It’s Demo Day (again)!

But first, here are my past YC posts if you want to check how my older picks have done. If you want to skip to the bottom, you can also see my own evaluation of my past picks for W21, S20, W20, S19, W19, S18, W18, and S17 (phew, that’s a LOT!)

The 10 YC Companies (S20) I’d Invest In

India, Pakistan, and SE Asia are startup economies to watch closely over the next few years. Author: Alex Mitchellmedium.com

The 10 YC Companies (W20) I’d Invest In

The most promising startups from YCombinator’s Winter 2020 class that I’d invest in. Author: Alex Mitchellblog.usejournal.com

The 10 YC Companies (S19) I’d Invest In

The 10 YC Companies (S19) I’d Invest In and how my past YC picks have performed! Author: Alex Mitchellblog.usejournal.com

The 10 YC Companies (W19) I’d Invest In

…and for the first time, a few I actually did invest in! Author: Alex Mitchellblog.usejournal.com

The 10 YC Companies (S18) I’d Invest In

Here are the 10 YC S18 companies I’d invest in (out of the 132 who demoed). Author: Alex Mitchellmedium.com

The 10 YC Companies (W18) I’d Invest In

YC had 128 companies in the Winter class. Here are the 10 I would invest in. Author: Alex Mitchellmedium.com

My Top 10 YC Companies (S17)

Here are the 10 YC S17 companies I’d invest in (out of the 124 who demoed). Author: Alex Mitchellmedium.com

YC’s classes just keep getting bigger!

The S21 class included: 377 startups, representing 47 (!) different countries, pitched on 8/31/21 and 9/1/21. Nearly 50% are based outside of the US.

37% of the founders overall were from “underrepresented groups” which, according to YC’s definition, include women, black, and latinx founders.

