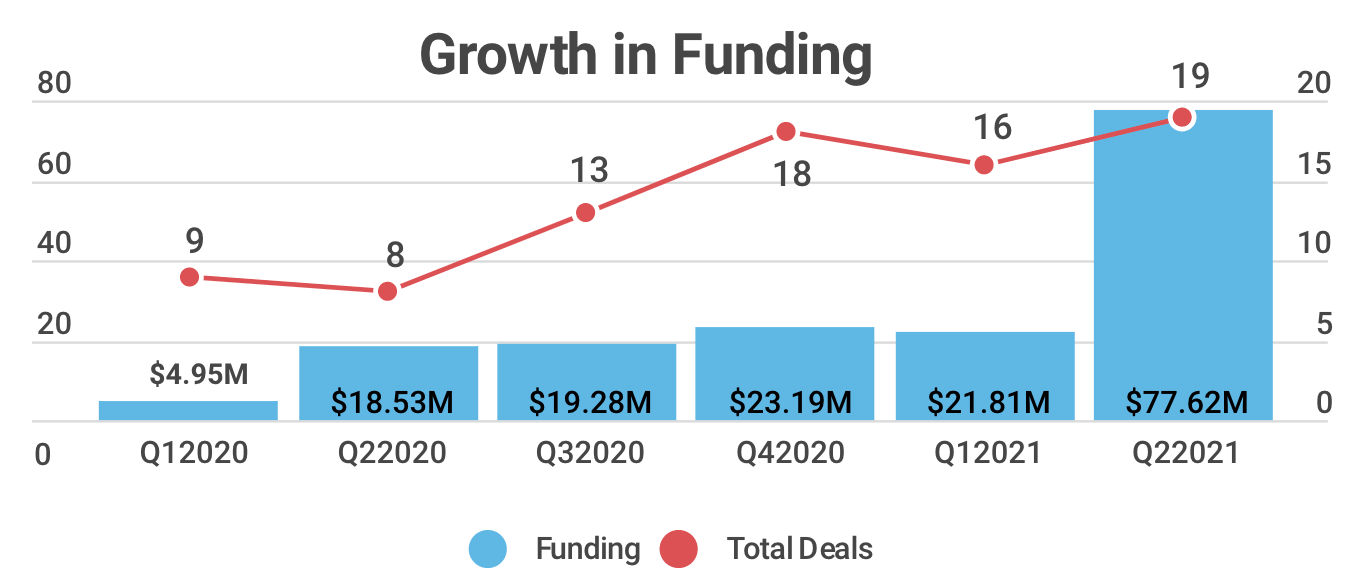

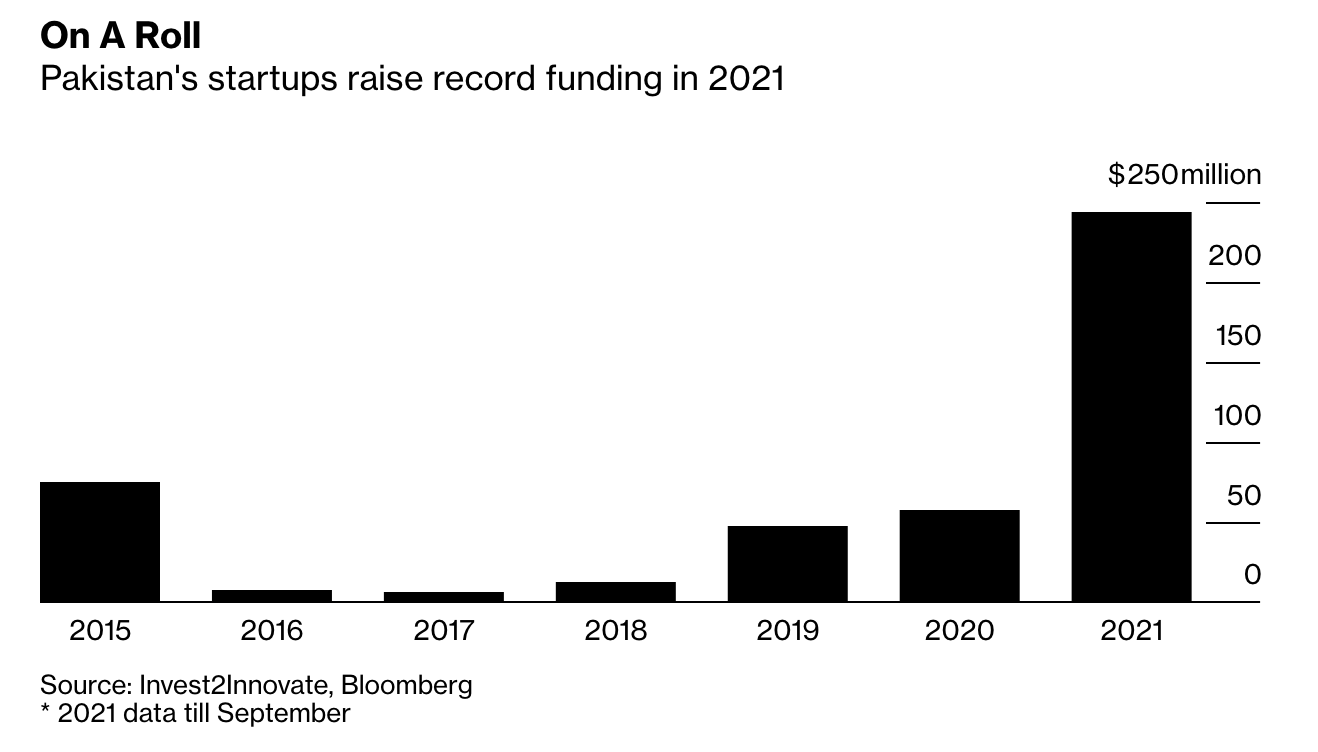

In 2020, Pakistani startups raised a total of $66MM.

In 2021, things changed dramatically.

It began in January, when $13.5 million was raised. Over the next few months from February to April, 7 companies raised $42.6 million in funding.

In May and June, startups raised an additional $69.2 million, with most of the funding going to eCommerce and FinTech startups.

Can you feel the acceleration?