The Top 10 Companies I’d Invest In

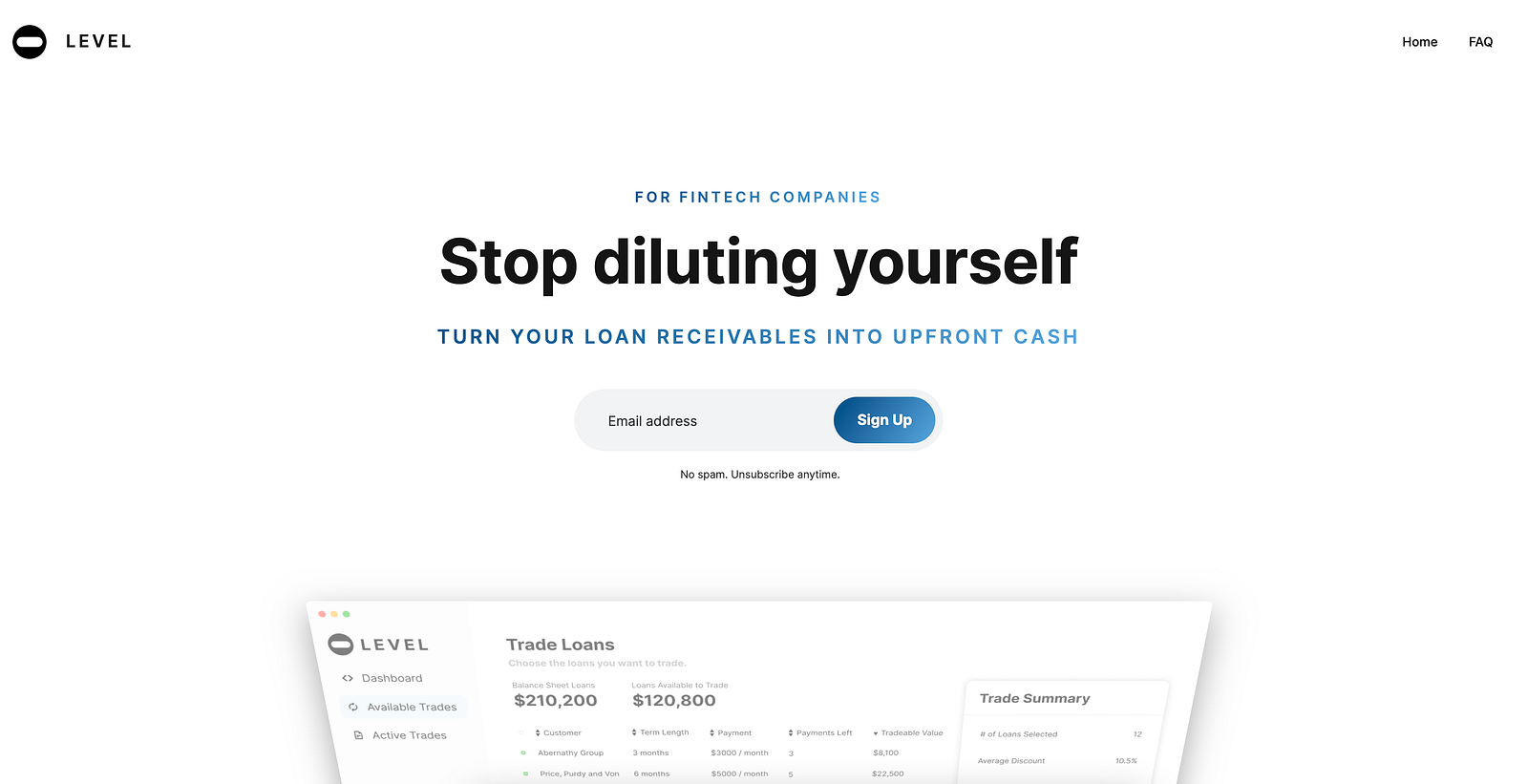

- Level— Pipe (YC ) for Fintech (Loan Receiveable Marketplace)

TechCrunch Description: A fintech financing platform that buys loans from fintech startups, helping them gain access to capital to scale faster. The company analyzes the fintech company’s performance and loan portfolio to source low-risk loans it can purchase at a discounted rate.

Why I Did Invest: Have you heard of Pipe? They transform recurring revenue streams into upfront capital for growing startups via an innovative marketplace that also allows investors to purchase those recurring revenue streams. Pipe was founded in September 2019 and hit onto something big, raising over $200MM since then, most recently at a $2B valuation in March 2021.

Level is taking a similar approach, but has focused on making it easier and cheaper for fintech/lending startups to obtain debt funding.

It can be very difficult and very very slow for these startups to get access to debt funding, so Level has created a two-sided marketplace to connect these startups seeking debt capital with investors willing to provide it and is off to a very fast start!

2. Salarybook — Gusto Meets LinkedIn for India

TechCrunch Description: Pitched as “Gusto for India,” Salarybook helps SMBs in India handle payroll, employee attendance and expenses. The company says it has 80,000 employers on the platform already.

Why I Did Invest: 80k employers is impressive traction for a company that was only founded in March 2021. And that’s only scratching the surface of the opportunity in India, where there are over 60MM SMBs, the majority of which who are still using paper notebooks to manually track attendance and salaries (!).

Salarybook also helps these SMBs hire the talent they need, bringing another set of company management and growth tools to the businesses that need them the most. I’m excited to watch the company continue to scale and continue to modernize this segment of the Indian economy.

3. StandardCode — APIs for Parental Consent and Age verification

TechCrunch Description: An API meant to help gaming/social companies deal with COPPA/GDPR compliance, automating the ID/parental approval/age verification process. Charges $0.50 per verification.

Why I Would Invest: Age verification and COPPA compliance have only become more important in recent years and most companies would love to outsource this action to a 3rd party so they can focus on their core competence.

Enter StandardCode, which takes a Checkr-style, developer-first approach to this problem, automating parental consent and age/ID verification for Gaming, Social, and EdTech use cases. If the company can build strong relationships with the developer community, I believe they can become the go-to API for parental consent and COPPA compliance.

4. Union54 — Card Issuing API for Africa

TechCrunch Description: An API to help companies (think banks, fintechs and large retailers) issue debit cards in Africa.

Why I Would Invest: African Tech is having a MAJOR moment. Since the beginning of 2021, the continent has raised more than $2B, with over $560MM raised in August 2021 alone! Much of this funding has been to fintech startups like Chipper Cash, OPay, and Flutterwave.

Union54 has attacked a common problem many of these fintech startups face: Issuing physical debit cards.

Instead of having to build an internal team and a relationship with a card issuer, these startups can now go directly to Union54 via their API to issue and fund cards, dramatically simplifying and accelerating the process. The company’s founding team also has experience at Zazu Africa, a 6-year-old African fintech, where they experienced this challenge first hand.

5. Gobillion — Social eCommerce for the Next 400M Customers in India

TechCrunch Description: Gobillion is taking the highly successful Pinduoduo model of group purchasing and applying it to India’s daily grocery buyers. Customers can band together and save 25%-40% by purchasing in bulk — and the team, vets of India’s e-commerce world, know how to get the retail giants on board.

Why I Did Invest: Shared bulk purchase orders have proven to be a very effective strategy for tier 2+ cities in China and Gobillion is taking this business model to India.

This group approach taps into existing offline social networks in these cities and also leads to significantly lower prices than individuals could access themselves.

Additionally, the founding team has worked together scaling several eCommerce initiatives over the past 15+ years. They are the ones to solve this problem.

6. Frontpage — Public.com for India

TechCrunch Description: Building on the retail investor boom, Frontpage wants to build a Public.com for India, helping market investors and traders find a community of people interested in the finance world while browsing trades, charts and new discussions taking place in real time.

Why I Would Invest: Over the course of the pandemic, retail trading has exploded, most visibly through the free trading platform Robinhood. But a strong secondary trend has emerged: Social trading communities. Think of the growth of the community and the growth of the influence of Reddit’s WallStreetBets, which now has millions of members discussing new investing strategies daily.

Public.com tapped into this cross section of community and trading, raising funding at a $1.2B valuation in February 2021. Frontpage has built a strong trading community in India, where trading is significantly earlier on the adoption curve than it is in the US.

As the company looks to grow post-YC, I’d expect them to work to extend their early success building a community into starting a brokerage where community members can trade, unlocking new revenue streams for Frontpage.

7. Palenca — Payroll API for Latin America

TechCrunch Description: Palenca lets employers in LatAm share and check employment records, do background checks and identity verification, then offer financial services based on that data. You know they’re going to be a success because, as the founder noted, they’re literally the only option for this! Hopefully this kind of accountability benefits the workers as well as the employers.

Why I Did Invest: As more and more of the workforce globally is composed of independent contractors, individuals move between different gig economy jobs more quickly. Due to this acceleration of career change, it’s been difficult to quickly gather information on these worker’s employment and earnings history.

Palenca solves this problem through employment record, background, and identity verifications that help employers hire faster and feel more confident in their workforce. Additionally, employees get hired and make $$$ faster, making for a win-win!

The Palenca team also has strong data + ops experience from Uber LatAM which is a big plus as well.

8. ODWEN — Airbnb of Warehousing for India

TechCrunch Description: ODWEN is building a massive warehouse network in India, aiming to leverage underutilized space at existing warehouses with a tech-enabled platform that helps users with storage needs find their own solution across a wide network.

Why I Did Invest: Throughout the pandemic, eCommerce volumes have understandably exploded. With more eCommerce volume comes the need for more robust delivery and warehouse networks. The problem, however, is that most warehouses in India and beyond are incredibly offline.