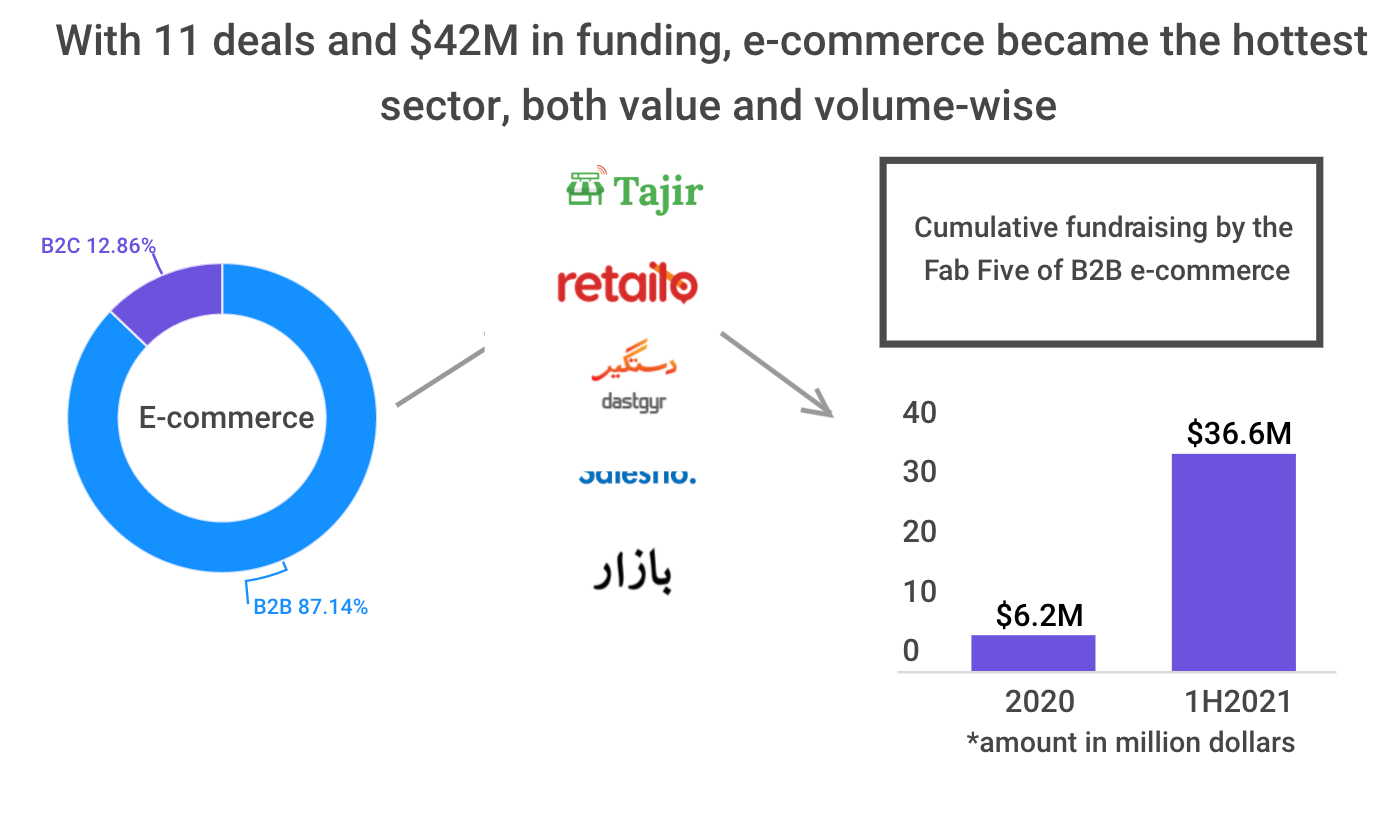

The first half of 2021 was simply incredible for Pakistani startups. According to data compiled by Data Darbaar, total investment into the country’s ecosystem topped $125 million across 35 unique deals during this period, almost doubling the total raised in all of 2020, when 48 total deals were completed.

We also began to see glimpses of big-name VC investors in the country, notably Kleiner Perkins leading Tajir’s $17MM Series A in June 2021.

During the first half of 2021, the Pakistani VC ecosystem also grew by 4x YoY, with Pakistani startups accounting for 7% of total deals made in Emerging Venture Markets (MENA, Turkey, Pakistan).

37% of total funding in Pakistan in the first half of 2021 was raised by seven FinTech startups, up from 0 FinTech deals in the first half of 2020.

In the first half of 2021, 72% of investors in Pakistani startups were foreign, while 43% of all investors were from the USA.

And then came Airlift…

Airlift Technologies received the largest single private funding round in Pakistan’s history in August 2021. The Lahore-based online shopping delivery firm raised $85 million in Series B financing co-led by Harry Stebbings from 20VC and Josh Buckley from Buckley Ventures Ltd., with participation from former Y Combinator president Sam Altman.

Other notable fundings in the second half of 2021 include TAG ($12MM), BridgeLinx ($10MM), and Dastgyr ($3.5MM).

As investors become more familiar with Pakistan and learn more about the macro trends in the country, the opportunity is incredibly clear.

Pakistan has one of the world’s largest youth markets, which is about half the size of its 230 million population. It also has one of the largest unbanked populations, with about 100 million adults without a bank account.

Additionally, 3G/4G phones have become affordable and ubiquitous and access to the internet is now widespread. Pakistan has 85% teledensity, with 183MM total cellular phones, 98MM 3G/4G phones, and 101MM internet subscribers.

However, there are still some significant challenges that need to be overcome.

According to Ammar Habib Khan, Chief Risk Officer at Karandaaz (a nonprofit focused on digital access to finance):

“Absence of an identity stack is the weakest link. The true potential of the FinTech space can only be unlocked through a robust identity stack enabling access to financial services for a largely underbanked and underinvested population.”

India faced a similar problem years ago. When they solved their identity stack challenge and integrated it with a universal payments interface, online transactions went from 90k/month to 2B/month (!)

Pakistan is doing its part to improve infrastructure and make it easier for startups and investors to operate in the country. Pakistan was the 4th biggest positive mover in the World Bank’s Ease of Doing Business Index last year.

As I mentioned at the beginning of this post, Pakistan is at an incredible inflection point and has already begun its exponential growth. The timing is right for the country and both founders and investors are jumping in with both feet to make the most of it!

Sources: Arab News, Forbes Middle East, Dawn, Al Jazeera, Bloomberg, TechCrunch, Magnitt, MENAbytes

How Did I Choose This Top 10?

Over my career, I’ve been fortunate to have worked with several incredibly talented Pakistani entrepreneurs. These friends have connected me with their networks, providing me access to the country’s leading entrepreneurs and startups before they hit mainstream.

While you’ll recognize a few of the names in the list, chances are you won’t recognize many of them, and that’s a good thing.

The opportunity in Pakistan simply cannot be overstated. We’re still in the early days of what is becoming a rapidly increasing exponential curve. Several years from now, we’ll look back and see that 2020 and 2021 were just the beginning for Pakistan (and wish we invested more!)

Let’s jump in!

The Top 10 Pakistani Startups to Watch

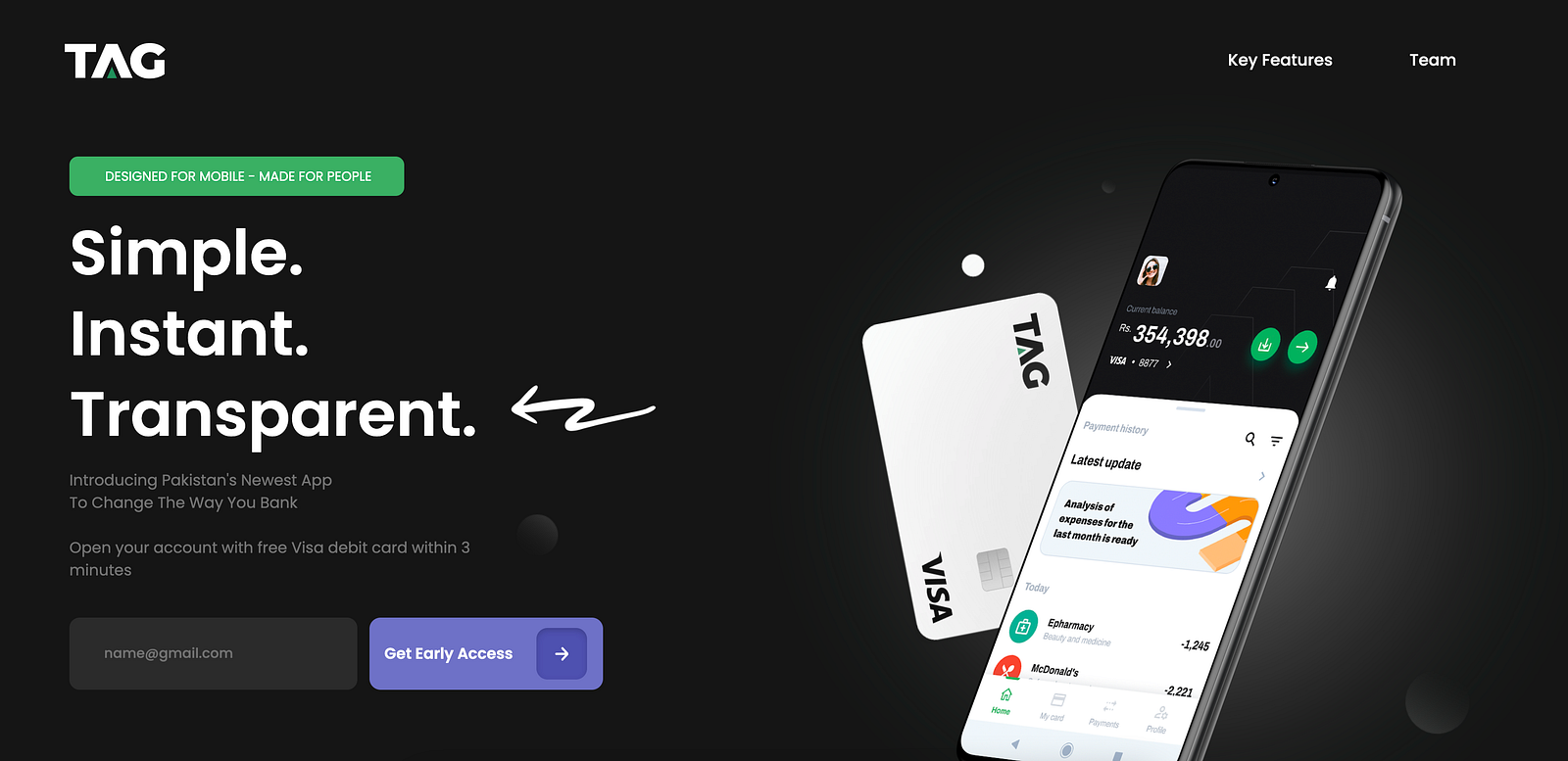

- TAG: Pakistani Neobank

Neobanks are some of the most well-funded and highest valued startups around the world: Chime — USA ($25B), NuBank — Brazil ($30B), Revolut — UK ($33B), N26 — Germany (>$3.5B), just to name a few!

TAG is looking to capitalize on this opportunity in Pakistan, which has the 3rd largest unbanked adult population globally. More than 100MM adults in the country don’t have a bank account, representing approximately 70% of the adult population!

And, believe it or not, there are no neobanks with serious traction in Pakistan.

It’s for this reason that TAG recently raised an incredible $12MM at a $100MM valuation in a SEED round (!) That is impressive for any country, let alone one with a still nascent startup and VC community.

TAG is undoubtedly a company to watch in 2022!

Offices In: Islamabad

Total Funding: $17.5MM

2. Tajir: b2b Inventory for Pakistan Stores

I initially wrote about Tajir in my Middle East Startups to Watch in 2021 post and they have delivered! Since I wrote about the company, they raised a $17.5MM Series A round from Silicon Valley legends Kleiner Perkins.

For the uninitiated, Tajir is a mobile app where Pakistani shopkeepers can purchase inventory with transparent prices, next-day delivery, and robust order tracking.

The system of retail in Pakistan is incredibly fragmented and inefficient and the company has made big strides in changing that.

But there is still plenty of ground to cover: The retail market in Pakistan is >$150B and has been growing at 9% YoY for 20 years.

Plus, 91% of the retail market still flows through mom-and-pop stores, talk about an opportunity!