Today, you first have to call the warehouse to inquire about their available space, negotiate with the warehouse owner, complete inconsistent and lengthy paperwork, and agree to long term contracts (to name just a few stages).

Enter ODWEN, which enables the millions of SMBs in India to find available warehouse space in minutes at prices 20% below market. The company already has 500 warehouses on their platform in India and is adding more each and every week. In addition to improving discovery, the company standardizes the warehouse experience, removing significant risk to the end user.

9. Laudable — Capture, Edit, and Share B2B Customer Testimonial Videos

TechCrunch Description: The B2B sales process needs to move past the PDF world, Laudable reckons. The startup wants to help its customers find and share videos of their customers using their product to share instead of written testimonials. We have some questions about how its product works, but the startup scaled from $0 to $27,000 in MRR in two months, so it appears to be onto something. Also sales tech tools have raised quite a lot of money in the last year, so there’s likely appetite for Laudable.

Why I Would Invest: For anyone who has worked for a b2b business before (myself included), you’re familiar with the decades-old “case study” format that most of these businesses use to pitch themselves to potential clients. These boring, flat, non-interactive, and impersonal PDFs simply don’t work in today’s world.

Laudable helps supercharge b2b sales by empowering companies to develop authentic customer testimonials that can be shared in sales materials, on social media, and more. Authentic, personal testimonials have been a critical part of the b2c world for years, it’s time b2b caught up and Laudable is the company to make it happen!

10. TAG — First Digital Bank for Pakistan

TechCrunch Description: TAG is building a neobank for Pakistan, a market that it claims features 100 million unbanked individuals out of a population of 250 million. The startup said that it is working with employers to help employees get their wages deposited into their TAG account instead of being handed out in cash. The company has local regulatory approval and is live in its market with a debit card product.

Why I Would Invest: I’ve written several times about the simply massive opportunity that exists in Pakistan and the YC/VC world is starting to catch on. In the past year, we’ve seen large funding rounds for Tajir (YC W20) and Airlift.

TAG is bringing a neobank to Pakistan, focused on the 100MM unbanked individuals with a startup model that’s worked on every continent around the world over the past decade. I can’t overstate how big the opportunity is in Pakistan right now not only for Fintech, but for tech startups in general!

Honorable Mentions

- Cache: “Dark” stores to supply goods to on-demand drivers

- Stack: Vanguard of India

- Suplias: Where small grocery stores in Africa buy inventory

- Telivy: Fastest way to purchase cyber insurance for small businesses

- Genomelink: App store for DNA

- Payhippo: Loans to Nigeria’s SMEs in under 3 hours

- Intellect: A modern-day mental health company for Asia

- Hotswap: We help companies onboard customers from competitors

- Tinai: Bookkeeping app for Vietnam’s 6M small businesses

- Maroo: Buy Now Pay Later for $95B US wedding market

- Swipe: Simple billing and payments for 75M+ Indian SMBs ??

- Slope: Buy Now, Pay Later for B2B

How Have My Picks from Past YC Classes Done?

W21

Too soon to report on the good, the misses, and the ?’s from the W21 YC class! Check back in a few months.

S20

The Good

- BukuWarung: Raised a $20MM Seed round in February 2020. Raised a $60MM Series A round in June 2021 (!)

- Verifiable: Raised $3MM Seed round in October 2020. Raised $17MM Series A round in August 2021 (!)

- Finmark: Raised a $5MM Seed round in October 2020

- Dapi: Raised a total of $2.2MM, including $400k post-YC

- Spenmo: Raised $2MM in August 2020

- Bikayi: Raised $2MM in August 2020

- Safepay: Raised $125k as part of YC and an undisclosed round led by Stripe in February 2021

- Decentro: Has not announced the funding size, but most recently raised funding in February 2021

The Misses

- n/a

The ?’s

- Bits: Raised $125k as part of YC and no other disclosed funding

- Panadata: Raised $125k as part of YC and no other disclosed funding

W20

The Good

- ElectroNeek: Raised a $2.5MM Seed round in March 2020. Raised a $20MM Series A in June 2021

- Robotire: Raised an undisclosed Seed round from Adam Morley and Asymmetry Ventures in November 2020. Raised a $10.6MM Series A in June 2021.