Offices In: Lahore

Total Funding: $19MM

3. Mucho: Pinduoduo + Costco for Pakistan

Mucho is an incredibly interesting company (still in beta release) with very impressive early traction.

The company offers factory prices to retail consumers via a C2M (consumer to manufacturer) business model that combines elements of Pinduoduo (the group-buying Chinese unicorn) and Costco (the original subscription business!).

For reference, Pinduoduo went from 0 to 824 million customers in just 6 years, recently overtaking Alibaba as the largest e-commerce player and becoming the fastest-growing e-commerce company EVER.

In addition to this high-level business model innovation, Mucho’s approach combines discovery-based social sharing, community group buying, an exclusive club-membership, a gamified shopping experience, and next-gen payment solutions.

Mucho even enables community leaders and influencers to create new income streams through steady sales commissions from their local social networks, win-win!

Keep a lookout for Mucho later this year as they exit their beta with a BIG waiting list (rumored to be well north of 100k) and start to scale in Pakistan.

Offices In: Lahore

Total Funding: Currently closing a funding round, are 5x oversubscribed (!)

4. CreditBook: Digital Ledger for Pakistani Businesses

I initially wrote about CreditBook in my Middle East Startups to Watch in 2021 and they also have delivered!

While Tajir helps small business owners in Pakistan manage their inventory, Creditbook focuses on finances, payments, and receivables for those same SMBs.

Creditbook (similar to Khatabook in India and Bukuwarang in Indonesia) is a replacement for all of this paperwork. The startup already has recorded millions of transactions and has hundreds of thousands of happy users.

Given the funding fury in Pakistan as of late, I wouldn’t be surprised to see the company raise a significant up round in late 2021 or early 2022 to fuel even faster growth.

Offices In: Karachi

Total Funding: $1.5MM

5. Airlift Technologies: 30-Minute Delivery of Household Essentials

Airlift Technologies has an incredibly interesting COVID-19 story. Pre-pandemic and for the first 6 months of the pandemic, the company focused on delivering people via their modern buses.

But after the pandemic largely killed that business model, the company pivoted in September 2020 to focus on delivering goods.

That pivot not only jumpstarted their growth, it turned them into a ?