- Handl: Raised an undisclosed Seed round from Socially Financed in December 2020

- ZeoAuto: Raised an $1MM Seed round from several investors in April 2020

The Misses

- Onetool: Raised a $1.7MM Seed round in July 2020. Shut down in July 2021.

The ?’s

- Spenny: Raised an undisclosed Seed round from CABRA VC and 500 Startups in July 2020

- Grain: Raised an undisclosed Seed round from Urban Innovation Fund in July 2020

- Pilot: Only has raised $120k from YC (or has not disclosed)

- Trimwire: Only has raised $150k from YC (or has not disclosed) — Also had previously raised pre-seed round of $350k

- Dashworks: Only has raised $150k from YC (or has not disclosed)

S19

The Good

- Narrator: Raised $13.6MM in total funding, including a $6.1MM Seed after YC and a $6.2MM Series A in September 2020. 15 employees as of September 2021

- EARTH AI: Raised $9.3MM in funding, including a $2.5MM Seed round in August 2019 and an additional $5.5MM in August 2021. 9 employees as of September 2021

- Localyze: Raised a $1.3MM Seed round in August 2019. Raised €10.2M Series A in July 2021. 30 employees as of September 2021

- Tandem: Raised $7.5MM in funding, including a Seed round with participation from Andreesen Horowitz. 17 employees as of September 2021

- Well Principled: Raised $2.6MM in funding. 14 employees as of September 2021

- Lezzoo: Has raised $150k from YC (or has not disclosed). 52 employees as of September 2021

The Misses

- Metacode: Only has raised $150k from YC (or has not disclosed). 0 employees on LinkedIn. Site doesn’t load. Calling this one dead.

The ?’s

- Apero Health: Only has raised $150k from YC (or has not disclosed). 13 employees as of September 2021

- Soteris: Only has raised $150k from YC (or has not disclosed). 5 employees as of September 2021

- SannTek Labs: Only has raised $150k from YC (or has not disclosed). 2 employees as of September 2021. Appears to have pivoted to “nanotechnology”

W19

The Good

- CareerKarma: Raised $1.5MM Seed round in July 2019 and raised $10MM Series A in December 2020; 134 employees as of September 2021

- Superb-AI: Raised $2MM seed round in February 2019 and raised $9.3MM Series A in February 2021; 48 employees as of September 2021

- FlowerCo: Raised $2.8MM seed round in July 2019; 62 employees as of September 2021

- Boundary Layer Technologies: Raised $2.3MM seed round in March 2019; 9 employees as of September 2021

- Pronto: Raised $2.2MM in total funding; 23 employees as of September 2021

- Skill-lync: Raised ₹1.3B (~$17MM) Series A round in August 2021. 484 employees as of September 2021

- CareerTu: Only has raised $150k from YC; 21 employees as of September 2021

The Misses

- Modern Labor: Website doesn’t load and I don’t see any signs of life, calling this one dead.

- Cherry: Only has raised $150k from YC. Shut down in May 2020.

The ?’s

- YourChoice: Raised $1.6MM Seed round in January 2019. Pivoted to focus on COVID treatments in March 2020. 4 employees as of September 2021

S18

The Good

- Kyte: Originally a Smart SMS inbox for India — rebranded as KhataBook, raised a $25MM Series A round in September 2019, a $60MM Series B in May 2020, $100MM Series C in August 2021. 322 employees as of September 2021

- OKCredit: Raised $1.7MM Seed round in August 2018 and a $15.5MM Series A in June 2019. Raised $67MM Series B in 2019. 142 employees as of September 2021