By the end of 2021, the company is planning to expand to 15 Pakistani cities up from the current 8. The company also raised an incredible $85MM Series B round in August 2021, a record for Pakistani startups.

Airlift is one of the companies you definitely need to watch in 2022!

Offices In: Lahore

Total Funding: $109.2MM

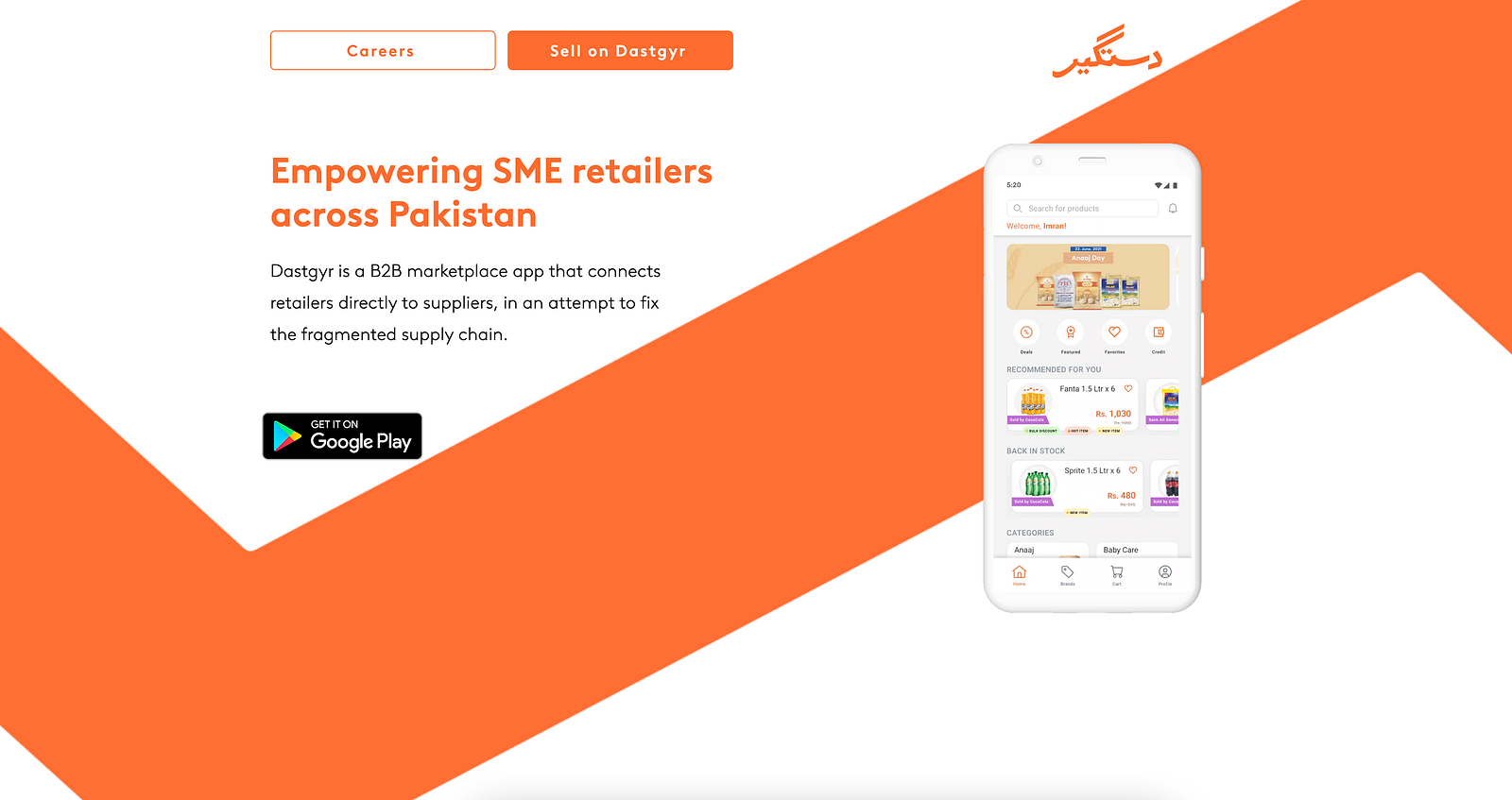

6. Dastgyr: B2B eCommerce Marketplace for SME Retailers and Suppliers

Dastgyr is pursuing a similar problem that Tajir is attacking but in a different way.

Instead of providing a curated platform with thousands of items like Tajir, Dastgyr offers a B2B marketplace, with an order of magnitude more items, and empowers those retailers to purchase directly from suppliers.

Interestingly, many of Dastgyr’s founding team members also originally worked at Airlift, before leaving to start the company.

Although I don’t know the full backstory here, it’s exciting to see top technology talent begin to build the ecosystem that will help turn Pakistan into a startup powerhouse of the Middle East! Keep an eye on this team and this startup in 2022.

Offices In: Karachi

Total Funding: $4MM

7. Finja: Payments, Lending, and Investing for Consumers and Businesses

Finja, founded in 2016, is a diversified financial services platform offering an impressively wide range of financial products to both Pakistani consumers and businesses.

The company most recently raised a $9MM Series A round in December 2020 from ICU Ventures and existing investors BeeNext, Vostok Emerging Finance, and Quona Capital.

Finja hasn’t received the same level of press coverage as some of the other startups I’ve profiled so far, but I wouldn’t be surprised if that changes in 2022.

They’ve demonstrated strong traction in their lending products for both SMEs and consumers and the market opportunity is HUGE: Small business and consumer lending together represent a $60B market opportunity in Pakistan, of which less than 4% is currently serviced (!)

Offices In: Lahore

Total Funding: $24.5MM

8. SadaPay: Pakistani Neobank

While TAG is often referred to as the “only” or the “first” neobank in Pakistan, Sadapay shouldn’t be overlooked. The startup was founded in 2018 (2 years before TAG) and most recently raised a $7.2MM Seed round of funding in May 2021, led by Recharge Capital.

Sadapay is following the tried-and-true neobank playbook, starting with a debit card and a no-fee bank account + free, instant transfers to any bank or wallet in Pakistan, and 3x/month free cash withdrawals at any ATM in Pakistan.

In 2022, I wouldn’t be surprised to see Sadapay add additional banking, lending, and investing services as they grow their customer base. Although TAG has the PR lead, there is plenty of room in Pakistan for (at least) 2 neobanks!

Offices In: Islamabad

Total Funding: $9.3MM

9. QisstPay: Buy Now, Pay Later (BNPL) for Pakistan

Buy Now, Pay Later is absolutely CRUSHING 2021.

The OG BNPL company, Affirm, went public earlier this year and is currently trading at a $36B+ valuation. Additionally, Square made a whopping $29B acquisition of Afterpay, the Australia-based BNPL company.

Talk about market validation!

QisstPay is bringing BNPL to Pakistan’s 220MM residents. The company was only founded in November 2020, but closed an impressive $15MM Seed round (!) led by MSA Capital in September 2021.

Keep an eye out for this company in 2022 and pay attention to how quickly they are or aren’t able to build partnerships with Pakistan’s leading eCommerce companies.

If you don’t see them showing up on the checkout pages of those eComm leaders by mid-2022, that would be a bad sign.

Offices In: Islamabad

Total Funding: $15MM

10. BridgeLinx: Freight Marketplace for Shippers and Carriers

BridgeLinx is another newcomer to the Pakistani startup scene. The company was founded in 2020 and has a simple model: Connect shippers to carriers through a marketplace.

While the model is simple, the opportunity in Pakistan is huge and investors are noticing. In September 2021, the company raised a $10 million seed round led by Harry Stebbings’ 20 VC, Josh Buckley’s Buckley Ventures, and Indus Valley Capital.

According to the company, BridgeLinx has already onboarded thousands of carriers and is moving thousands of freight loads each week. I’m excited to see how they scale those numbers massively in 2022.

Offices In: Lahore

Total Funding: $10MM

Honorable Mentions

Maqsad: EdTech App for K12

Offices In: Karachi

Total Funding: $2.1MM

KTrade: Robinhood for Pakistan

Offices In: Karachi

Total Funding: $4.5MM

Udhaar: Khatabook for Pakistan

Offices In: Bangalore

Total Funding: Not disclosed

What Pakistani Startups Did I Miss?

I’m sure I missed quite a few prolific, fast-growing Pakistani startups. Let me know which ones on Twitter at @amitch5903!

0 Comments