- Berbix: Raised $2.5MM Seed round in July 2019 and $9MM Series A in August 2020. 33 employees as of September 2021

- Cambridge Glycoscience: Rebranded as Supplant. Raised $9.1MM Seed in August 2018, $15MM Series A in February 2021. 17 employees as of September 2021

- Alpha Vantage: Raised $2.2MM Seed round in 2018, nothing raised since. 4 employees as of September 2021

- Goodly: Raised $1.3MM Seed round in March 2019, nothing raised since. 5 employees as of September 2021

- CSPA: Raised $1.5MM Seed round in September 2018, nothing raised since. 13 employees as of September 2021

- Inscribe: Raised $3MM Seed round in December 2018, $10.5MM Series A in April 2021. 33 employees as of September 2021

- Scanwell Health: Raised $3.5MM Seed round in November 2019. 25 employees as of September 2021

The Misses

- Togg: Raised $4MM Seed round in September 2018, nothing raised since. Website does not load.

W18

The Good

- Juni Learning: Raised an additional $790k in January 2018. Raised a $10.5MM Series A in August 2020. 609 employees as of September 2021

- Veriff: Raised a $7.7M Series A in June 2018, a $15.5MM Convertible note in July 2020, a $69MM Series B in April 2021. 276 employees as of September 2021

- NexGenT: Raised $2MM in January 2018. Raised $15MM Series A in November 2018. 90 employees as of September 2021

- Sheerly Genius: Raised undisclosed Series A in September 2019 and $30MM Series B in October 2020(!) Rebranded as Sheertex, 69 employees as of September 2021

- HelloVerify: Undisclosed Series A in March 2019. Scaled to 242 employees as of September 2021

- Reverie Labs: Seed round raised in March 2018 (undisclosed) and $25MM Series A in February 2021. 23 employees as of September 2021

- OpenLand: Raised $2.3M in August 2018 and pivoted into a messaging app. 7 employees as of September 2021

- Memora Health: $1.7MM Seed round in April 2018. $10.5MM venture round led by a16z in May 2021. 29 employees as of September 2021

- Lawyaw: No fundraising since YC. 22 employees as of September 2021

The Misses

- N/A

The ?’s

- Onederful: No fundraising since YC. 5 employees as of September 2021

S17

The Good

- Standard Cognition: Raised $5MM (October 2017) from Charles River, Initialized Capital, and YC. Raised $40M Series A in November 2018. Raised $35MM Series B in July 2019. Raised $150MM Series C in February 2021. 132 employees as of September 2021

- PayFazz: 457 employees as of September 2021 and closed a convertible note after YC (September 2017). Raised $21M Series A in November 2018. Raised $53MM Series B in July 2020

- PullRequest: Raised a $2.3MM Seed round from Google’s Gradient Ventures in December 2017 and then raised a $10.4M Series A in April 2018. 34 employees as of September 2021

- Pop Meals/Dahmahkan: Raised $5MM Series A in May 2019. Raised $18MM Series B in February 2020. 76 employees as of September 2021

- 70MillionJobs: Finalist in the Social and Culture Technologies Category at SXSW Accelerator Pitch Event. Raised $150k from Quake Capital Partners in March 2019. 13 employees as of September 2021

- Zendar: Incredibly difficult to find information on this company over the past year, but they raised a $10.5MM Series A round in March 2019 and an $8MM venture round in June 2021. 26 employees as of September 2021

- Piggy: Pivoted into banking for couples: 18 employees as of September 2021, but no money raised since YC

The Misses

- Ubiq: Little to no press since YC. Last blog post on the website is 10/30/17. I’m calling this one dead.

- Net30: Similar to Ubiq, little to no press since YC. Down to 2 employees on LinkedIn. Haven’t raised money post-YC. I’m calling this one dead.

- Plasticity: Only 2 employees on LinkedIn, no money raised since YC. No press since 2017. I’m calling this one dead.